4

Financial Report | Statutory Auditors’ Report on the Consolidated Financial Statements |

Consolidated

Financial Statements

| Statutory Auditors’ Report on the Financial Statements | Statutory Financial Statements

Note 9. Goodwill

■

■

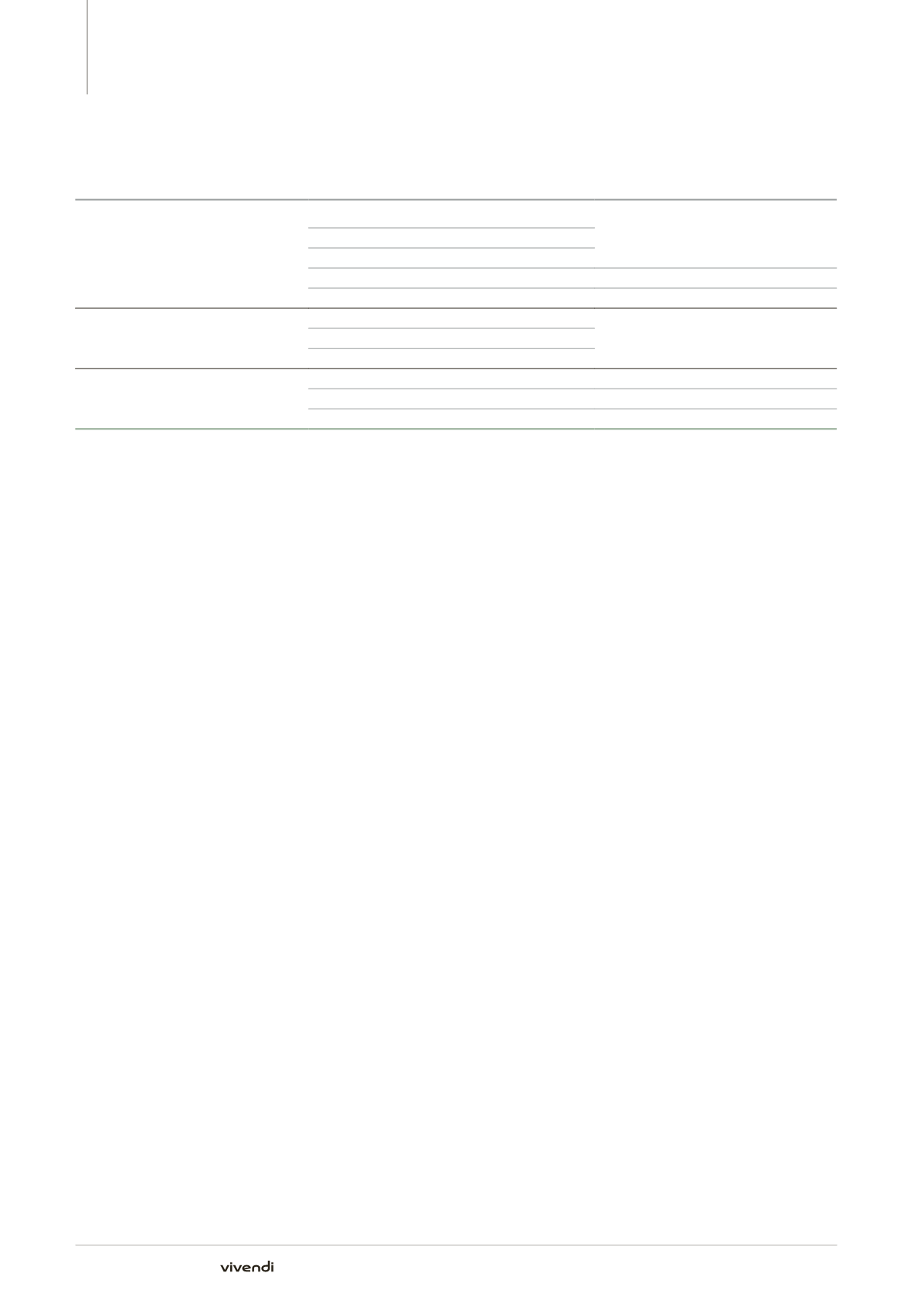

Presentation of CGU or groups of CGUs tested

Operating Segments

Cash Generating Units (CGU)

CGU or groups of CGU tested

Canal+ Group

Pay-TV in Mainland France

Pay-TV and free-to-air TV in France,

Africa and Vietnam

(b)

Canal+ Overseas

(a)

Free-to-air TV

nc+ (Poland)

nc+

Studiocanal

Studiocanal

Universal Music Group

Recorded music

Universal Music Group

Artist services and merchandising

Music publishing

Vivendi Village

See Tickets

See Tickets

Digitick

Digitick

Wengo

Wengo

(a)

Relates to pay-TV in France overseas, Africa and Vietnam.

(b)

The process of integrating free-to-air TV operations (D8/D17 channels acquired on September 27, 2012) with pay-TV operations in mainland France,

as well as the development of pay-TV in Vietnam reflects the further convergence of pay-TV and free-to-air TV operations in French-speaking

countries in which Canal+ Group operates. As a result, as of December 31, 2014, Vivendi performed a goodwill impairment test related to pay-TV

and free-to-air TV operations in France, Africa and Vietnam by aggregating the CGU of pay-TV in Mainland France, Canal+ Overseas and free-to-air

TV, which corresponds to the level of monitoring the return on such investments.

During the fourth quarter of 2014, Vivendi performed a goodwill

impairment test on each cash generating unit (CGU) or groups of CGU,

on the basis of valuations of recoverable amounts determined with

the assistance of third-party appraisers, for pay-TV and free-to-air TV

in France, Africa and Vietnam as well as Universal Music Group and

internal valuations for nc+ in Poland, Studiocanal, See Tickets, Digitick

and Wengo. As a result, Vivendi Management concluded that, as of

December 31, 2014, except for the cases of Digitick and Wengo (see

above), the recoverable amount for each CGU or groups of CGU tested

exceeded their carrying value.

As a reminder, as of December 31, 2013, Vivendi examined the value of

goodwill of pay-TV in Mainland France and Canal+ Overseas (previously

Canal+ France), using the usual valuation methods and concluded that

its recoverable amount, based upon the DCF method, using the most

recent cash flow forecasts approved by the Management of the group,

exceeded its carrying value at that date. Since November 5, 2013,

Vivendi holds a 100% interest in pay-TV operations of Canal+ in France

and Africa pursuant to the acquisition of Lagardère Group’s 20% interest

in Canal+ France for €1,020 million, in cash. In accordance with IFRS 10,

this transaction was recognized as the acquisition of a non-controlling

interest and the difference between the consideration paid and the

carrying value of the acquired non-controlling interest was recorded as a

deduction from equity attributable to Vivendi SA shareowners.

As a reminder, in respect of SFR: as of December 31, 2013, Vivendi

examined the value of SFR’s goodwill. SFR’s recoverable amount was

determined upon the basis of the usual valuation methods, in particular

the value in use, based upon the DCF method. The most recent cash flow

forecasts, and financial assumptions approved by the Management of

the group were used and were updated to take into account the strong

impact on revenues of the new pricing policies decided by SFR in a

competitive environment, partially offset by cost savings which were

consistent with expectations under SFR’s transformation plan, while

maintaining high capital expenditures, notably due to SFR’s acceleration

of very-high speed mobile network investments. As a result, Vivendi’s

Management concluded that SFR’s recoverable amount was below its

carrying value as of December 31, 2013 and decided to record a goodwill

impairment loss of €2,431 million.

242

Annual Report 2014