4

Note 8. Current Assets

Financial Report | Statutory Auditors’ Report on the Consolidated Financial Statements | Consolidated

Financial Statements | Statutory Auditors’ Report on the Financial Statements |

Statutory Financial Statements

Note 8.

Current Assets

8.1. Receivables

As of December 31, 2014, receivables, net of impairment, amounted to

€2,025.6 million (compared to €9,763.8 million as of December 31, 2013)

and included:

p

p

current account advances by Vivendi to its subsidiaries for a net

amount of €1,843.2 million (including €1,432.7 million for Groupe

Canal+ SA), compared to €9,244.9 million as of December 31, 2013,

which included (i) €7,472.5 million for SFR, approximately €4 billion

of which were reimbursed during 2014 following the sale of Maroc

Telecom in May, with the remaining balance of approximately

€3.5 billion being sold to Numericable and (ii) €1,464.6 million for

Groupe Canal+ SA;

p

p

receivables of €53.8 million in relation to the termination of the

French Consolidated Tax System, which included €37.6 million from

consolidated affiliates; and

p

p

moratorium interest of €43 million on the €366 million tax claim in

respect of tax savings for the fiscal year ended December 31, 2011,

was recorded as accrued income (collection in January 2015); the tax

refund of €366 million was received pursuant to the decision of the

Administrative Court of Montreuil dated October 6, 2014 (see Note 5,

Income taxes). However, the provision to cover this tax refund was

maintained (see Note 16, Provisions) and increased in 2014 with

respect to moratorium interest.

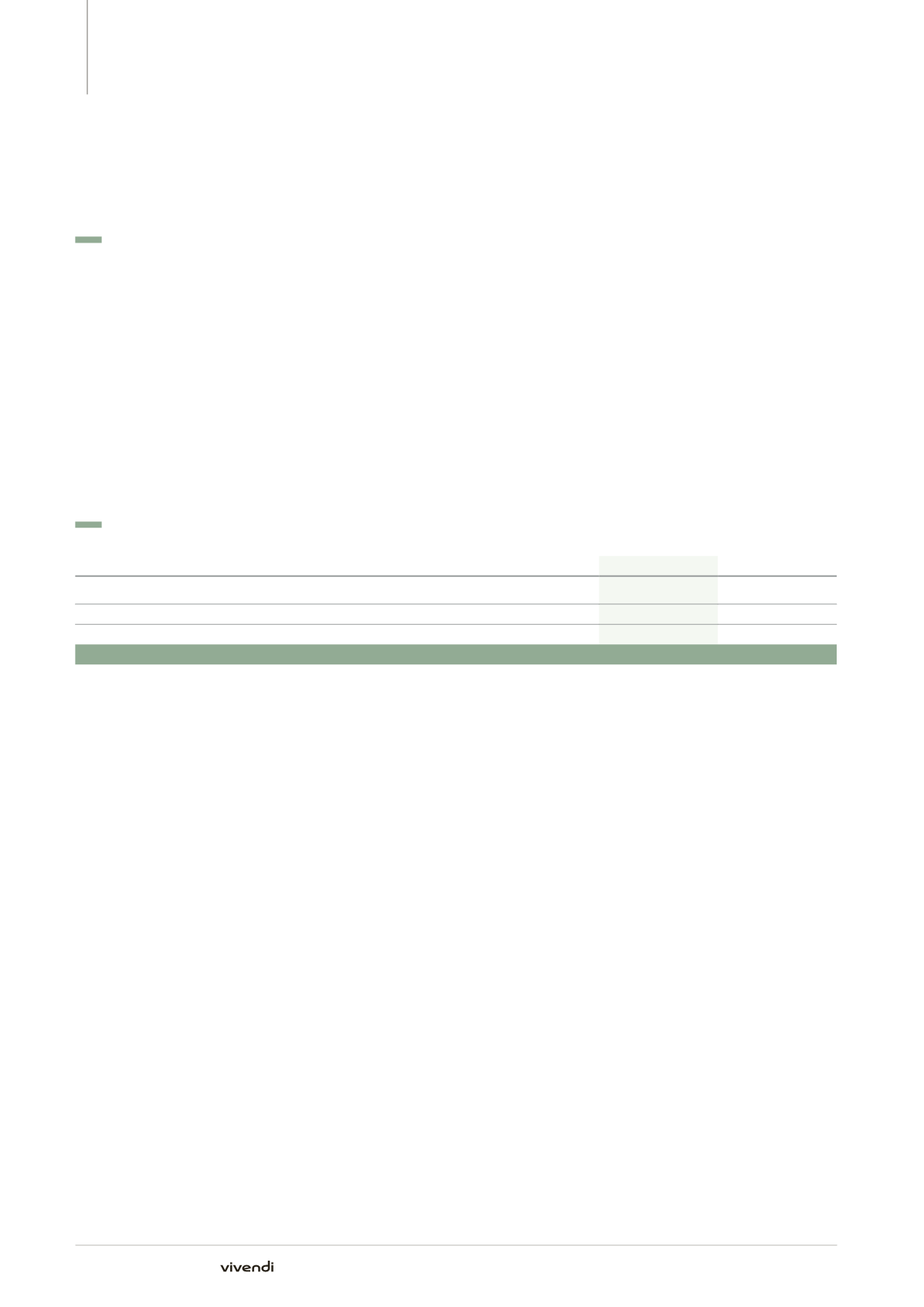

8.2. Prepaid expenses

(in millions of euros)

2014

2013

Expenses relating to the following period

2.4

2.5

Discount paid to subscribers of bonds

(a)

3.2

23.8

Amount paid as settlement of swaps

(b)

1.2

38.1

Total

6.8

64.4

(a)

In 2014, this includes other exceptional amortization for €15.9 million due to the anticipated repayment of bonds (see Note 17, Borrowings); and

(b)

In 2014, this includes other exceptional amortization for €25.6 million due to the anticipated repayment of bonds (see Note 17, Borrowings).

312

Annual Report 2014