4

Note 12. Deferred Charges

Financial Report | Statutory Auditors’ Report on the Consolidated Financial Statements | Consolidated

Financial Statements | Statutory Auditors’ Report on the Financial Statements |

Statutory Financial Statements

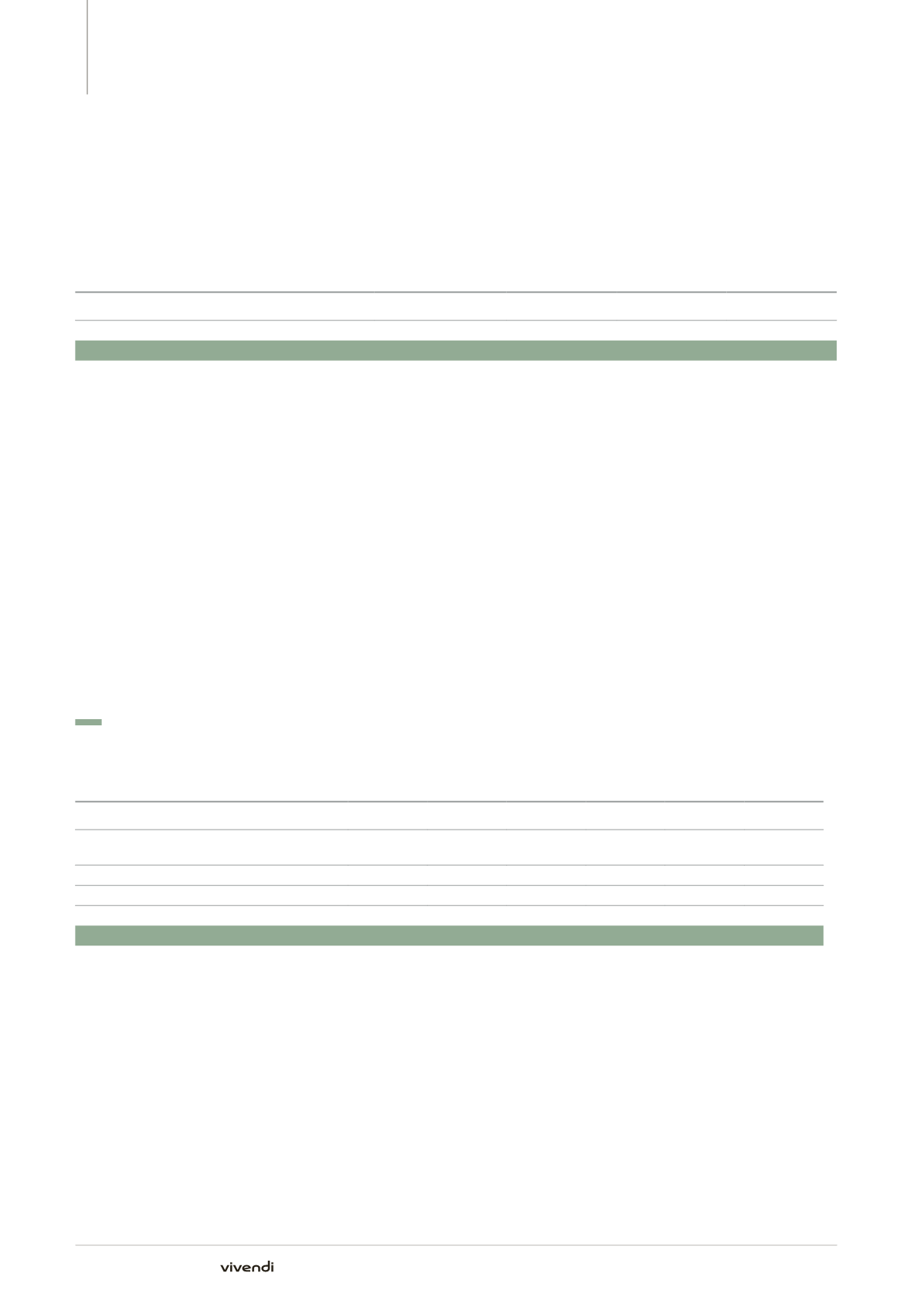

Note 12.

Deferred Charges

Deferred charges relating to financial instruments

(in millions of euros)

Opening balance

Increase

Amortization Closing balance

Deferred charges relating to credit lines

17.6

4.0

(13.3)

8.3

Issue costs of bonds

13.2

(11.1)

2.1

Total

30.8

4.0

(24.4)

10.4

Note 13.

Unrealized Foreign Exchange Gains and Losses

At year-end 2014, the decrease in unrealized foreign exchange losses

to €0.0 million from €21.6 million at year-end 2013 resulted from the

€21.3 million decrease in unrealized losses in relation to the $700 million

bond issue dated April 2008 and maturing in April 2018, its remaining

balance of $241 million being early redeemed in December 2014 (see

Note 17, Borrowings).

The decrease in unrealized foreign exchange gains to €0.2 million from

€7.7 million at year-end 2013 resulted primarily from the reversal of

unrealized gains of €7.7 million recorded at year-end 2013, in relation

to the revaluation of remaining debt obligations of $353.9 million from

two bonds; these bonds were early redeemed in December 2014 (see

Note 17, Borrowings).

Note 14.

Equity

14.1. Changes in equity

(in millions of euros)

(a)

Number of

shares

Share

capital

Additional

paid-in

capital

Reserves

and retained

earnings

(Loss)/

Earnings

Total

As of 12/31/13

1,339,609,931

7,367.9

13,194.1

3,540.0

(4,857.6)

19,244.5

Allocation of earnings/(loss) and return of capital

distribution

(3,351.3)

(2,854.0)

4,857.6

(1,347.7)

50 bonus share plan

727,118

4.0

(4.0)

0.0

Stock options

11,263,589

61.9

135.0

196.9

Earnings for the year

2,914.9

2,914.9

As of 12/31/14

1,351,600,638

7,433.8

9,973.9

686.0

2,914.9

21,008.6

(a)

Par value of €5.50 per share

The potential number of shares that may be issued upon the exercise of stock subscription options granted before 2013 is 42,722,348.

314

Annual Report 2014