4

Financial Report | Statutory Auditors’ Report on the Consolidated Financial Statements |

Consolidated

Financial Statements

| Statutory Auditors’ Report on the Financial Statements | Statutory Financial Statements

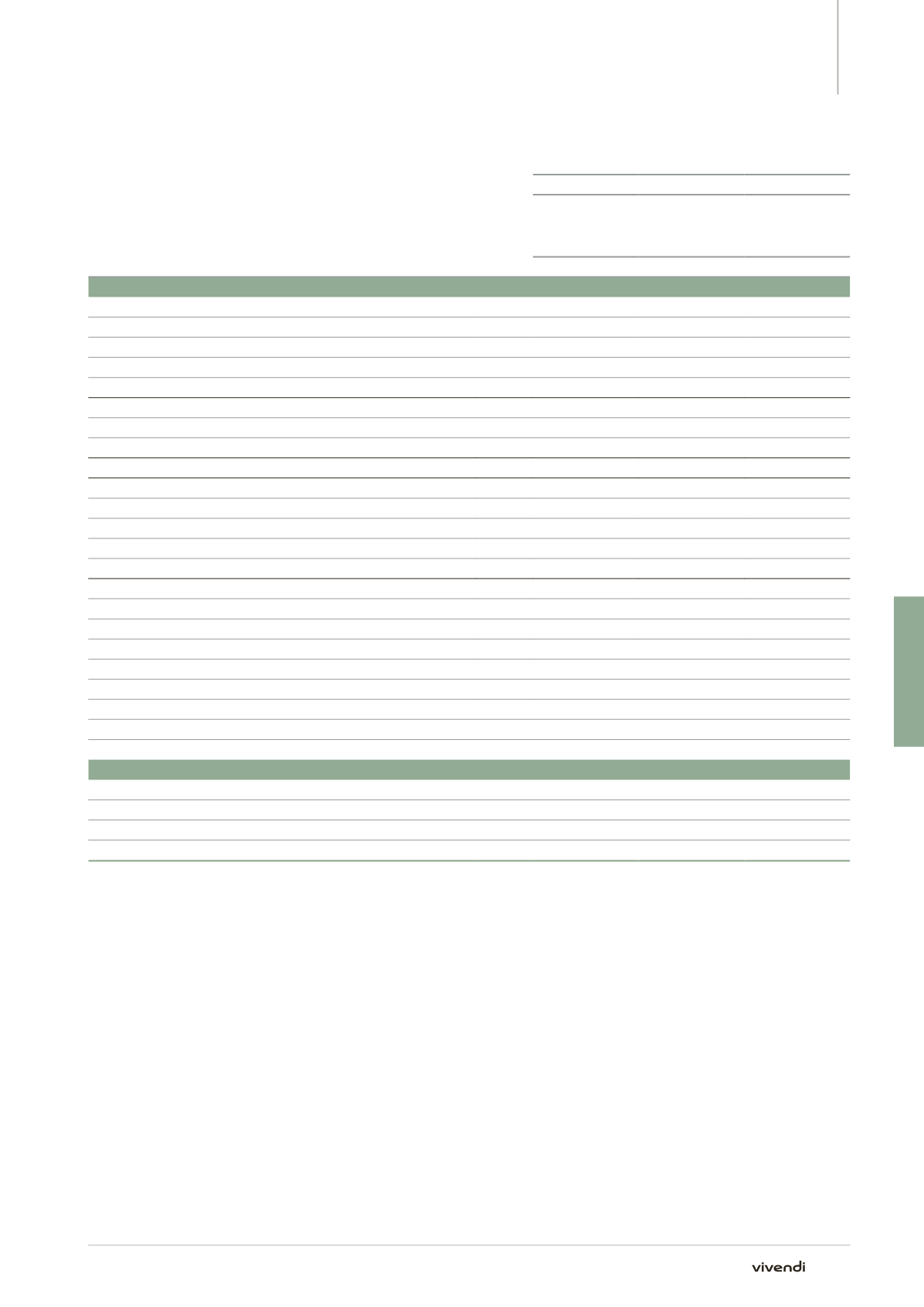

Note 19. Employee benefits

(in millions of euros)

Note

Employee defined benefit plans

Year ended December 31, 2013

Benefit obligation

Fair value of plan

assets

Net (provision)/

asset recorded in

the statement of

financial position

(A)

(B)

(B)-(A)

Opening balance

1,020

367

(653)

Current service cost

21

(21)

Past service cost

(e)

(18)

18

(Gains)/losses on settlements

(29)

(22)

7

Other

1

(1)

Impact on selling, administrative and general expenses

3

Interest cost

35

(35)

Expected return on plan assets

13

13

Impact on other financial charges and income

(22)

Net benefit cost recognized in profit and loss

(19)

Experience gains/(losses)

(a)

12

(1)

(13)

Actuarial gains/(losses) related to changes in demographic assumptions

2

(2)

Actuarial gains/(losses) related to changes in financial assumptions

5

(5)

Adjustment related to asset ceiling

-

Actuarial gains/(losses) recognized in other comprehensive income

(20)

Contributions by plan participants

1

1

-

Contributions by employers

46

46

Benefits paid by the fund

(9)

(9)

-

Benefits paid by the employer

(36)

(36)

-

Business combinations

(f)

12

9

(3)

Divestitures of businesses

-

-

-

Transfers

-

-

-

Other (of which foreign currency translation adjustments)

(20)

(12)

8

Reclassification to assets held for sale

(g)

(31)

-

31

Closing balance

966

356

(610)

of which wholly or partly funded benefits

487

wholly unfunded benefits

(c)

479

of which assets related to employee benefit plans

9

provisions for employee benefit plans

(d)

18

(619)

(a)

Includes the impact on the benefit obligation resulting from the difference between actuarial assumptions at the previous year-end and effective

benefits during the year, and the difference between the expected return on plan assets at the previous year-end and the actual return on plan assets

during the year.

(b)

Relates to the impact of the sale of SFR on November 27, 2014.

(c)

In accordance with local laws and practices, certain plans are not covered by plan assets. As of December 31, 2014 and December 31, 2013, such

plans principally comprise supplementary pension plans in the United States, pension plans in Germany and post-retirement benefit plans in the

United States.

(d)

Includes a current liability of €48 million as of December 31, 2014 (compared to €55 million as of December 31, 2013).

(e)

In 2013, past service costs mainly related to the effect of decreases related to restructuring at SFR, as well as the renewal of some members of the

group’s management team since the end of June 2012.

(f)

Relates to the adjustment in 2013 to account for the impact of the acquisition on September 28, 2012 of EMI Recorded Music on the value of the

obligations, plan assets, and underfunded obligation.

(g)

Relates to the impact of the reclassification of Maroc Telecom group as a discontinued operation, in accordance with IFRS 5.

257

Annual Report 2014