254

Annual Report -

2013

-

Vivendi

4

Financial Report | Statutory Auditors’ Report on the Consolidated Financial Statements |

Consolidated

Financial Statements

| Statutory Auditors’ Report on the Financial Statements | Statutory Financial Statements

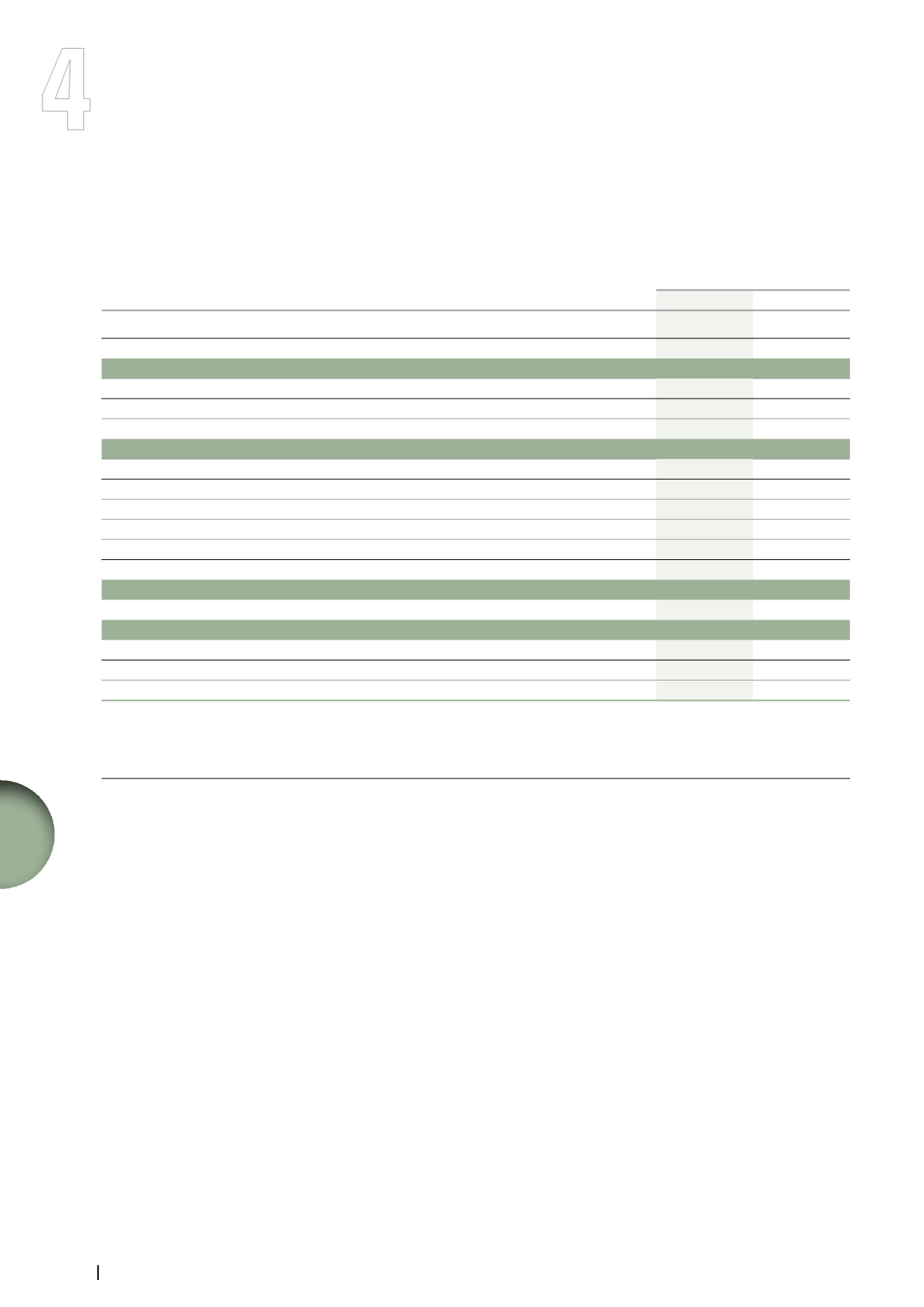

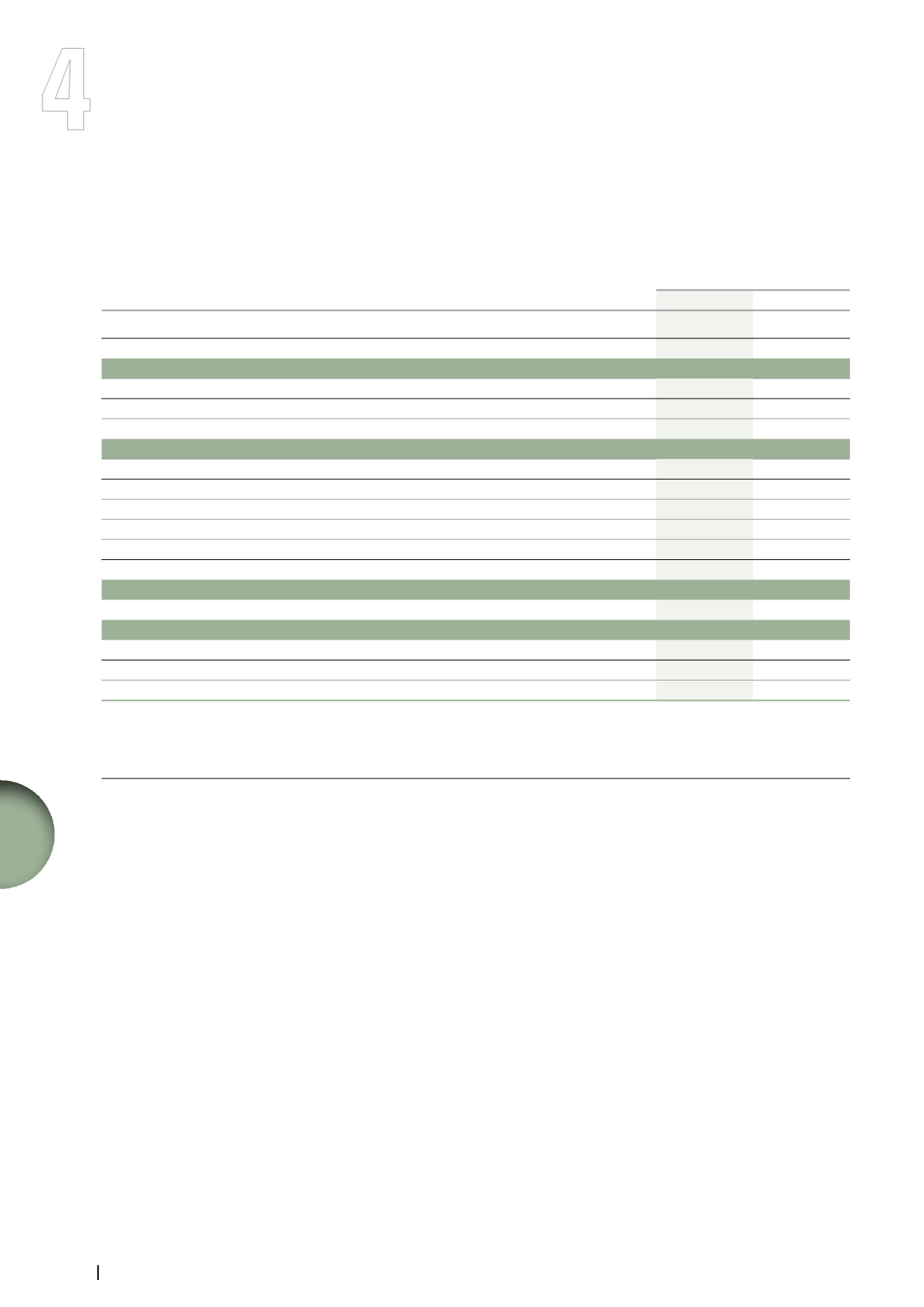

Note 7. Discontinued operations

7.1.2.

Statement of Cash Flows

Given the deconsolidation of Activision Blizzard on October 11, 2013, the 2013 Statement of Cash Flows included Activision Blizzard until that date.

Activision Blizzard

(in millions of euros)

Year ended December 31,

2013

2012

Operating activities

Gross cash provided by operating activities before income tax paid

907

1,220

Net cash provided by Activision Blizzard’s operating activities

307

1,037

Investing activities

Capital expenditures, net

(44)

(57)

Change in financial assets, net

(1,479)

(35)

Net cash provided by/(used for) Activision Blizzard’s investing activities

(1,523)

(92)

Financing activities

Dividends paid to non-controlling interests

(66)

(62)

Stock repurchase program

-

(241)

Other

1,720

15

Net cash provided by/(used for) Activision Blizzard’s financing activities excluding dividends paid to Vivendi

1,654

(288)

Dividends paid to Vivendi

(98)

(94)

Net cash provided by/(used for) Activision Blizzard’s financing activities

1,556

(382)

Foreign currency translation adjustments

(43)

(22)

Change in Activision Blizzard’s cash and cash equivalents

297

541

Activision Blizzard’s cash and cash equivalents

At beginning of the period

2,989

2,448

At end of the period

(a)

3,286

2,989

(a)

Relates to the balance of net divested cash on October 11, 2013: it was recognized as a deduction from the amount received in cash with respect

to the sale as an investing activity in Vivendi’s Consolidated Statement of Cash Flows.

7.2.

Plan to sell Maroc Telecom Group

On November 4, 2013, Vivendi entered into a definitive agreement with

Etisalat, with whom exclusive negotiations had begun on July 22, 2013,

regarding the sale of Vivendi’s 53% interest in Maroc Telecom Group.

The key terms of this agreement known to date are as follows:

the agreement values the interest in Maroc Telecom Group at

MAD 92.6 per share or sale proceeds to Vivendi of approximately

€4.2 billion in cash, including a €310 million dividend distribution

with respect to fiscal year 2012, according to the financial terms

known to date. Taking into account Maroc Telecom Group’s net

debt, the transaction reflects a proportional enterprise value of

€4.5 billion for Vivendi’s interest, equal to an EBITDA multiple of

6.2x; and

the completion of this transaction is contingent upon the

satisfaction of certain closing conditions, including receipt of

required regulatory approvals in Morocco and the countries in

which Maroc Telecom Group operates, as well as finalization of

the shareholders’ agreement between Etisalat and the Kingdom of

Morocco. This transaction is expected to be completed during the

first months of 2014.