4

Financial Report | Statutory Auditors’ Report on the Consolidated Financial Statements |

Consolidated

Financial Statements

| Statutory Auditors’ Report on the Financial Statements | Statutory Financial Statements

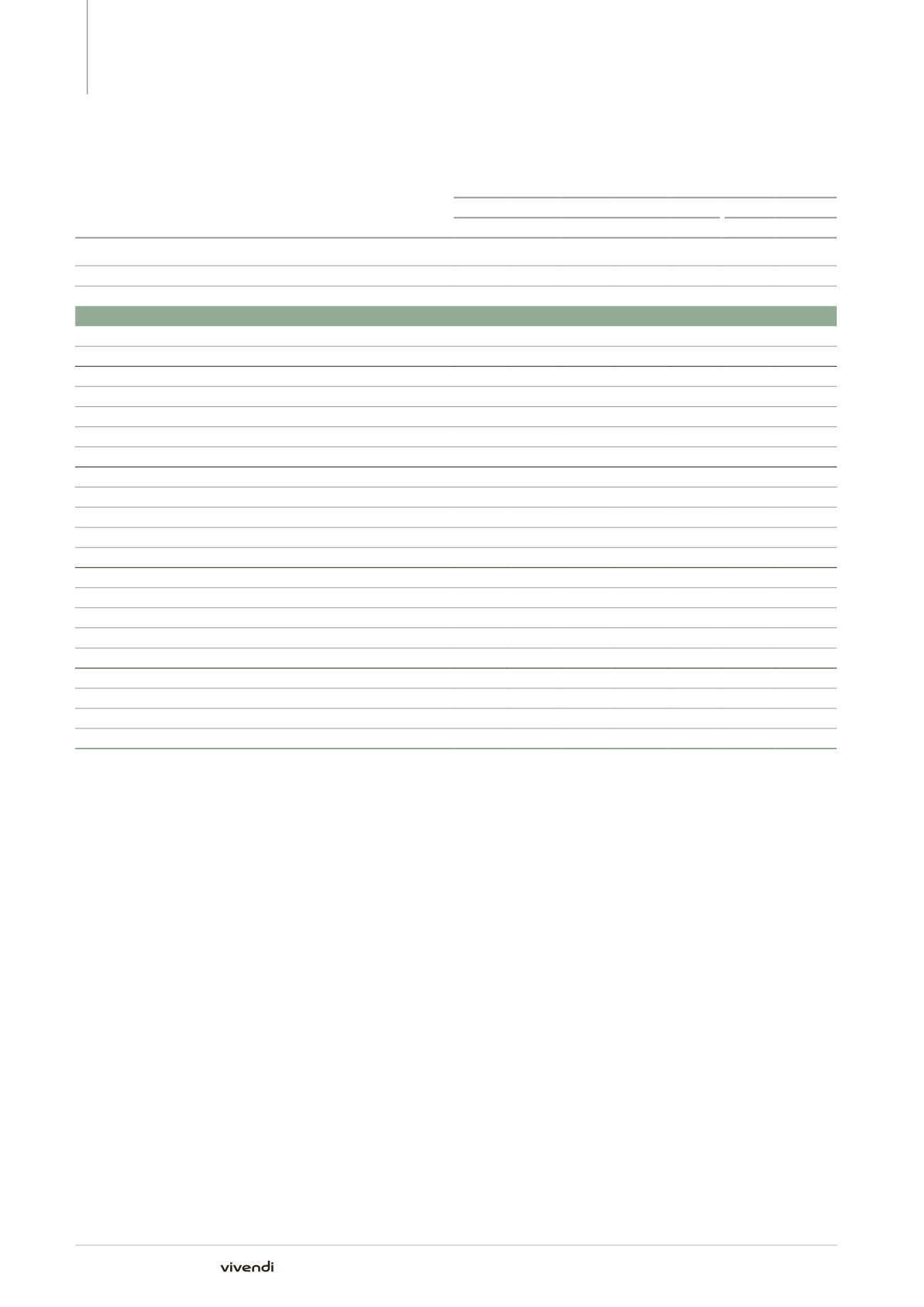

Note 22. Financial instruments and management of financial risks

(in millions of euros)

December 31, 2013

Notional amounts

Fair value

Total

USD PLN GBP Other Assets Liabilities

Sales against the euro

(1,060)

(49)

(105)

(834)

(72)

2

(10)

Purchases against the euro

2,329 1,330

21

888

90

11

(7)

Other

-

187

(81)

(4)

(102)

4

(2)

1,269 1,468 (165)

50

(84)

17

(19)

Breakdown by accounting category of foreign currency hedging instruments

Cash fow hedge

Sales against the euro

(73)

(11)

(42)

(7)

(13)

-

-

Purchases against the euro

85

85

-

-

-

1

(1)

Other

-

168

(75)

-

(93)

4

(2)

12

242 (117)

(7)

(106)

5

(3)

Fair value hedge

Sales against the euro

(93)

(38)

(51)

(4)

-

1

(2)

Purchases against the euro

450

432

-

18

-

-

(6)

Other

-

8

(6)

(4)

2

-

-

357

402

(57)

10

2

1

(8)

Net investment hedge

Sales against the euro

(823)

-

-

(a)

(823)

-

-

(8)

Purchases against the euro

-

-

-

-

-

-

-

Other

-

-

-

-

-

-

-

(823)

-

-

(823)

-

-

(8)

Economic hedging

(b)

Sales against the euro

(71)

-

(12)

-

(59)

1

-

Purchases against the euro

1,794

813

21

870

90

10

-

Other

-

11

-

-

(11)

-

-

1,723

824

9

870

20

11

-

(a)

Relates to the hedge of the net investment in certain subsidiaries in the United Kingdom for a notional amount of £832 million as of December 31,

2014 (£692 million as of December 31, 2013).

(b)

The economic hedging instruments relate to derivative financial instruments which are not eligible for hedge accounting pursuant to IAS 39.

22.2.5.

Liquidity risk management

Vivendi SA centralizes daily cash surpluses (cash pooling) of all controlled

entities (a) that are not subject to local regulations restricting the

transfer of financial assets or (b) that are not subject to other contractual

agreements.

As of December 31, 2014, the future undiscontinued cash flows related

to borrowings and other financial liabilities amounted to €2,623 million

(compared to a carrying value of €2,347 million) and are presented in

Note 25.1 within the group’s contractual minimum future payments.

As of February 11, 2015, Vivendi considers that the cash flows generated

by its operating activities, its cash and cash equivalents, as well as the

amounts available through its current bank credit facility will be sufficient

to cover its operating expenses and capital expenditures, service its debt,

pay its income taxes, dividends and share repurchases, if any, as well as

to fund its investment projects, if any, for the next 12 months.

272

Annual Report 2014