4

Financial Report | Statutory Auditors’ Report on the Consolidated Financial Statements |

Consolidated

Financial Statements

| Statutory Auditors’ Report on the Financial Statements | Statutory Financial Statements

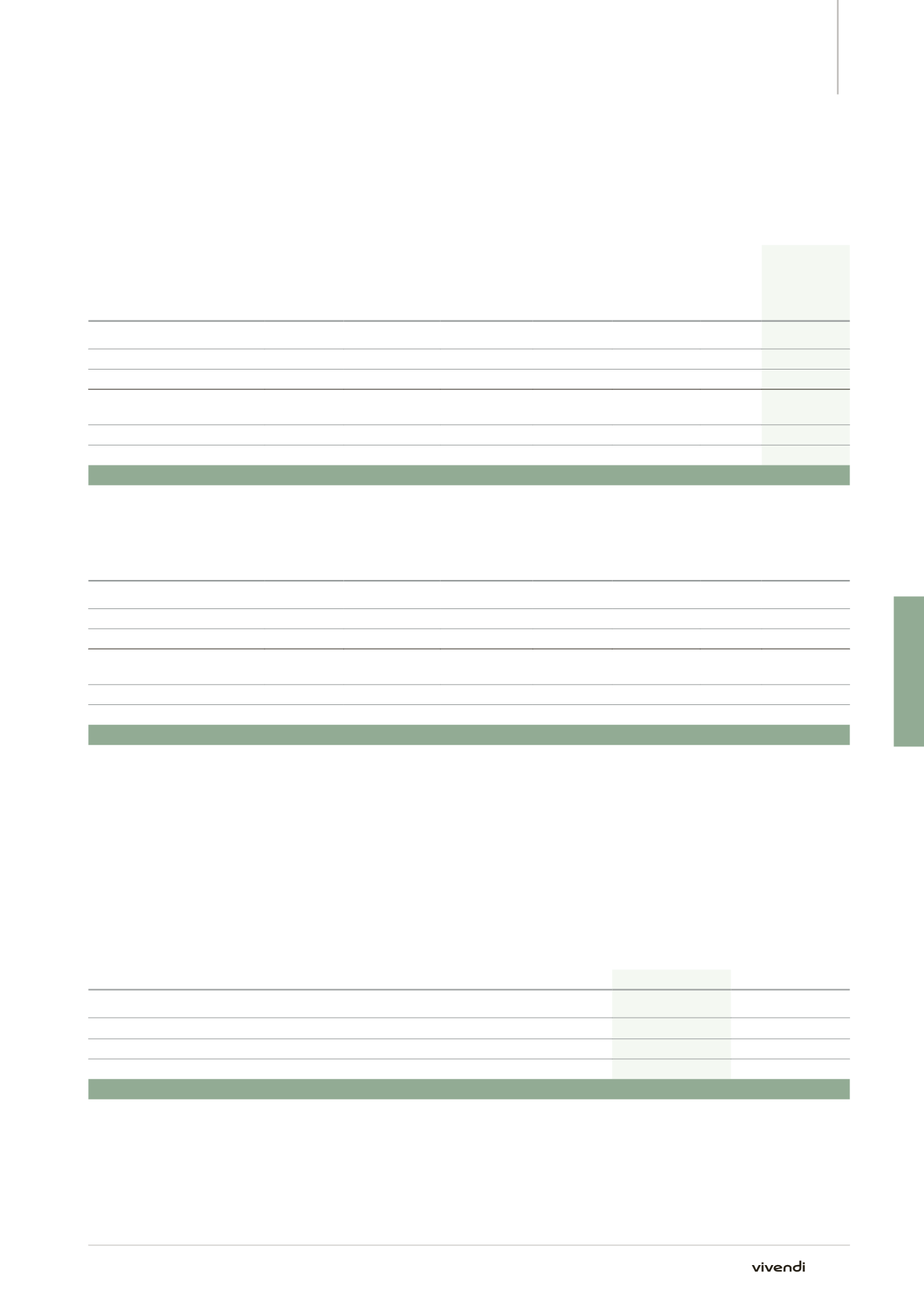

Note 16. Cash and cash equivalents

Note 15.

Net working capital

Changes in net working capital

(in millions of euros)

December 31,

2013

Changes in

operating

working

capital

(a)

Business

combinations

Divestitures

in progress

or completed

Changes

in foreign

currency

translation

adjustments Other

(b)

December 31,

2014

Inventories

330

16

19

(257)

6

-

114

Trade accounts receivable and other

4,898

135

107

(3,218)

42

19

1,983

Working capital assets

5,228

151

126

(3,475)

48

19

2,097

Trade accounts payable

and other

(c)

10,416

20

138

(5,422)

156

(2)

5,306

Other non-current liabilities

757

8

(8)

(576)

13

(73)

121

Working capital liabilities

11,173

28

130

(5,998)

169

(75)

5,427

Net working capital

(5,945)

123

(4)

2,523

(121)

94

(3,330)

(in millions of euros)

December 31,

2012

Changes in

operating

working

capital

(a)

Business

combinations

Divestitures

in progress

or completed

Changes

in foreign

currency

translation

adjustments Other

(b)

December 31,

2013

Inventories

738

(20)

(3)

(376)

(9)

-

330

Trade accounts receivable and other

6,587

(8)

(192)

(1,419)

(79)

9

4,898

Working capital assets

7,325

(28)

(195)

(1,795)

(88)

9

5,228

Trade accounts payable

and other

(c)

14,196

(252)

(8)

(3,506)

(211)

197

10,416

Other non-current liabilities

1,002

(84)

17

(12)

(23)

(143)

757

Working capital liabilities

15,198

(336)

9

(3,518)

(234)

54

11,173

Net working capital

(7,873)

308

(204)

1,723

146

(45)

(5,945)

(a)

Excludes content investments made by Canal+ Group and UMG. In 2013, related to amounts as published in the 2013 Annual Report; does not

include the adjustments from the impact of the application of IFRS 5 to Activision Blizzard and Maroc Telecom group as well as GVT and SFR on the

Consolidated Statement of Cash Flows.

(b)

Mainly includes the change in net working capital relating to content investments, capital expenditures, and other investments.

(c)

Includes trade accounts payable for €2,215 million (€5,454 million as of December 31, 2013) as well as music royalties to artists and repertoire

owners of UMG whose maturity is lesser than one year for €1,699 million as of December 31, 2014 (€1,598 million as of December 31, 2013). Please

refer to Note 10.2.

Note 16.

Cash and cash equivalents

(in millions of euros)

December 31, 2014

December 31, 2013

Cash

240

525

Cash equivalents

6,605

516

of which UCITS

4,754

46

Term deposits and interest-bearing current accounts

1,851

470

Cash and cash equivalents

6,845

1,041

As of December 31, 2014, outstanding cash and cash equivalents of

Vivendi amounted to €6,845 million, of which €6,524 million is held by

Vivendi SA and invested in the following financial institutions with at

least an A2/A rating:

p

p

€4,754 million in 10 UCITS monetary funds, managed by five

management companies; and

p

p

€1,770 million in term deposits and interest-bearing current accounts

within eight banks. Term deposits with initial maturities greater than

three months contain an option to terminate at any time and present

an insignificant risk of changing in value.

251

Annual Report 2014