264

Annual Report -

2013

-

Vivendi

4

Financial Report | Statutory Auditors’ Report on the Consolidated Financial Statements |

Consolidated

Financial Statements

| Statutory Auditors’ Report on the Financial Statements | Statutory Financial Statements

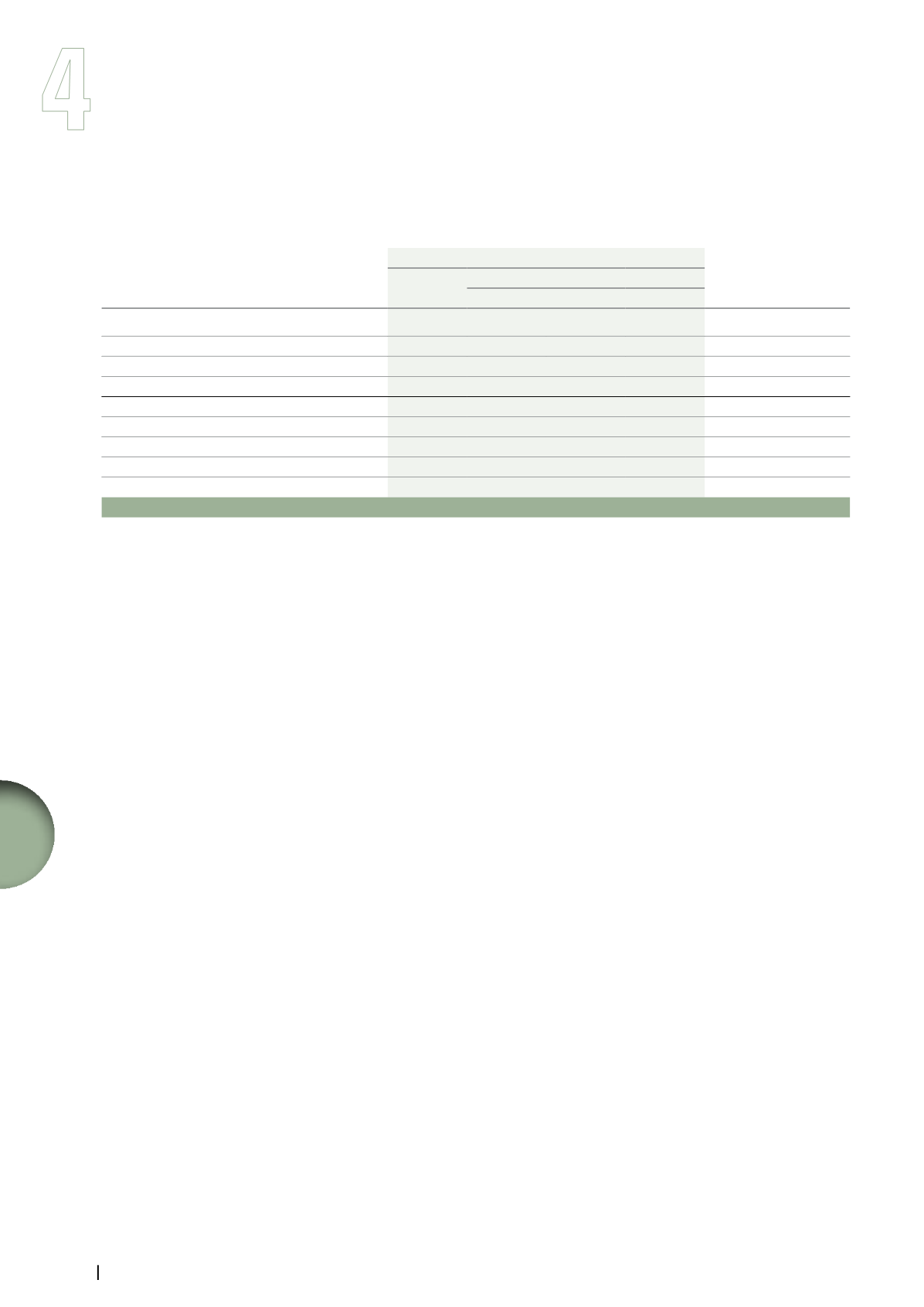

Note 11. Content assets and commitments

Off-balance sheet commitments given/(received)

(in millions of euros)

Minimum future payments as of December 31, 2013

Total minimum future

payments as of

December 31, 2012

Total

Due in

2014 2015-2018 After 2018

Film and television rights

(a)

2,383

1,219

1,151

13

2,590

Sports rights

(b)

1,350

668

682

-

1,715

Creative talent, employment agreements and others

(c)

754

356

355

43

959

Given commitments

4,487

2,243

2,188

56

5,264

Film and television rights

(a)

(179)

(118)

(61)

-

(114)

Sports rights

(10)

(7)

(3)

-

(12)

Creative talent, employment agreements and others

(c)

not available

Other

-

-

-

-

(199)

Received commitments

(189)

(125)

(64)

-

(325)

Total net

4,298

2,118

2,124

56

4,939

(a)

Mainly includes contracts valid over several years for the broadcast of film and TV productions (mainly exclusivity contracts with major US

studios, as well as the license agreement entered into on March 29, 2013 regarding the entire HBO new series, for five years, as of May 2013)

and pre-purchase contracts in the French movie industry, Studiocanal film production and co-production commitments (given and received) and

broadcasting rights of Canalsat and “nc+” multichannel digital TV packages. They are recorded as content assets when the broadcast is available

for initial release. As of December 31, 2013, provisions recorded relating to these commitments amounted to €71 million, compared to €86 million

as of December 31, 2012.

In addition, this amount does not include commitments in relation to channel right contracts, ISP (Internet Service Provider) royalties and non-

exclusive distribution of channels, under which neither Canal+ Group nor GVT granted minimum guarantees. The variable amount of these

commitments cannot be reliably determined and is not reported in the Statement of Financial Position or in commitments and is instead recorded

as an expense for the period in which it was incurred. Based on the estimation of the future subscriber number at Canal+ Group, commitments

in relation to channel right contracts would have increased by a net amount of €354 million as of December 31, 2013, compared to €288 million

as of December 31, 2012.

Moreover, according to the agreement entered into with cinema professional organizations on December 18, 2009,

Société d’Edition de Canal Plus (SECP) is required to invest, every year for a five-year period (2010-2014), 12.5% of its annual revenues

in the financing of European films. With respect to audiovisual, in accordance with the agreements with producers and authors’ organizations,

Canal+ France is required to invest a percentage of its revenues in the financing of heritage work every year.

Agreements with cinema organizations and with producers and authors’ organizations are not recorded as off-balance sheet commitments

as the future estimate of these commitments cannot be reliably determined.

(b)

Notably includes broadcasting rights for the French professional Soccer League 1 awarded to Canal+ Group for the 2014-2015 and 2015-2016

seasons. The price paid by Canal+ Group represents €427 million per season, or a remaining total of €854 million as of December 31, 2013,

compared to €1,281 million as of December 31, 2012. Moreover, the broadcasting rights also includes the English Premier League for the 2014-

2015 and 2015-2016 seasons, renewed in January 2013 and the Formula 1 World Championship awarded in February 2013. These commitments

will be recognized in the Statement of Financial Position either upon the start of every season or upon initial significant payment.

(c)

Primarily relates to UMG which routinely commits to artists and other parties to pay agreed amounts upon delivery of content or other products

(“Creative talent and employment agreements”). Until the artist or the other party has delivered his or her content or the repayment of an advance,

UMG discloses its obligation as an off-balance sheet given commitment. While the artist or the other party is obligated to deliver a content or

other product to UMG (these arrangements are generally exclusive), this counterpart cannot be reliably determined and, thus, is not reported in

received commitments.