4

Financial Report | Statutory Auditors’ Report on the Consolidated Financial Statements |

Consolidated

Financial Statements

| Statutory Auditors’ Report on the Financial Statements | Statutory Financial Statements

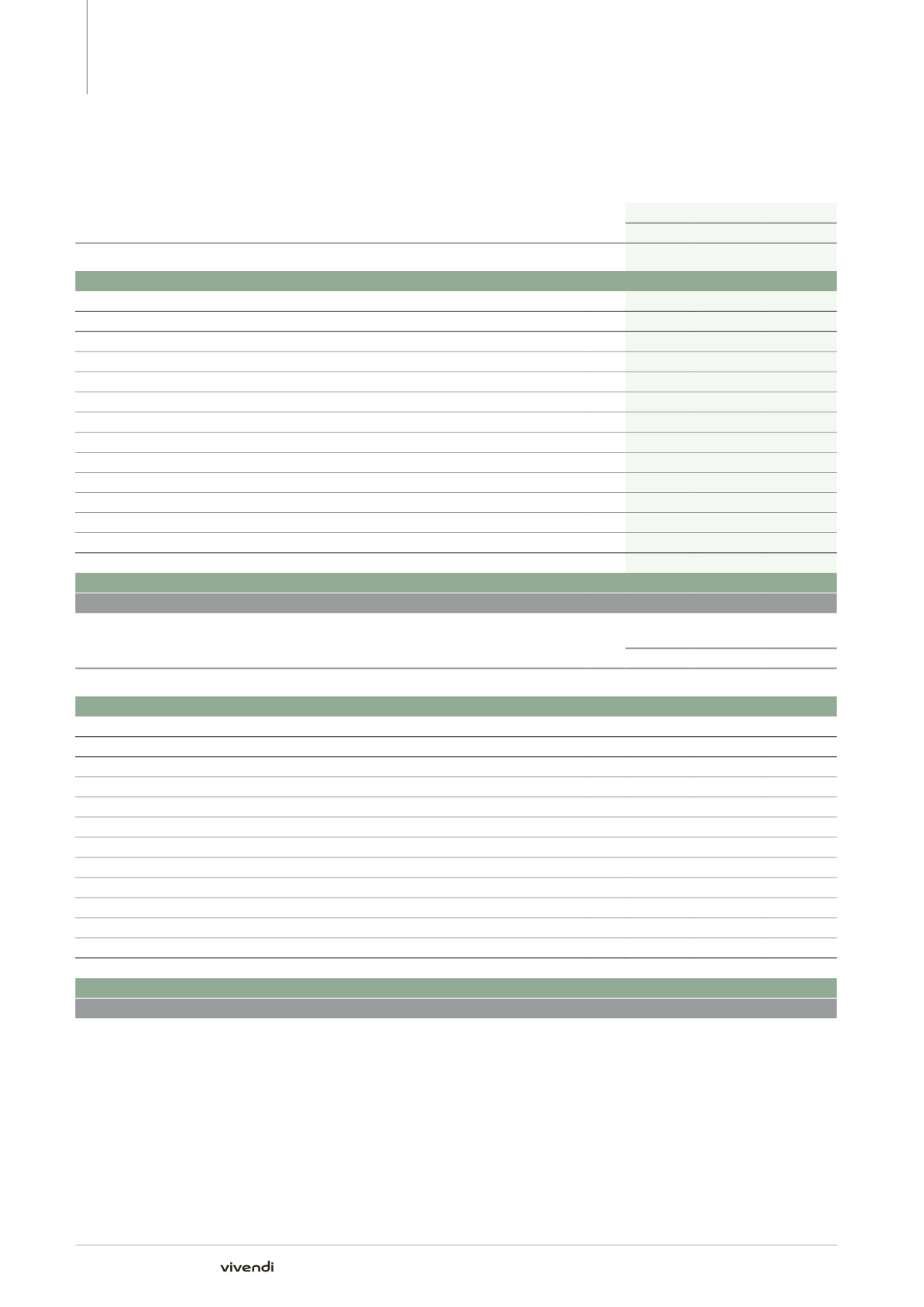

Note 8. Charges and income directly recognized in equity

Note 8.

Charges and income directly recognized in equity

(in millions of euros)

Note

Year ended December 31, 2014

Gross

Tax

Net

Actuarial gains/(losses) related to employee defined benefit plans

19

(93)

25

(68)

Items not reclassified to profit or loss

(93)

25

(68)

Foreign currency translation adjustments

(a)

778

-

778

Unrealized gains/(losses)

907

29

936

Change in fair value

(b)

920

(5)

915

Transferred to profit or loss of the period

(c)

(95)

36

(59)

Other

(d)

123

-

123

Assets available for sale

14

948

31

979

Cash flow hedge instruments

15

(1)

14

Change in fair value

6

(1)

5

Transferred to profit or loss of the period

9

-

9

Net investment hedge instruments

(56)

-

(56)

Change in fair value

(56)

-

(56)

Transferred to profit or loss of the period

-

-

-

Hedging instruments

22

(41)

(1)

(42)

Other impacts

(94)

-

(94)

Items to be subsequently reclassified to profit or loss

1,591

29

1,620

Charges and income directly recognized in equity

1,498

54

1,552

(in millions of euros)

Note

Year ended December 31, 2013

Gross

Tax

Net

Actuarial gains/(losses) related to employee defined benefit plans

19

(22)

(1)

(23)

Items not reclassified to profit or loss

(22)

(1)

(23)

Foreign currency translation adjustments

(e)

(1,429)

-

(1,429)

Unrealized gains/(losses)

99

(41)

58

Change in fair value

120

(42)

78

Transferred to profit or loss of the period

1

-

1

Assets available for sale

14

121

(42)

79

Cash flow hedge instruments

2

1

3

Change in fair value

16

-

16

Transferred to profit or loss of the period

(14)

1

(13)

Net investment hedge instruments

(24)

-

(24)

Change in fair value

15

-

15

Transferred to profit or loss of the period

(39)

-

(39)

Hedging instruments

22

(22)

1

(21)

Other impacts

16

(1)

15

Items to be subsequently reclassified to profit or loss

(1,314)

(42)

(1,356)

Charges and income directly recognized in equity

(1,336)

(43)

(1,379)

(a)

Mainly relates to foreign currency translation adjustments due to fluctuations in exchange rates at UMG (€730 million).

(b)

Primarily includes unrealized capital gains related to 97.4 million shares in Numericable-SFR from November 27 to December 31, 2014 for

€743 million (please refer to Note 3.1) and 41.5 million shares in Activision Blizzard in 2014 for €150 million (please refer to Note 3.4). In accordance

with IAS 39, these available-for-sale securities were valued on stock market price at each reporting date; relevant unrealized gains and losses were

directly recognized in equity and will be reclassified to profit or loss upon their sale, if any.

(c)

Relates to the reclassification to profit or loss of the gain realized on the sale of the interest in Beats by UMG in August 2014.

(d)

Relates to the unrealized gain generated from October 11 to December 31, 2013 with respect to 41.5 million Activision Blizzard shares held by Vivendi

as of December 31, 2014 following their reclassification from assets held for sale to available-for-sale securities as Vivendi Management has decided

not to sell this interest in the immediate future. As of December 31, 2014, this interest amounted to $836 million (€689 million) and the unrealized

capital gain with respect to this interest amounted to €273 million.

(e)

Includes the changes in foreign currency translation adjustments relating to discontinued operations for €685 million and the reclassification in

earnings for €555 million as part of the sale of 88% of the interest in Activision Blizzard.

240

Annual Report 2014