282

Annual Report -

2013

-

Vivendi

4

Financial Report | Statutory Auditors’ Report on the Consolidated Financial Statements |

Consolidated

Financial Statements

| Statutory Auditors’ Report on the Financial Statements | Statutory Financial Statements

Note 22. Share-based compensation plans

■

■

Employee stock purchase and leveraged plans

Vivendi also maintains share purchase plans (stock purchase and

leveraged plans) that allow substantially all of its employees and

retirees to purchase Vivendi shares through capital increases reserved

to them. These shares, which are subject to certain sale or transfer

restrictions, may be purchased by employees with a maximum discount

of 20% on the average opening market price for Vivendi shares during

the 20 trading days preceding the date of approval of the share capital

increase by the Management Board (purchase date). The difference

between the subscription price of the shares and the share price on

the date of grant (corresponding to the subscription period closing date)

represents the benefit granted to the beneficiaries. Furthermore, Vivendi

applies a discount for non-transferability in respect of the restrictions

on the sale or transfer of the shares during a five-year period, which is

deducted from the benefit granted to the employees. The value of the

stock purchase plans granted is estimated and fixed at the grant date.

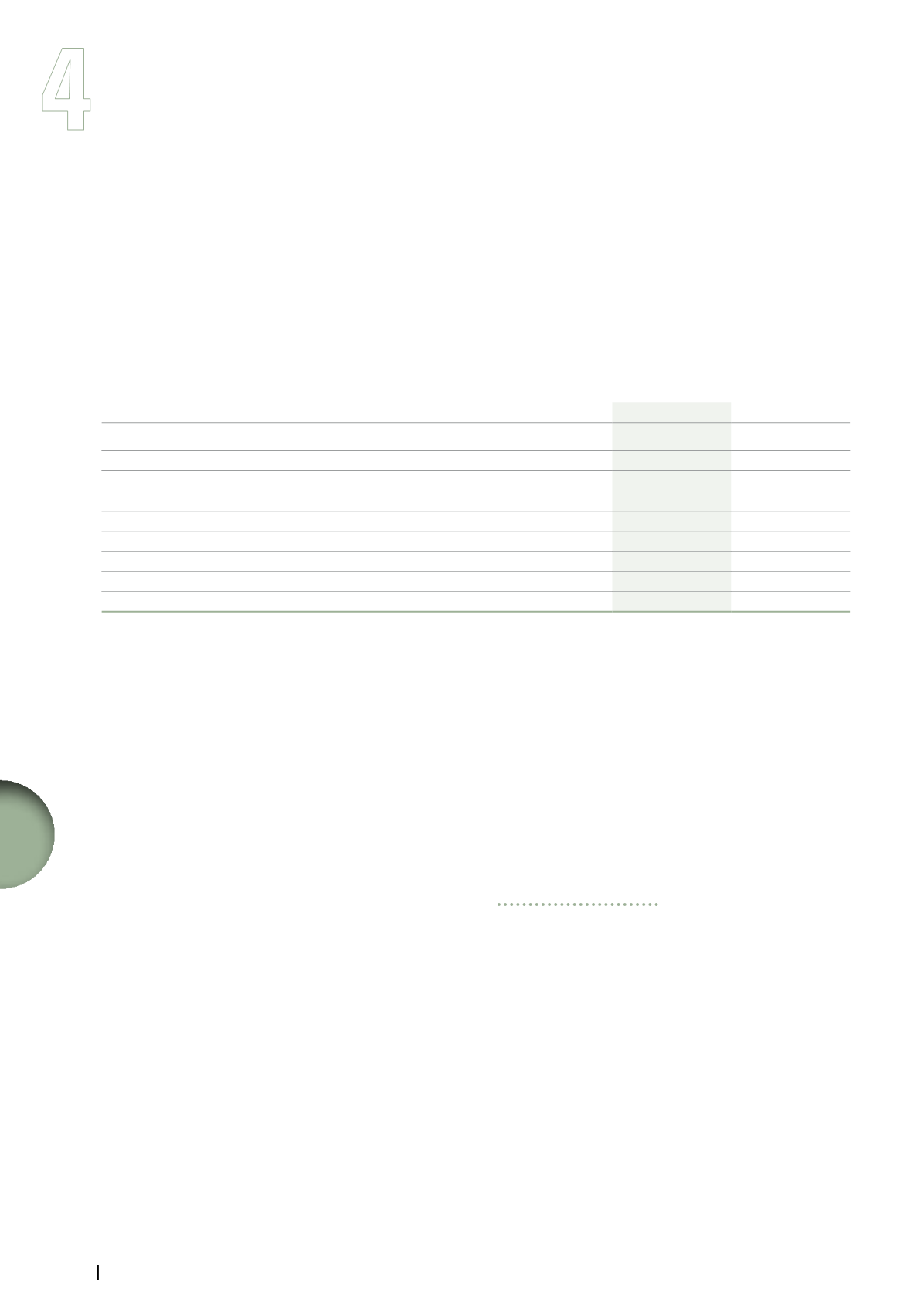

For the employee stock purchase and leveraged plans subscribed in 2013 and 2012, the applied valuation assumptions were as follows:

2013

2012

Grant date

June 28

June 25

Subscription price

(in euros)

12.10

10.31

Data at grant date:

Share price

(in euros)

14.55

13.57

Discount to face value

16.82%

24.02%

Expected dividend yield

6.87%

7.37%

Risk-free interest rate

1.19%

1.37%

5-year interest rate

in fine

6.08%

6.51%

Repo rate

0.36%

0.36%

Under the employee stock purchase plans, 2,055 thousand shares were

subscribed in 2013 (2,108 thousand shares subscribed in 2012). After

taking into account a 15.2% discount for non-transferability to the share

price on the grant date (15.3% in 2012), the fair value per subscribed

share was €0.24 on June 28, 2013, compared to €1.18 per subscribed

share on June 25, 2012.

Under the leveraged plans, virtually all employees and retirees of

Vivendi and its French and foreign subsidiaries were entitled to

subscribe for Vivendi shares through a reserved share capital increase,

while obtaining a discounted subscription price, and to ultimately

receive the capital gain (calculated pursuant to the terms and conditions

of the plan) corresponding to 10 shares for one subscribed share. A

financial institution mandated by Vivendi hedges this transaction.

In 2013, 9,758 thousand shares were subscribed under the leveraged

plan (compared to 9,845 subscribed shares in 2012). After taking into

account a 1.5% discount for non-transferability measured after the

leveraged impact (unchanged compared to 2012), the fair value per

subscribed share on June 28, 2013 was €2.23, compared to €3.05 per

subscribed share on June 25, 2012.

In 2013, the charge recognized with respect to employee stock purchase

and leveraged plans amounted to €23 million (compared to €33 million

in 2012).

Stock purchase and leveraged plans resulted in a capital increase

(including issue premium) totaling €149 million on July 25, 2013, and

€127 million on July 19, 2012.

■

■

Cash-settled instruments

In 2006 and 2007, Vivendi granted specific instruments to its US

resident managers and employees, with economic features similar to

those granted to non-US resident managers and employees, except that

these equity instruments are settled in cash only. The value of the cash-

settled instruments granted is initially estimated as of the grant date

and is then re-estimated at each reporting date until the payment date

and the expense is adjusted pro rata taking into account the vested

rights at each such reporting date. All the rights for these plans were

definitively vested as of April 2010.

Stock appreciation right plans

When the instruments entitle the beneficiaries thereof to receive the

appreciation in the value of the Vivendi share price, they are known as

“stock appreciation rights” (SAR) which are the economic equivalent of

stock options. Under a SAR plan, the beneficiaries will receive a cash

payment upon exercise of their rights based on the Vivendi share price

equal to the difference between the Vivendi share price upon exercise

of the SAR and their strike price as set at the grant date. SAR expire at

the end of a ten-year period.