4

Financial Report | Statutory Auditors’ Report on the Consolidated Financial Statements |

Consolidated

Financial Statements

| Statutory Auditors’ Report on the Financial Statements | Statutory Financial Statements

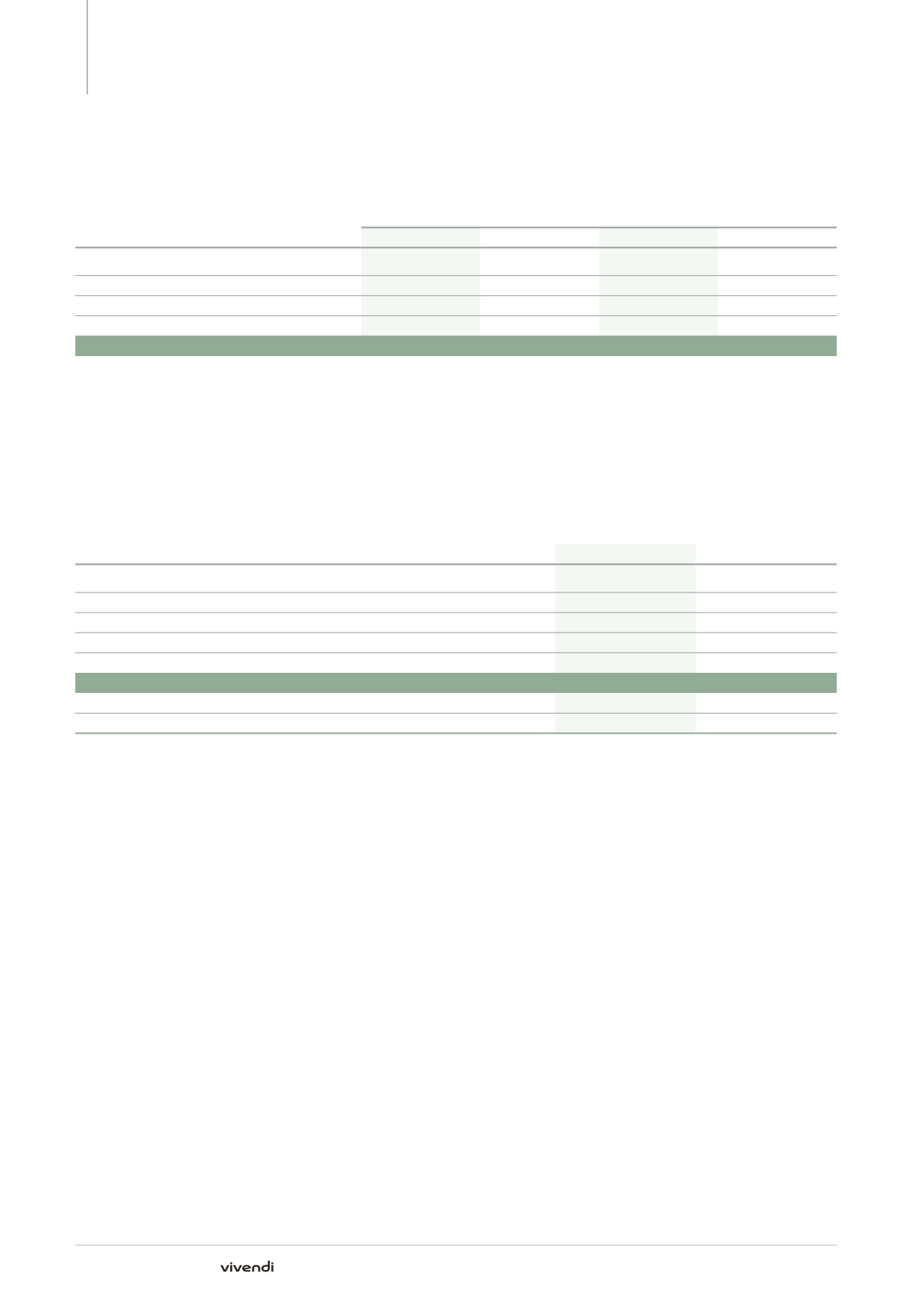

Note 13. Investments in equity affiliates

Note 14.

Financial assets

(in millions of euros)

December 31, 2014

December 31, 2013

Available-for-sale securities

(a)

4,881

360

Other loans and receivables

(b)

1,160

206

Derivative financial instruments

139

126

Cash deposits backing borrowings

-

2

Other financial assets

13

5

Financial assets

6,193

699

Deduction of current financial assets

(49)

(45)

Non-current financial assets

6,144

654

(a)

As of December 31, 2014, available-for-sale securities notably included:

–– 97,387,845 Numericable-SFR shares valued at stock market price on the closing date, or €40.94/share, for an aggregate value of €3,987 million

(please refer to Note 3.1); and

–– 41,499,688 Activision Blizzard shares valued at stock market price on the closing date, or USD$20.15/share, for an aggregate value of $836 million

(€689 million) (please refer to Note 3.4).

As of December 31, 2013, available-for-sale securities included securities held by UMG in Beats for €161 million. On August 1, 2014, these securities

were sold for a net amount of €250 million resulting in a €179 million net gain on sale.

Available-for-sale securities did not include any other publicly quoted securities as of December 31, 2014 and December 31, 2013, and were not

subject to any impairment with respect to fiscal years 2014 and 2013.

(b)

Relates to the cash deposits of €975 million as part of the appeal against the Liberty Media judgment and €45 million ($55 million) as part of the

securities class action in the United States. Please refer to Note 26.

Note 13.

Investments in equity affiliates

(in millions of euros)

Voting interest

Value of equity affiliates

December 31, 2014

December 31, 2013

December 31, 2014

December 31, 2013

N-Vision

(a)

49%

49%

213

215

VEVO

48%

47%

71

58

Numergy

-

47%

-

95

Other

na

na

22

78

306

446

na: not applicable.

(a)

As of December 31, 2014, N-Vision, which indirectly owns a 51% interest in TVN (FTA broadcaster in Poland), was held by Canal+ Group (49%

interest) and ITI (51% interest). On October 16, 2014 Canal+ Group and ITI announced that they were jointly considering strategic options in respect

of their interest in TVN.

250

Annual Report 2014