290

Annual Report -

2013

-

Vivendi

4

Financial Report | Statutory Auditors’ Report on the Consolidated Financial Statements |

Consolidated

Financial Statements

| Statutory Auditors’ Report on the Financial Statements | Statutory Financial Statements

Note 24. Financial instruments and management of financial risks

Note 24.

Financial instruments and management of financial risks

24.1.

Fair value of financial instruments

Financial instruments classified as liabilities under Vivendi’s Statement

of Financial Position include bonds and bank credit facilities, other

financial liabilities (including commitments to purchase non-controlling

interests), as well as trade accounts payable and other non-current

liabilities. As assets under Vivendi’s Statement of Financial Position,

they include financial assets measured at fair value and at historical

cost, trade accounts receivable and other, as well as cash and cash

equivalents. In addition, financial instruments include derivative

instruments (assets or liabilities) and assets available for sale.

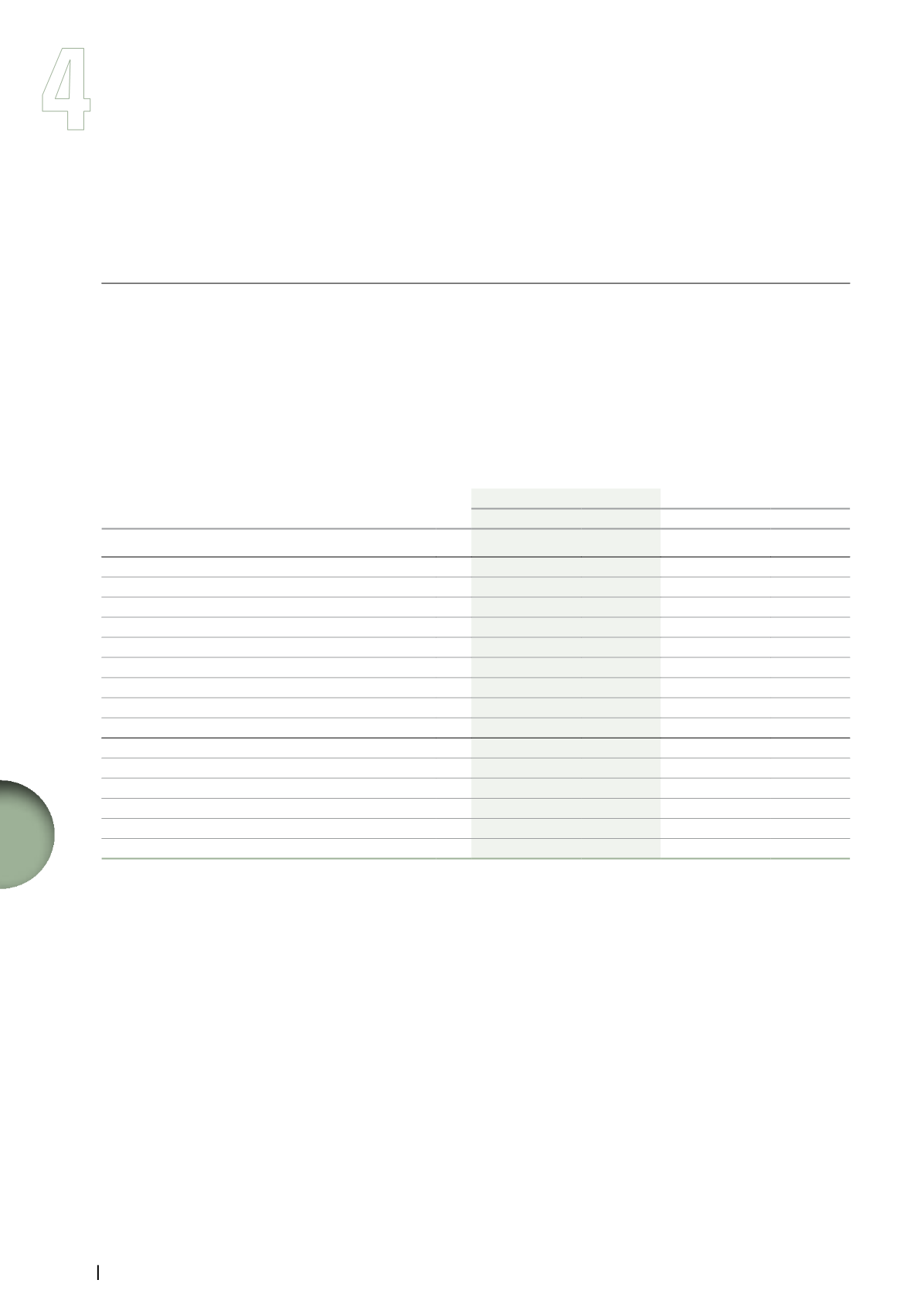

Accounting category and fair value of financial instruments

(in millions of euros)

Note

December 31, 2013

December 31, 2012

(a)

Carrying value Fair value

Carrying value Fair value

Assets

Cash management financial assets

-

-

301

301

Available-for-sale securities

360

360

197

197

Derivative financial instruments

126

126

137

137

Other financial assets at fair value through profit or loss

5

5

15

15

Financial assets at amortized cost

208

208

202

202

Financial assets

16

699

699

852

852

Trade accounts receivable and other, at amortized cost

17

4,898

4,898

6,587

6,587

Cash and cash equivalents

18

1,041

1,041

3,894

3,894

Liabilities

Borrowings, at amortized cost

12,218

12,721

17,713

18,637

Derivative financial instruments

26

26

36

36

Commitments to purchase non-controlling interests

22

22

8

8

Borrowings and other financial liabilities

23

12,266

12,769

17,757

18,681

Other non-current liabilities, at amortized cost

17

757

757

1,002

1,002

Trade accounts payable and other, at amortized cost

17

10,416

10,416

14,196

14,196

(a)

Vivendi applied from January 1, 2013, with retrospective effect from January 1, 2012, amended IAS 19 -

Employee Benefits

, whose application is

mandatory in the European Union beginning on or after January 1, 2013 (please refer to Note 1). As a result, the 2012 Financial Statements were

adjusted in accordance with the new standard (please refer to Note 33).

The carrying value of trade accounts receivable and other, cash and cash equivalents, and trade accounts payable is a reasonable approximation of

fair value, due to the short maturity of these instruments.