4

Financial Report | Statutory Auditors’ Report on the Consolidated Financial Statements |

Consolidated

Financial Statements

| Statutory Auditors’ Report on the Financial Statements | Statutory Financial Statements

Note 17. Equity

Note 17.

Equity

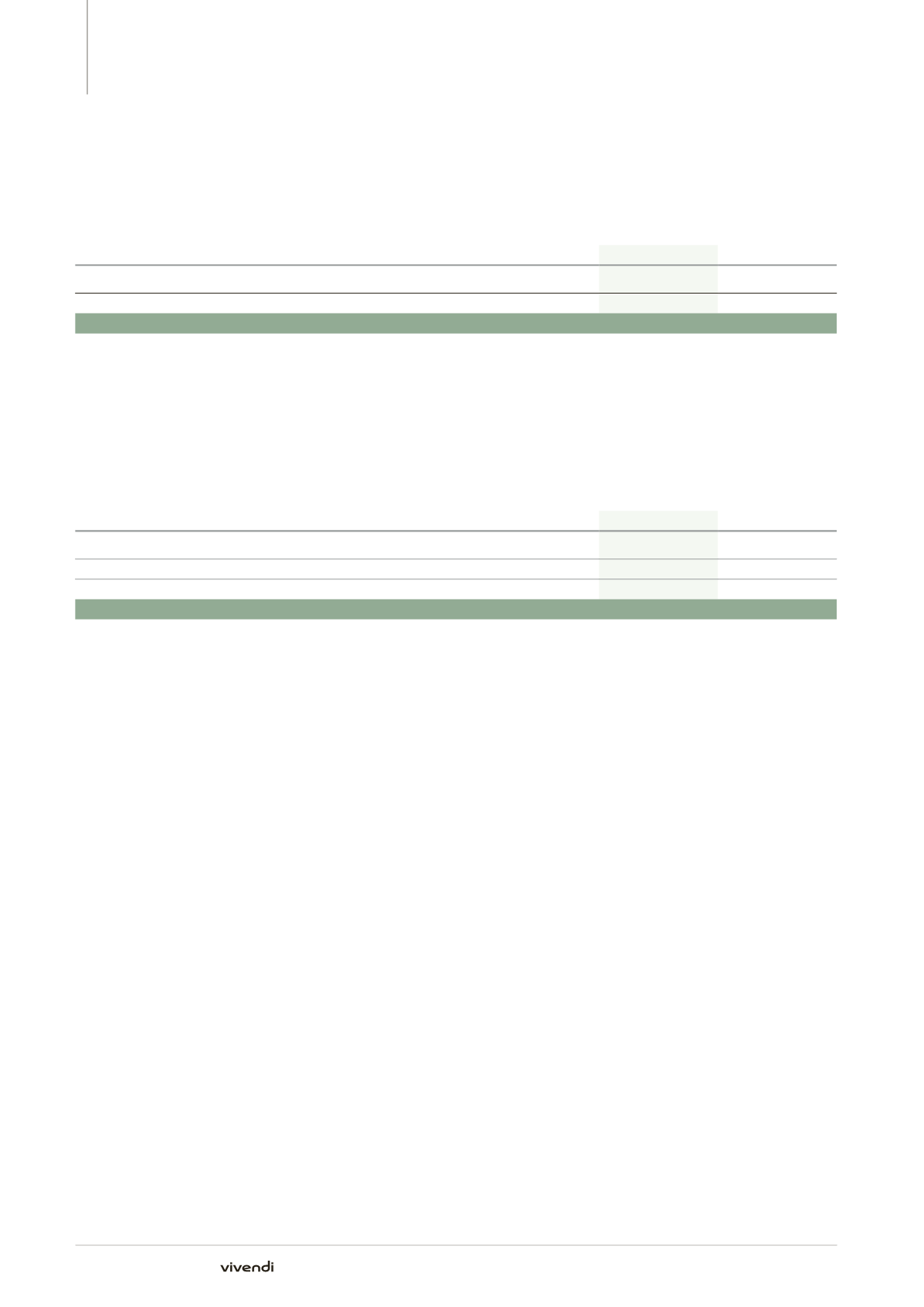

Share capital of Vivendi SA

(in thousands)

December 31, 2014

December 31, 2013

Common shares outstanding (nominal value: €5.5 per share)

1,351,601

1,339,610

Treasury shares

(50)

(51)

Voting rights

1,351,551

1,339,559

As of December 31, 2014, Vivendi held 50 thousand treasury shares,

representing a non-significant portion of its share capital. These shares

are backed to the partial hedging of performance share plans. As of

December, 31, 2014, the market value of the portfolio amounted to

approximately €1 million.

In addition, as of December 31, 2014, approximately 42.7 million stock

options were outstanding, representing a potential maximum nominal

share capital increase of €235 million (i.e., 3.16%).

Non-controlling interests

(in millions of euros)

December 31, 2014

December 31, 2013

Canal+ Group

369

368

Maroc Telecom group

(a)

-

1,176

Other

13

29

Total

382

1,573

(a)

On May 14, 2014, Vivendi sold its 53% interest in Maroc Telecom group (please refer to Note 3.3).

Distributions to shareowners of Vivendi SA

On June 30, 2014, Vivendi SA paid an ordinary €1 per share to its

shareholders from additional paid-in capital for an aggregate amount

of €1,348 million, considered as a return of capital distribution to

shareholders.

On February 11, 2015, the date of Vivendi’s Management Board’s

meeting which approved the Consolidated Financial Statements as

of December 31, 2014 and the appropriation of earnings for the fiscal

year then ended, Vivendi’s Management Board decided to propose to

shareholders an ordinary dividend of €1 per share, comprising €0.20

relative to the Group’s business performance and a €0.80 return to

shareholders as a result of the disposals of assets. Based on Vivendi’s

share capital outstanding shares as of December 31, 2014, this dividend

would represent a total distribution estimated at approximately

€1.4 billion, to be paid in cash on April 23, 2015, following the coupon

detachment on April 21, 2015. This proposal was presented to, and

approved by, Vivendi’s Supervisory Board at its meeting held on

February 27, 2015.

Share repurchase program

In addition to this distribution, a share repurchase program will be

submitted to shareholders’ approval, within the legal limit of 10% of

the share capital, for approximately €2.7 billion in accordance with the

market regulations on share repurchases. The program will run over a

period of 18 months.

252

Annual Report 2014