4

Financial Report | Statutory Auditors’ Report on the Consolidated Financial Statements |

Consolidated

Financial Statements

| Statutory Auditors’ Report on the Financial Statements | Statutory Financial Statements

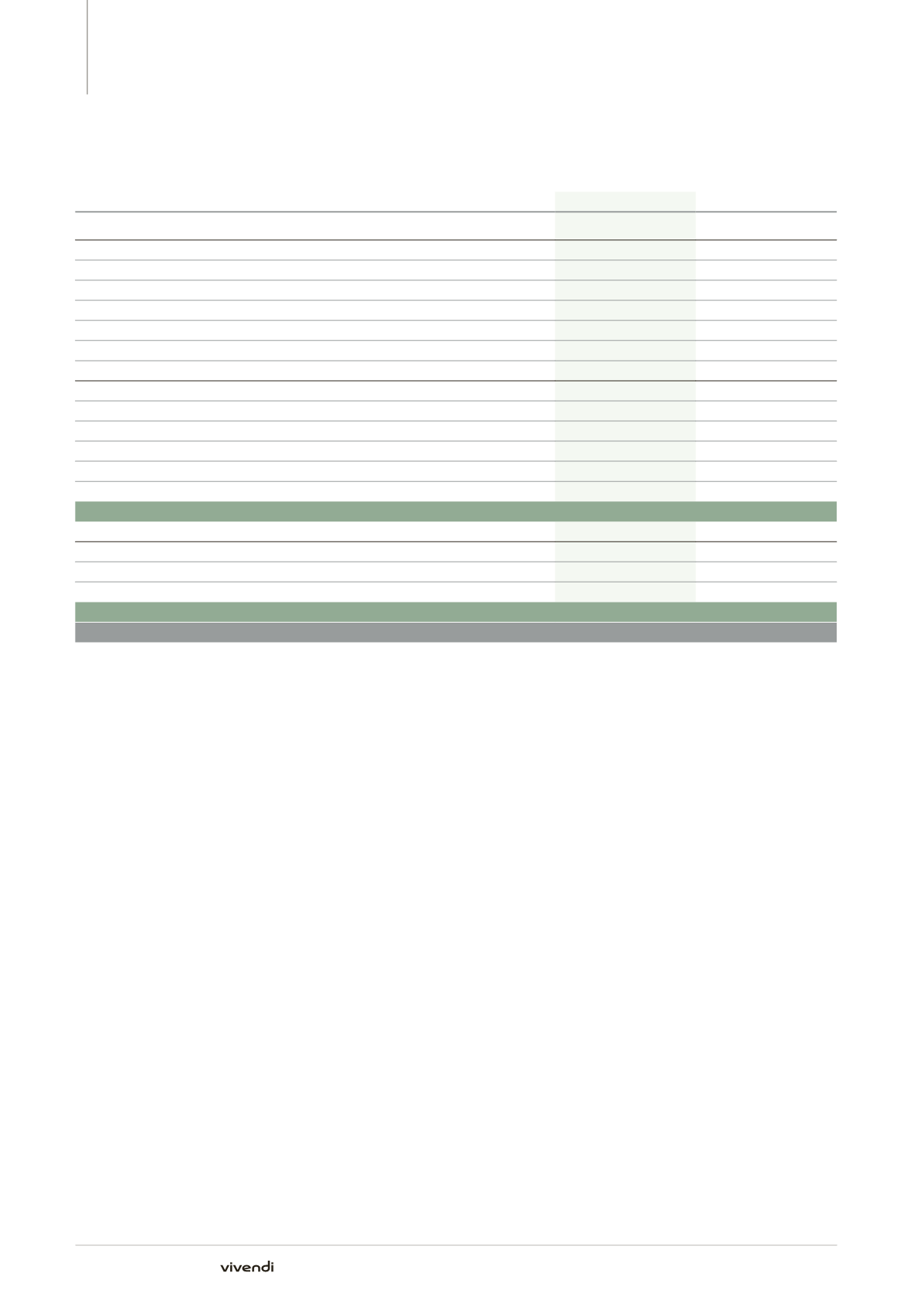

Note 6. Income taxes

Components of deferred tax assets and liabilities

(in millions of euros)

December 31, 2014

December 31, 2013

Deferred tax assets

Recognizable deferred taxes

Tax attributes

(a)

2,437

2,591

of which Vivendi SA

(b)

1,400

1,527

US tax group

(c)

419

364

Temporary differences

(d)

704

1,105

Netting

(124)

(501)

Recognizable deferred taxes

3,017

3,195

Deferred taxes, unrecognized

Tax attributes

(a)

(2,155)

(2,262)

of which Vivendi SA

(b)

(1,274)

(1,364)

US tax group

(c)

(419)

(364)

Temporary differences

(d)

(152)

(200)

Deferred taxes, unrecognized

(2,307)

(2,462)

Recorded deferred tax assets

710

733

Deferred tax liabilities

Asset revaluations

(e)

484

591

Other

297

590

Netting

(124)

(501)

Recorded deferred tax liabilities

657

680

Deferred tax assets/(liabilities), net

53

53

(a)

The amounts of tax attributes, as reported in this table, were estimated at the end of the relevant fiscal years. In jurisdictions which are significant

for Vivendi, mainly France and the United States, tax returns are filed on May 1 and September 15 of the following year at the latest, respectively.

The amounts of tax attributes reported in this table and the amounts reported to the tax authorities may therefore differ, and if necessary, may need

to be adjusted at the end of the following year in the above table.

(b)

Relates to deferred tax assets recognizable in respect of tax attributes by Vivendi SA as head of the French Tax Group, representing €1,400 million

as of December 31, 2014 (please refer to Note 6.1), of which €1,115 million related to tax losses and €285 million related to tax credits, taking into

account the estimated impact (-€110 million) of 2014 transactions (taxable income and use or expiration of tax credits), but before taking into account

the effects of ongoing tax audits (please refer to Note 6.6).

In France, tax losses can be carried forward indefinitely and Vivendi considers that tax credits can be carried forward for a minimum period of five

years upon exit from the Consolidated Global Profit Tax System. In 2014, €265 million tax credits matured as of December 31, 2014.

(c)

Relates to deferred tax assets recognizable in respect of tax attributes by Universal Music Group, Inc. in the United States as head of the US tax

group, representing $509 million as of December 31, 2014, taking into account the estimated impact (-$68 million) of the 2014 transactions (taxable

income, capital losses, and tax credits that expired, capital losses and tax credits generated, but before taking into account the final outcome of

ongoing tax audits (please refer to Note 6.6).

As a reminder, with respect to the divestiture of 88% of the interest in Activision Blizzard and in accordance with US tax rules, Vivendi allocated to

Activision Blizzard, the acquirer of the majority of the Activision Blizzard shares transferred in the transaction, a fraction of its tax losses estimated

at more than $700 million. In addition, Universal Music Group Inc. replaced Vivendi Holding I LLC (formerly, Vivendi Holding I Corp.) as head of the

Tax Group System in the United States.

In the United States, tax losses can be carried forward for a period of up to 20-years and tax credits can be carried forward for a period of up to

10-years. No tax credit will mature prior to December 31, 2021 and no tax credit had matured in 2014.

(d)

Mainly relates to the deferred tax assets associated with non-deducted provisions upon recognition, including provisions relating to employee benefit

plans, and share-based compensation plans.

(e)

These tax liabilities, generated by asset revaluations following purchase allocations are terminated upon the amortization or divestiture of the

underlying asset and generate no current tax charge.

238

Annual Report 2014