4

Note 3. Net Financial Income/(Loss)

Financial Report | Statutory Auditors’ Report on the Consolidated Financial Statements | Consolidated

Financial Statements | Statutory Auditors’ Report on the Financial Statements |

Statutory Financial Statements

Note 2.

Operating Earnings/(Losses)

2.1. Revenues

Revenues consisting of revenues generated from services provided by Vivendi and rebilling of costs to its subsidiaries amounted to €58.3 million.

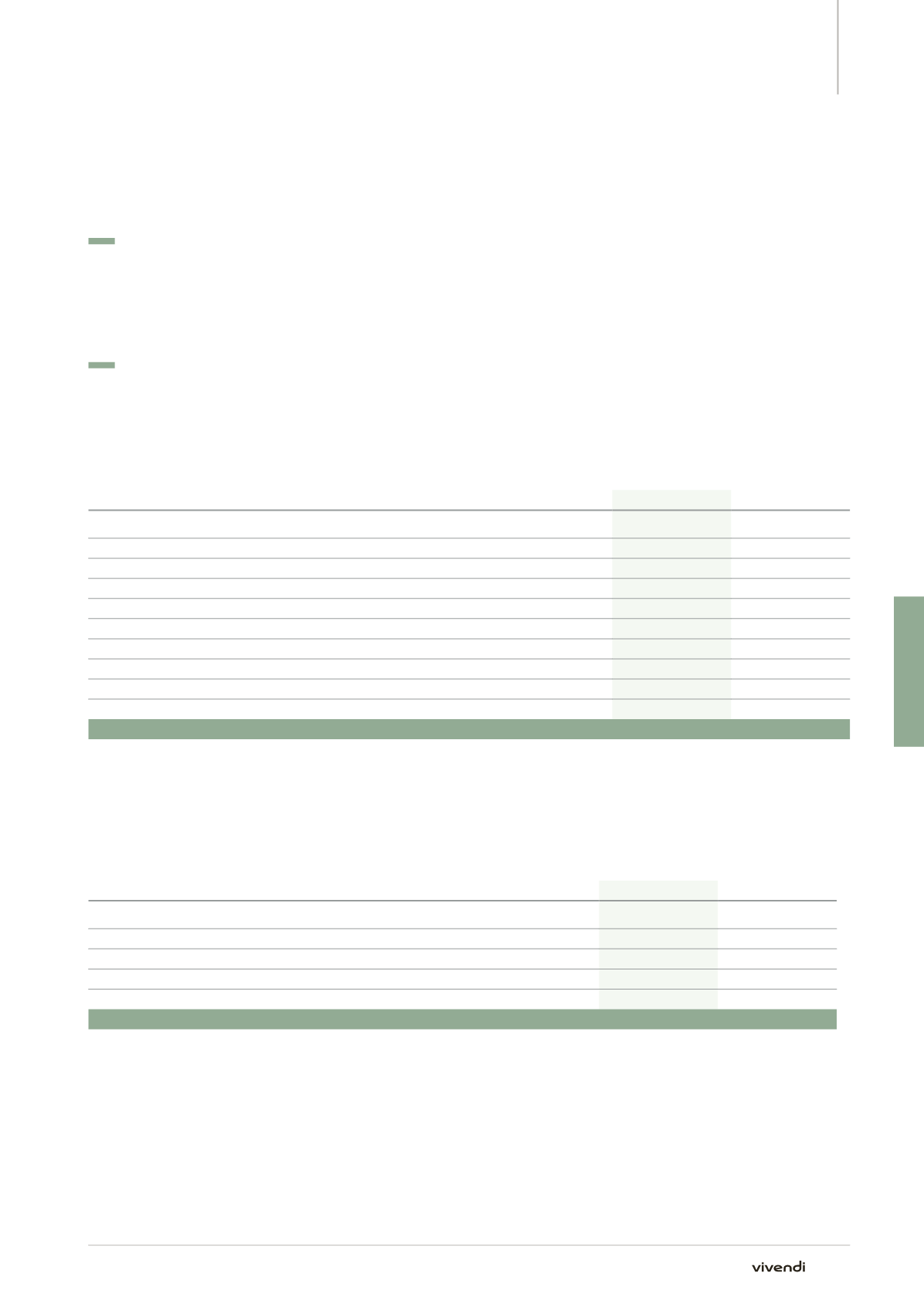

2.2. Operating expenses and expense reclassifications

In 2014, operating expenses amounted to €283.7 million, compared to

€223.4 million in 2013.

Within this total, “other purchases and external charges” represented

€144.7 million in 2014, compared to €125.5 million in 2013.

Other purchases and external charges, including amounts rebilled

to subsidiaries (recorded in revenues) and expense reclassifications

(recorded in reversal of provisions and expense reclassifications), are

broken-down as follows:

(in millions of euros)

2014

2013

Purchases consumed

0.6

0.7

Rent

8.4

8.4

Insurance

6.1

6.6

Service providers, temporary staff and sub-contracting

14.1

6.5

Commissions and professional fees

84.7

61.7

Bank services

18.2

26.9

Other external services

12.6

14.7

Sub-total other purchases and external charges

144.7

125.5

Amounts rebilled to subsidiaries (other income)

(6.3)

(8.8)

Expense reclassifications

(4.0)

(8.6)

Total net of rebilled expenses, insurance repayments and expense reclassifications

134.4

108.1

Note 3.

Net Financial Income/(Loss)

Net financial income/(loss) is broken-down as follows:

(in millions of euros)

2014

2013

Net financing costs

(53.8)

(172.2)

Dividends received

12.4

3,545.5

Foreign exchange gains & losses

(57.4)

(19.2)

Other financial income and expenses

(16.9)

(36.9)

Movements in financial provisions

(255.2)

(5,692.6)

Total

(370.9)

(2,375.4)

307

Annual Report 2014