274

Annual Report -

2013

-

Vivendi

4

Financial Report | Statutory Auditors’ Report on the Consolidated Financial Statements |

Consolidated

Financial Statements

| Statutory Auditors’ Report on the Financial Statements | Statutory Financial Statements

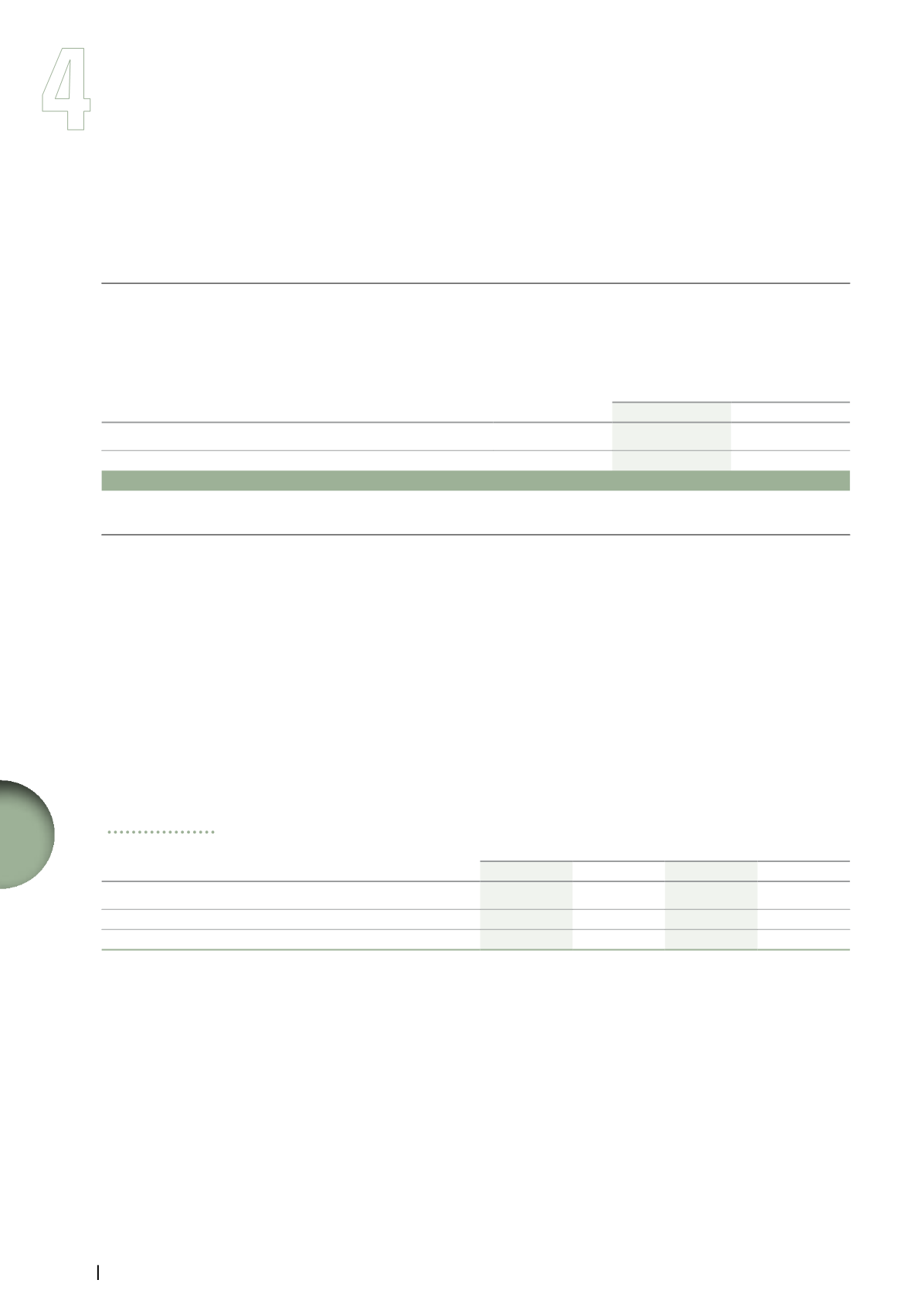

Note 21. Employee benefits

Note 21.

Employee benefits

21.1.

Analysis of expenses related to employee benefit plans

The following table provides information about the cost of employee benefit plans excluding its financial component. The total cost of defined benefit

plans is set forth in Note 21.2.2 below.

(in millions of euros)

Note

Year ended December 31,

2013

2012

Employee defined contribution plans

50

46

Employee defined benefit plans

21.2.2

(4)

(1)

Employee benefit plans

46

45

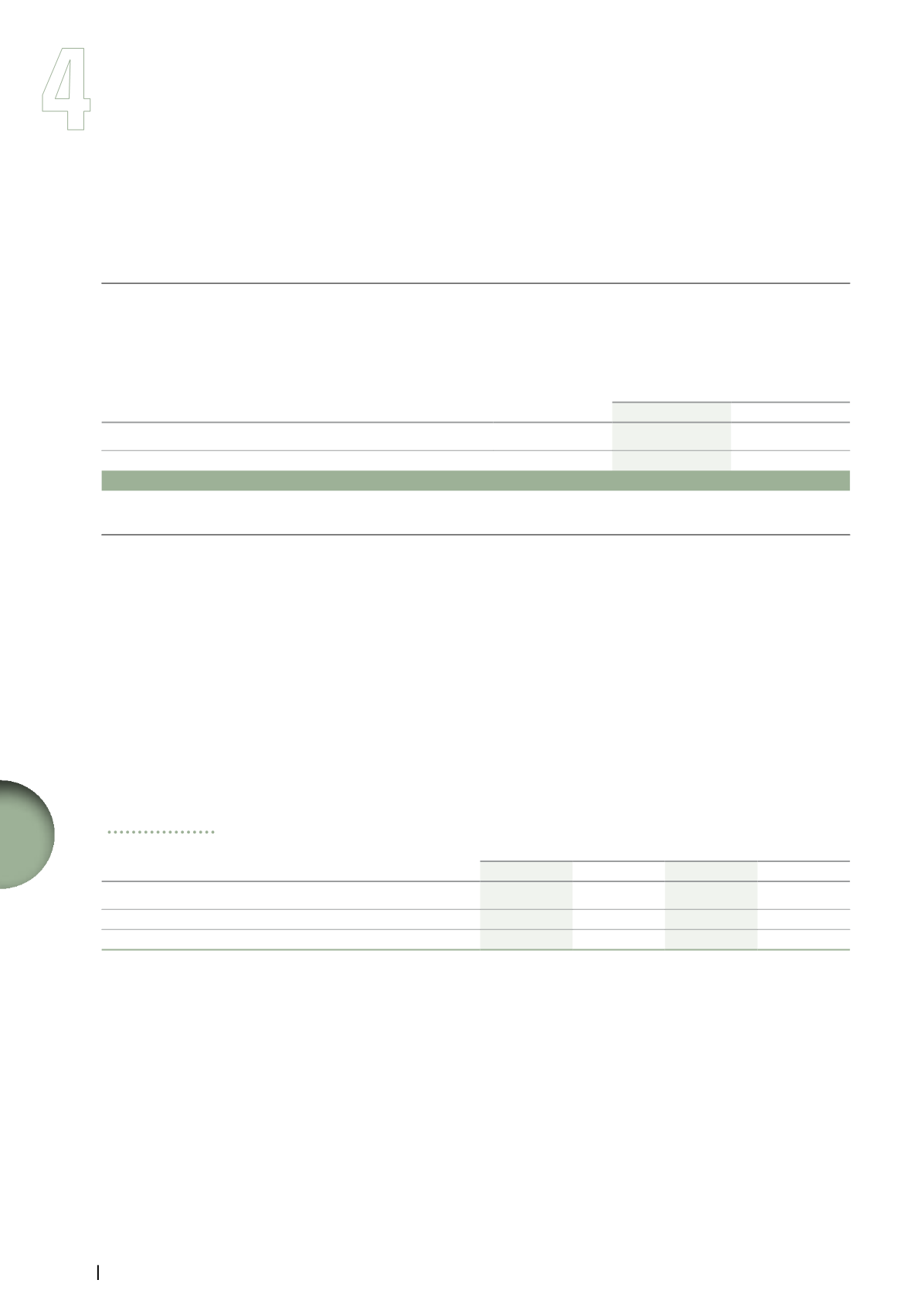

21.2.

Employee defined benefit plans

21.2.1.

Assumptions used in the evaluation and sensitivity analysis

■

■

Discount rate, expected return on plan assets,

and rate of compensation increase

The assumptions underlying the valuation of defined benefit plans

were made in compliance with the accounting policies presented

in Note 1.3.8 and have been applied consistently for several years.

Demographic assumptions (including notably the rate of compensation

increase) are company specific. Financial assumptions (notably the

discount rate) are determined by independent actuaries and other

independent advisors and reviewed by Vivendi’s Finance department.

The discount rate is thus determined for each country by reference

to yields on notes issued by investment grade companies having a

credit rating of AA and maturities identical to that of the valued plans,

generally based on relevant rate indices. The discount rates selected

are thus used, at year-end, to determine the best estimate by Vivendi’s

Finance department of expected trends in future payments from the first

benefit payments.

In accordance with amended IAS 19, the expected return on plan assets

is estimated using the discount rate used to value the obligations of the

previous year.

In weighted average

Pension benefits

Post-retirement benefits

2013

2012

2013

2012

Discount rate

(a)

3.6%

3.6%

4.5%

3.6%

Rate of compensation increase

2.0%

2.0%

2.9%

3.1%

Duration of the benefit obligation

(in years)

14.2

14.2

10.0

10.5

(a)

A 50 basis point increase (or a 50 basis point decrease, respectively) in the 2013 discount rate would have led to a decrease of €2 million in pre-tax

expense (or an increase of €1 million, respectively) and would have led to a decrease in the obligations of pension and post-retirement benefits

of €60 million (or an increase of €64 million, respectively).