250

Annual Report -

2013

-

Vivendi

4

Financial Report | Statutory Auditors’ Report on the Consolidated Financial Statements |

Consolidated

Financial Statements

| Statutory Auditors’ Report on the Financial Statements | Statutory Financial Statements

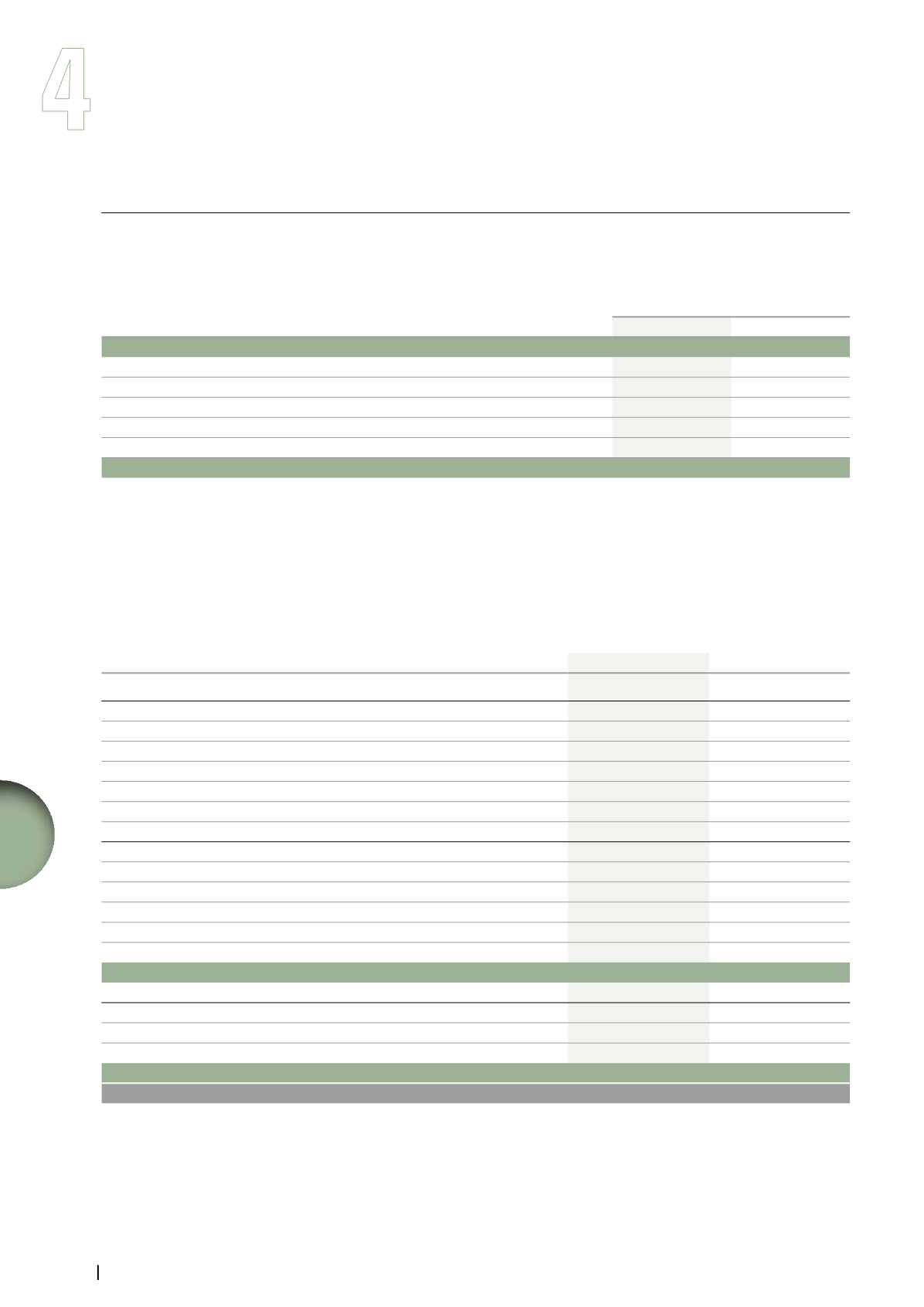

Note 6. Income taxes

6.5.

Deferred tax assets and liabilities

Changes in deferred tax assets/(liabilities), net

(in millions of euros)

Year ended December 31,

2013

2012

(a)

Opening balance of deferred tax assets/(liabilities)

454

719

Provision for income taxes

(b)

(437)

(8)

Charges and income directly recorded in equity

(c)

-

18

Business combinations

163

(278)

Divestitures in progress or completed

(206)

-

Changes in foreign currency translation adjustments and other

79

3

Closing balance of deferred tax assets/(liabilities)

53

454

(a)

Vivendi applied from January 1, 2013, with retrospective effect from January 1, 2012, amended IAS 19 -

Employee Benefits

, whose application is

mandatory in the European Union beginning on or after January 1, 2013 (please refer to Note 1). As a result, the 2012 Financial Statements were

adjusted in accordance with the new standard (please refer to Note 33).

(b)

Includes income/(charge) related to Activision Blizzard and Maroc Telecom Group taxes: in accordance with IFRS 5, these amounts were

reclassified to the line “Earnings from discontinued operations” in the 2013 and 2012 Consolidated Statement of Earnings.

(c)

Includes -€43 million recognized in other items of charges and income directly recognized in equity for the year ended December 31, 2013,

compared to +€22 million in 2012 (please refer to Note 9).

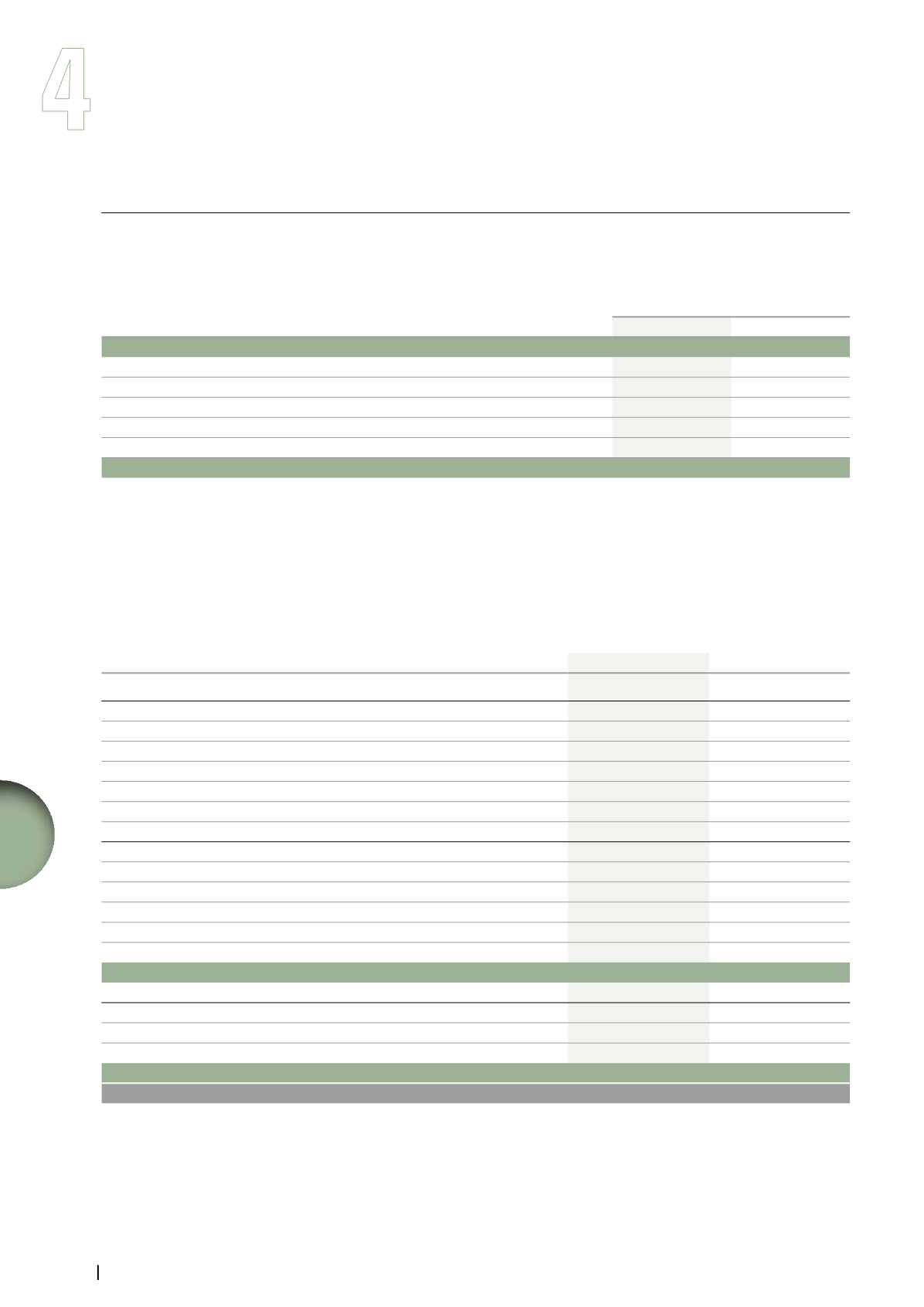

Components of deferred tax assets and liabilities

(in millions of euros)

December 31, 2013

December 31, 2012

(a)

Deferred tax assets

Deferred taxes, gross

Tax attributes

(b)

2,623

2,639

of which Vivendi SA

(c)

1,527

1,567

US tax group

(d)

364

623

Temporary differences

(e)

1,073

1,795

Netting

(501)

(366)

Deferred taxes, gross

3,195

4,068

Deferred taxes, unrecognized

Tax attributes

(b)

(2,271)

(2,138)

of which Vivendi SA

(c)

(1,364)

(1,243)

US tax group

(d)

(364)

(623)

Temporary differences

(e)

(191)

(485)

Deferred taxes, unrecognized

(2,462)

(2,623)

Recorded deferred tax assets

733

1,445

Deferred tax liabilities

Purchase accounting asset revaluations

(f)

591

901

Other

590

456

Netting

(501)

(366)

Recorded deferred tax liabilities

680

991

Deferred tax assets/(liabilities), net

53

454

(a)

Vivendi applied from January 1, 2013, with retrospective effect from January 1, 2012, amended IAS 19 -

Employee Benefits

, whose application is

mandatory in the European Union beginning on or after January 1, 2013 (please refer to Note 1). As a result, the 2012 Financial Statements were

adjusted in accordance with the new standard (please refer to Note 33).

(b)

The amounts of tax attributes, as reported in this table, were estimated at the end of the relevant fiscal years. In jurisdictions which are material

to Vivendi, mainly France and the United States, tax returns are filed at the latest on May 15 and September 15 of the following year, respectively.