4

Financial Report | Statutory Auditors’ Report on the Consolidated Financial Statements |

Consolidated

Financial Statements

| Statutory Auditors’ Report on the Financial Statements | Statutory Financial Statements

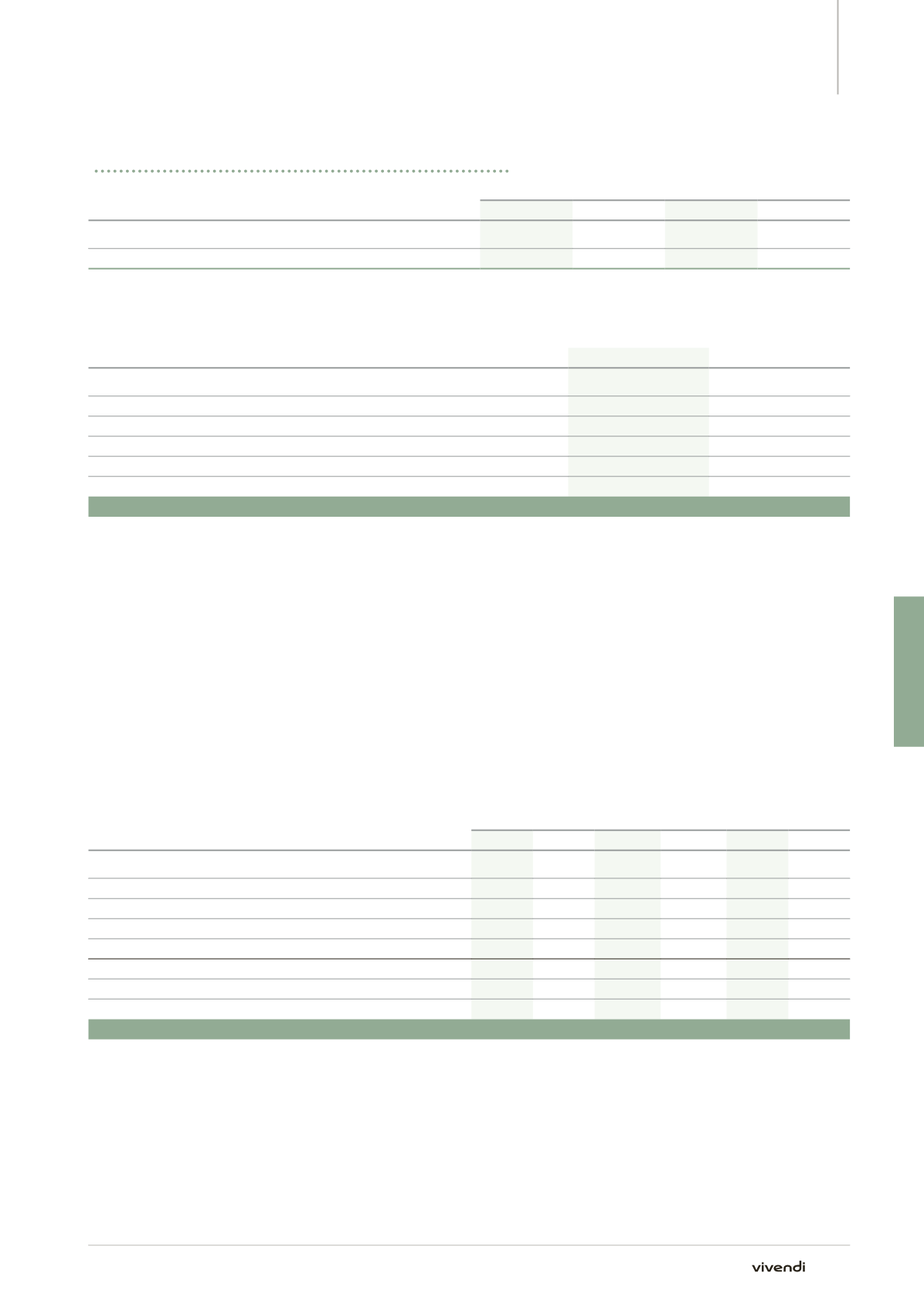

Note 19. Employee benefits

Assumptions used in accounting for post-retirement benefits, by country

United States

Canada

2014

2013

2014

2013

Discount rate

3.75%

4.50%

3.75%

4.50%

Rate of compensation increase

3.50%

3.50%

na

na

na: not applicable.

■

■

Allocation of pension plan assets

December 31, 2014 (a)

December 31, 2013

(a)

Equity securities

3%

4%

Debt securities

45%

48%

Diversified funds

36%

31%

Insurance contracts

4%

5%

Real estate

1%

1%

Cash and other

11%

11%

Total

100%

100%

(a)

Pension plan assets are mainly financial assets actively traded in organized financial markets.

Pension plan assets which were not transferred have a limited exposure

to stock market fluctuations. These assets do not include occupied

buildings or assets used by Vivendi nor shares or debt instruments of

Vivendi.

■

■

Cost evolution of post-retirement benefits

For the purpose of measuring post-retirement benefits, Vivendi assumed

the annual growth in the

per capita

cost of covered health care benefits

would slow down from 6.7% for the under 65 years of age and 65 years

of age and older categories in 2014, to 4.5% in 2022 for these categories.

In 2014, a one-percentage-point increase in the assumed cost evolution

rates would have increased post-retirement benefit obligations by

€11 million and the pre-tax expense by €1 million. Conversely, a one-

percentage-point decrease in the assumed cost evolution rates would

have decreased post-retirement benefit obligations by €9 million and the

pre-tax expense by €1 million.

19.2.2.

Analysis of the expense recorded and of the amount of benefits paid

(in millions of euros)

Pension benefits Post-retirement benefits

Total

2014

2013

2014

2013

2014

2013

Current service cost

14

12

-

-

14

12

Past service cost

(a)

(25)

(5)

-

-

(25)

(5)

(Gains)/losses on settlements

-

(7)

-

-

-

(7)

Other

1

1

-

-

1

1

Impact on selling, administrative and general expenses

(10)

1

-

-

(10)

1

Interest cost

25

25

6

6

31

31

Expected return on plan assets

(12)

(13)

-

-

(12)

(13)

Impact on other financial charges and income

13

12

6

6

19

18

Net benefit cost recognized in profit and loss

3

13

6

6

9

19

(a)

The recorded past service cost relates to the change of part of the group’s management team since June 2012.

In 2014, benefits paid amounted to (i) €45 million (compared to

€35 million in 2013) with respect to pensions, of which €18 million

(compared to €9 million in 2013) was paid by pension funds, and

(ii) €9 million (compared to €10 million in 2013) was paid with respect to

post-retirement benefits.

255

Annual Report 2014