272

Annual Report -

2013

-

Vivendi

4

Financial Report | Statutory Auditors’ Report on the Consolidated Financial Statements |

Consolidated

Financial Statements

| Statutory Auditors’ Report on the Financial Statements | Statutory Financial Statements

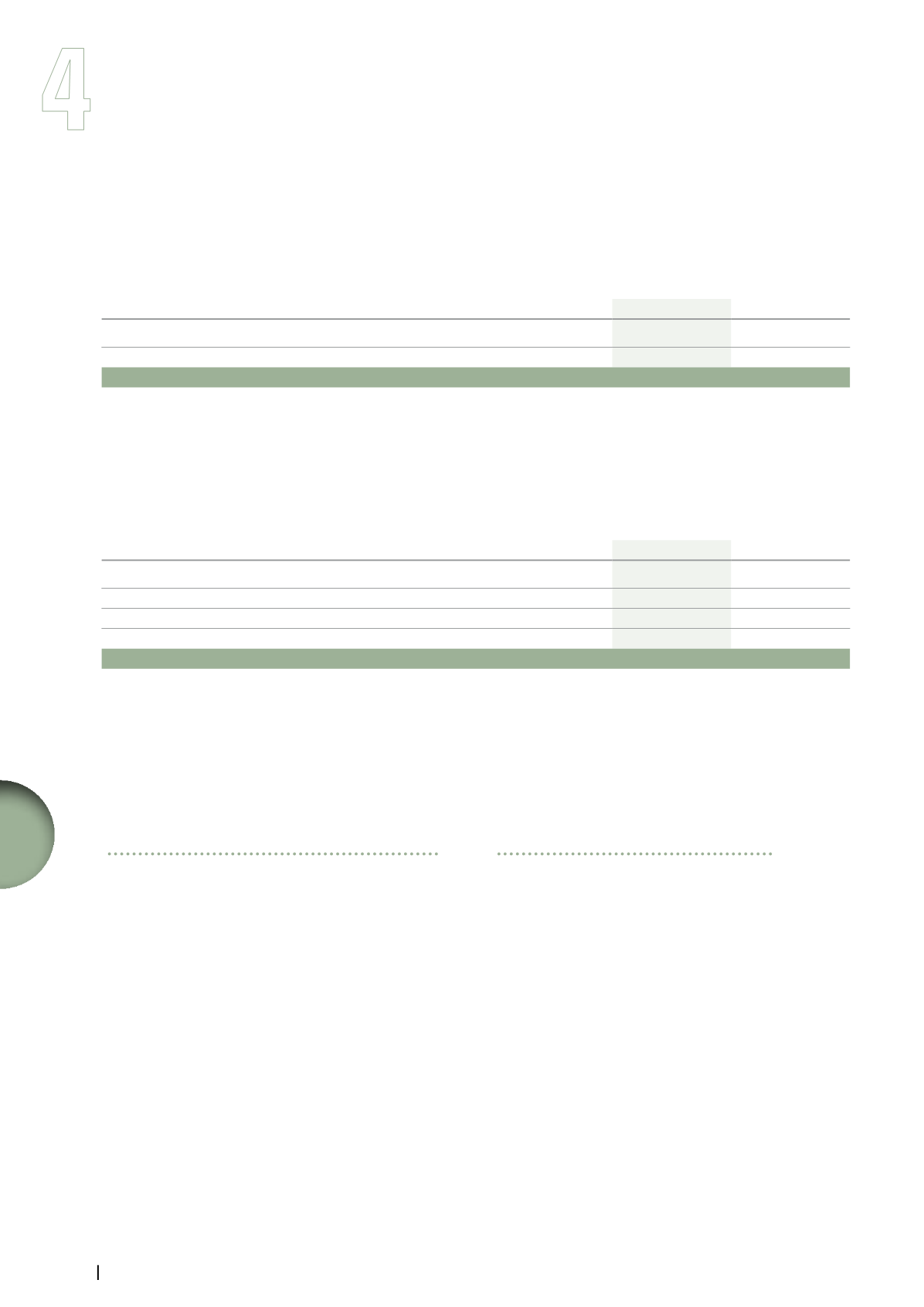

Note 19. Equity

Note 19.

Equity

Share capital of Vivendi SA

(in thousands)

December 31, 2013

December 31, 2012

Common shares outstanding (nominal value: €5.5 per share)

1,339,610

1,323,962

Treasury shares

(51)

(1,461)

Voting rights

1,339,559

1,322,501

As of December 31, 2013, Vivendi held 51 thousand treasury shares,

representing a non significant part of its share capital. These shares are

backed to the hedging of performance share plans. The market value of

the portfolio amounted to less than €1 million as of December 31, 2013.

In addition, as of December 31, 2013, approximately 52.8 million stock

options were outstanding, representing a maximum nominal share

capital increase of €291 million (i.e., 3.94%).

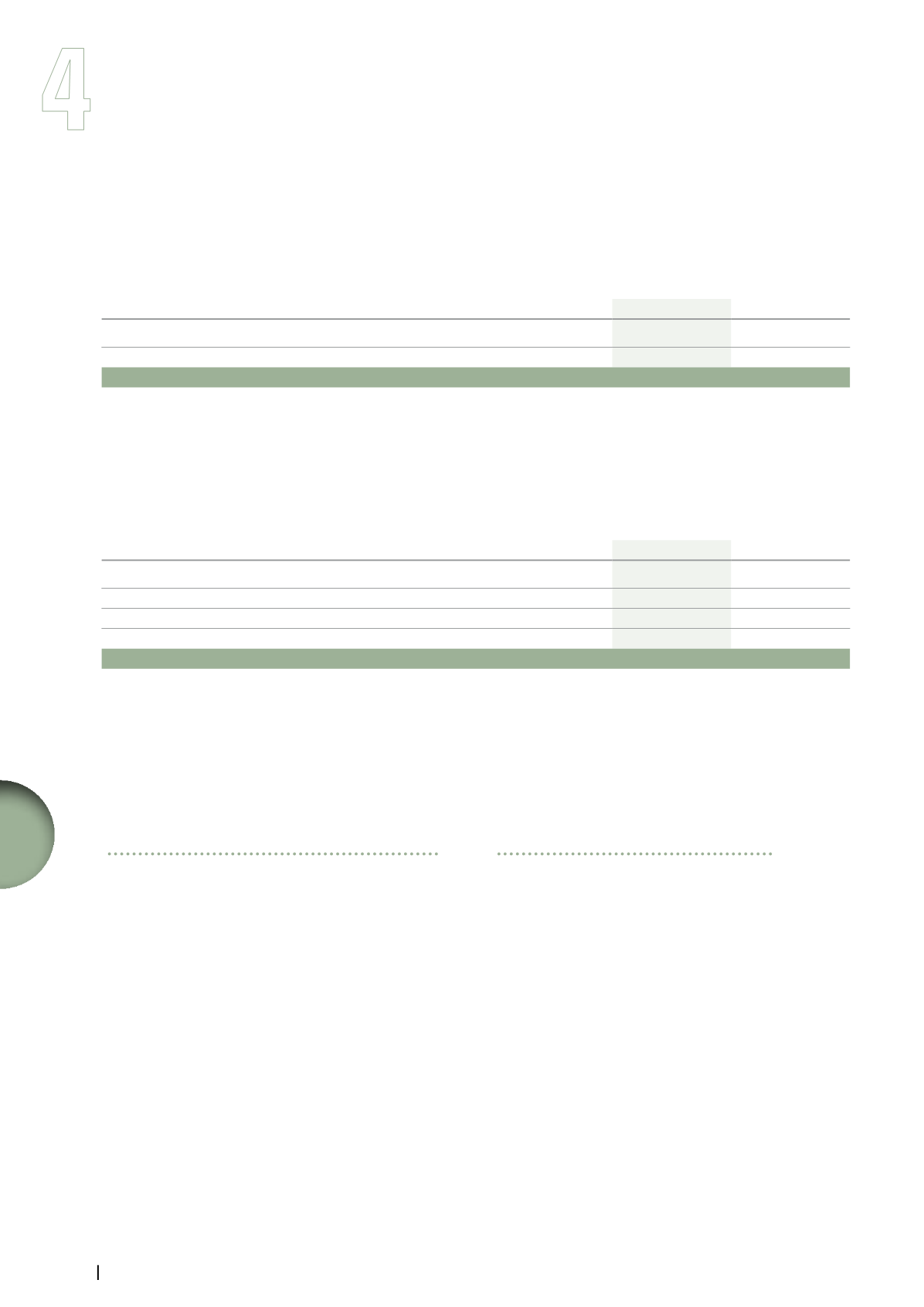

Non-controlling interests

(in millions of euros)

December 31, 2013

December 31, 2012

Canal+ Group

(a)

368

692

Activision Blizzard

(b)

-

1,183

Maroc Telecom Group

(c)

1,176

1,067

Other

29

24

Total

1,573

2,966

(a)

As of December 31, 2012, included Lagardère Group’s 20% interest in Canal+ France for €308 million. Vivendi acquired this ownership interest on

November 5, 2013 for €1,020 million, in cash (please refer to Note 2).

(b)

On October 11, 2013, Vivendi deconsolidated Activision Blizzard pursuant to the sale of 88% of its interest. As of December 31, 2013, Vivendi’s

remaining 83 million Activision Blizzard shares were recorded as “Assets available for sale” (please refer to Note 7).

(c)

On November 4, 2013, Vivendi and Etisalat entered into a definitive agreement for the sale of Vivendi’s 53% interest in Maroc Telecom Group

(please refer to Note 7).

Distributions to shareowners of Vivendi SA

Dividend paid by Vivendi SA with respect to fiscal year 2012

At the Annual General Shareholders’ Meeting of April 30, 2013,

Vivendi’s shareholders approved the distribution of a dividend of €1 per

share, representing a total distribution of €1,325 million, paid in cash

on May 17, 2013 by withdrawal from reserves, following the coupon

detachment on May 14, 2013. The additional contribution of 3% on

dividends was recorded as a tax charge (€40 million) in the consolidated

earnings at the time of the payment of the dividend by Vivendi on

May 17, 2013.

Bonus shares granted to Vivendi SA shareowners

At its meeting held on February 29, 2012, following the Supervisory

Board’s recommendation, Vivendi’s Management Board decided to grant

to its shareowners one bonus share per 30 shares held. This transaction

resulted in the issuance on May 9, 2012, by a €229 million withdrawal

from additional paid-in capital, of 41.6 million new shares with a

nominal value of €5.5 each and entitlement as from January 1, 2012.