4

Financial Report | Statutory Auditors’ Report on the Consolidated Financial Statements |

Consolidated

Financial Statements

| Statutory Auditors’ Report on the Financial Statements | Statutory Financial Statements

Note 22. Financial instruments and management of financial risks

22.2.3.

Interest rate risk management

Vivendi’s interest rate risk management seeks to reduce its net exposure

to interest rate increases. Therefore, Vivendi uses pay-floating and pay-

fixed interest rate swaps. These instruments enable thus the group to

manage and reduce volatility for future cash flows related to interest

payments on borrowings.

In December 2014, concomitantly with the redemption of the bonds

with make-whole option, Vivendi early settled pay-floating interest

rate swaps with a notional amount of €750 million and €400 million.

As of December 31, 2014, the portfolio of Vivendi’s interest rate hedging

instruments included the following swaps:

p

p

pay-fixed interest rate swaps with a notional amount of €450 million,

maturing in 2017, set up in 2012;

p

p

pay-floating interest rate swaps with a notional amount of

€450 million, maturing in 2017, set up in 2010; and

p

p

pay-floating interest rate swaps with a notional amount of

€1,000 million, maturing in 2016, set up in 2011.

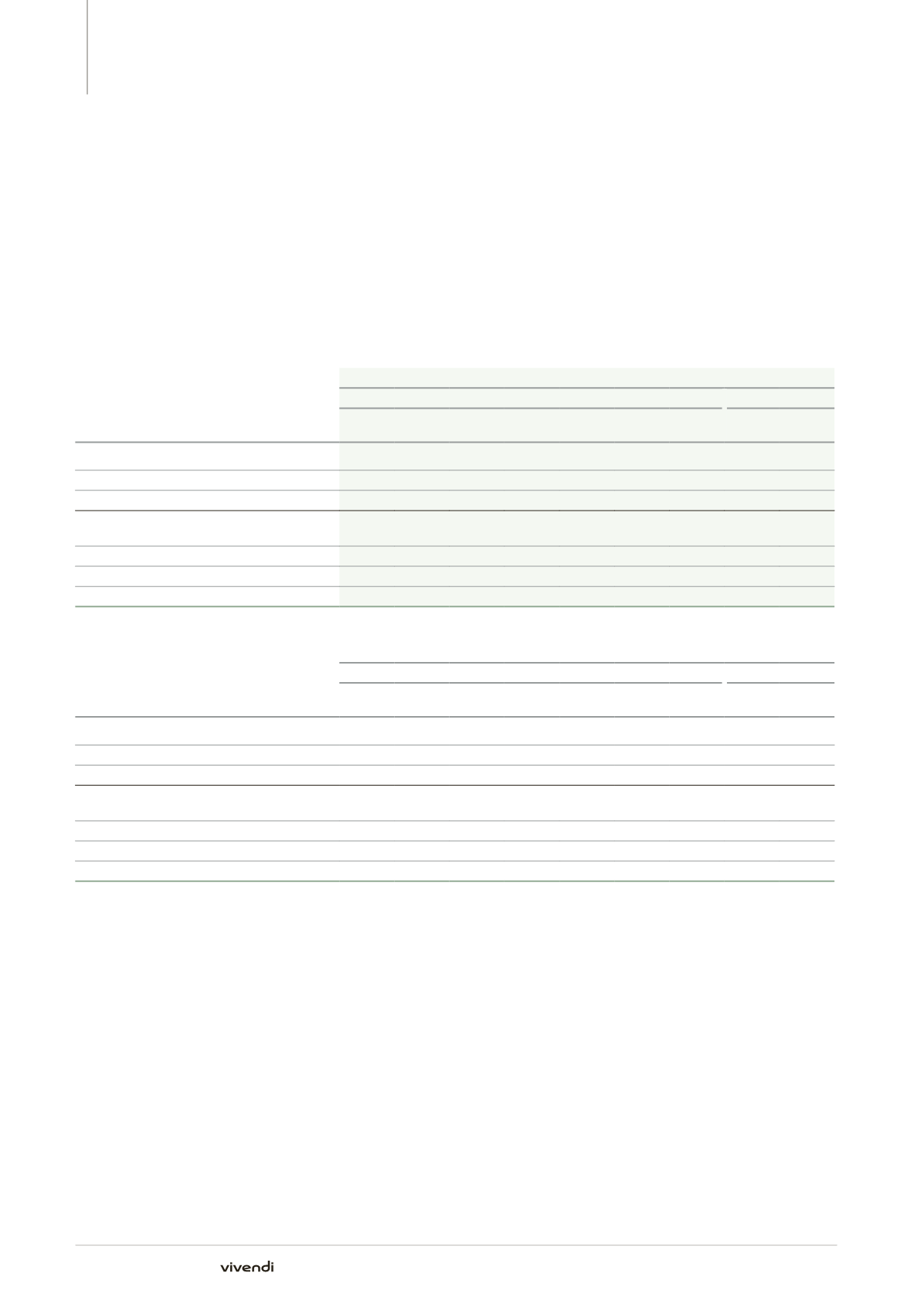

(in millions of euros)

December 31, 2014

Notional amounts

Fair value

Total

2015

2016

2017

2018

2019

After

2019 Assets Liabilities

Pay-fixed interest rate swaps

450

450

-

(12)

Pay-floating interest rate swaps

(1,450)

(1,000)

(450)

75

-

Net position at fixed interest rate

(1,000)

(1,000)

(a)

-

75

(12)

Breakdown by accounting category of rate hedging

instruments

Cash fow hedge

-

-

-

Fair value hedge

(1,000)

(1,000)

35

-

Economic hedging

(b)

-

(a)

-

40

(12)

(in millions of euros)

December 31, 2013

Notional amounts

Fair value

Total

2014

2015

2016

2017

2018

After

2018 Assets Liabilities

Pay-fixed interest rate swaps

450

450

-

(7)

Pay-floating interest rate swaps

(2,600)

(1,400)

(450)

(750)

88

-

Net position at fixed interest rate

(2,150)

(1,400)

(a)

-

(750)

88

(7)

Breakdown by accounting category of rate hedging

instruments

Cash fow hedge

-

-

-

Fair value hedge

(2,150)

(1,400)

(750)

46

-

Economic hedging

(b)

-

(a)

-

42

(7)

(a)

Includes pay-floating interest rate swaps for a notional amount of €450 million as well as pay-fixed interest rate swaps for a notional amount of

€450 million, maturing in 2017, qualified as economic hedges.

(b)

The economic hedging instruments relate to derivative financial instruments which are not eligible for hedge accounting pursuant to IAS 39.

270

Annual Report 2014