248

Annual Report -

2013

-

Vivendi

4

Financial Report | Statutory Auditors’ Report on the Consolidated Financial Statements |

Consolidated

Financial Statements

| Statutory Auditors’ Report on the Financial Statements | Statutory Financial Statements

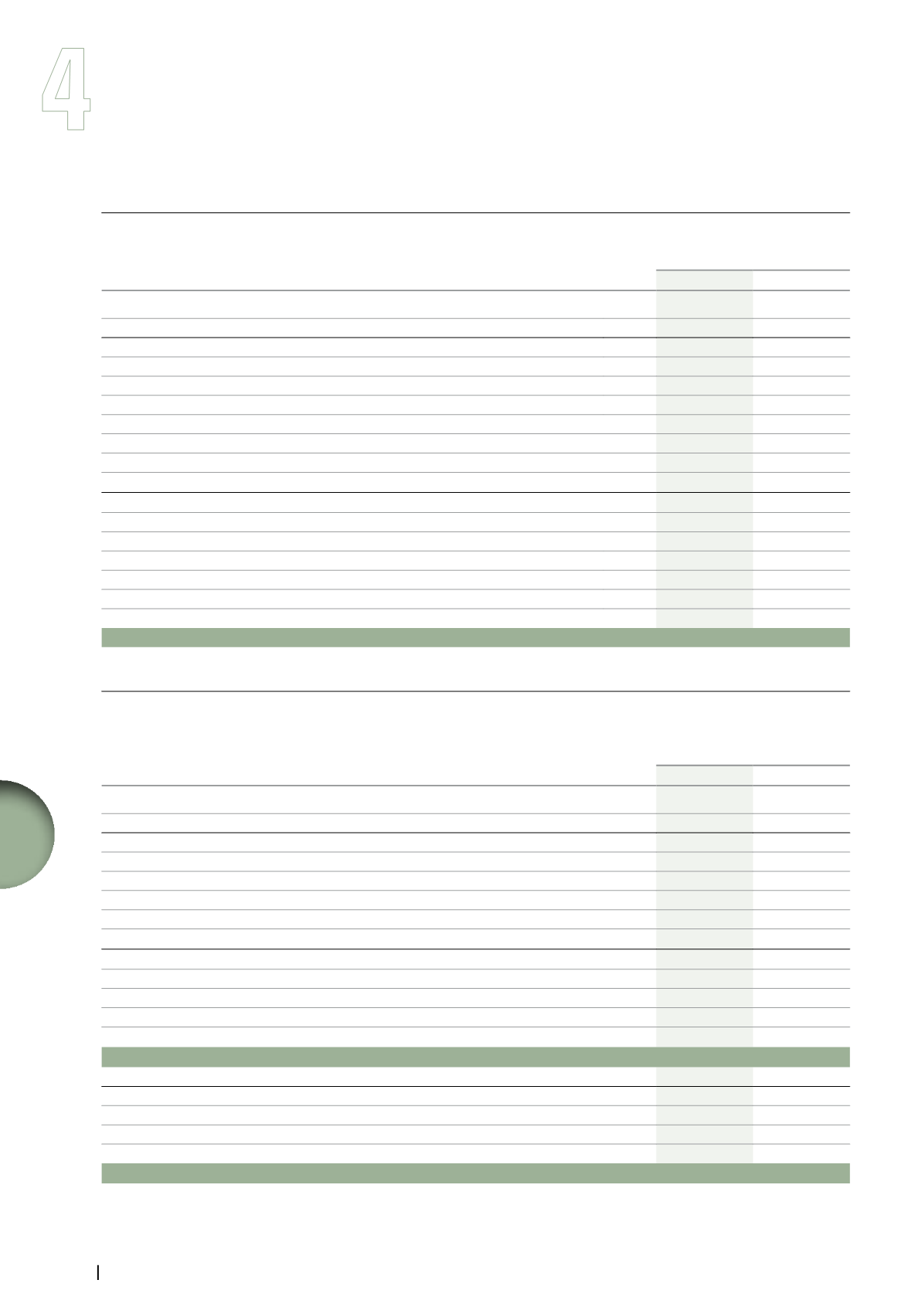

Note 6. Income taxes

6.2.

Provision for income taxes

(in millions of euros)

Note

Year ended December 31,

2013

2012

(Charge)/Income

Current

Use of tax losses and tax credits:

Tax savings related to Vivendi SA’s French Tax Group System and to the Consolidated Global Profit Tax System 6.1

415

381

Tax savings related to the US tax group

25

20

Adjustments to prior year’s tax expense

(22)

(10)

Consideration of risks related to previous years’ income taxes

127

(22)

Other income taxes items

(715)

(991)

(170)

(622)

Deferred

Impact of Vivendi SA’s French Tax Group System and of the Consolidated Global Profit Tax System

6.1

(161)

(48)

Impact of the US tax group

-

-

Other changes in deferred tax assets

(9)

7

Impact of the change(s) in tax rates

41

1

Reversal of tax liabilities relating to risks extinguished over the period

12

-

Other deferred tax income/(expenses)

(130)

58

(247)

18

Provision for income taxes

(417)

(604)

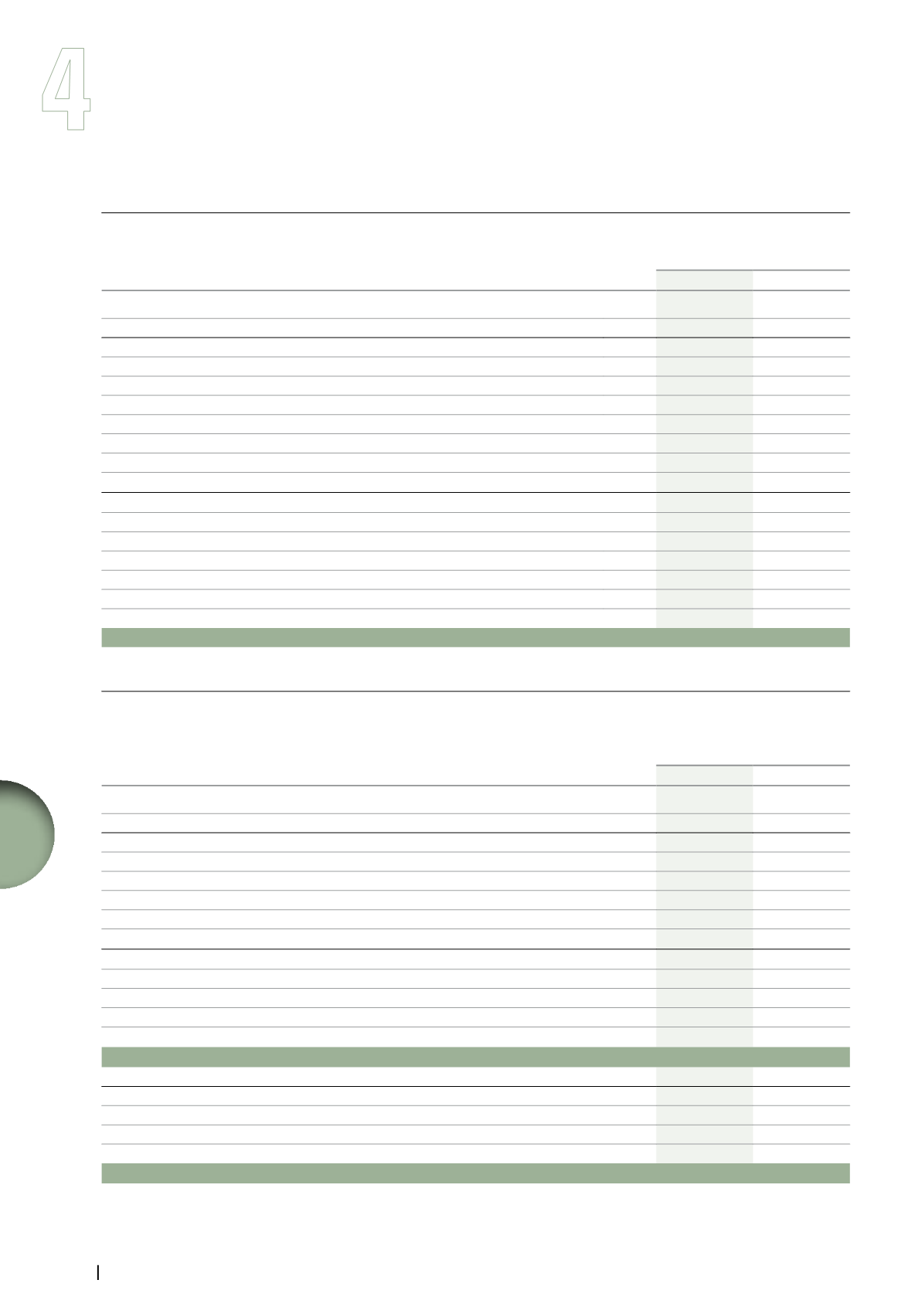

6.3.

Provision for income taxes and income tax paid by geographic region

(in millions of euros)

Year ended December 31,

2013

2012

(Charge)/Income

Current

France

(83)

(510)

United States

8

(12)

Brazil

(65)

(88)

Other jurisdictions

(30)

(12)

(170)

(622)

Deferred

France

(282)

(38)

United States

(46)

20

Brazil

31

(12)

Other jurisdictions

50

48

(247)

18

Provision for income taxes

(417)

(604)

Income tax (paid)/collected

France

(22)

(187)

United States

(8)

(10)

Brazil

(104)

(74)

Other jurisdictions

(63)

(82)

Income tax paid

(197)

(353)