4

Financial Report | Statutory Auditors’ Report on the Consolidated Financial Statements |

Consolidated

Financial Statements

| Statutory Auditors’ Report on the Financial Statements | Statutory Financial Statements

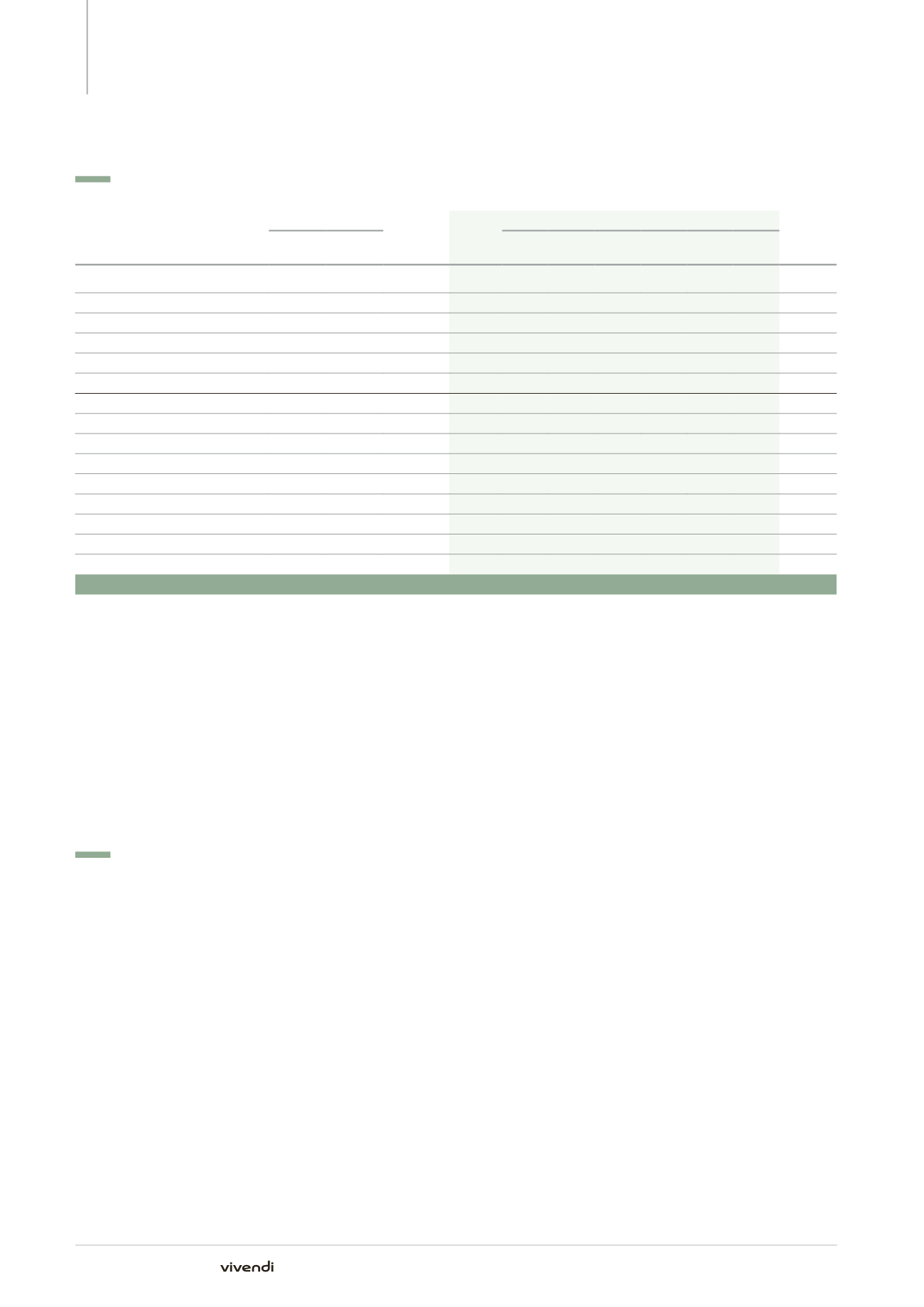

Note 21. Borrowings and other financial liabilities

21.1.

Bonds

(in millions of euros)

Interest rate (%)

Maturity

Dec.

31, 2014

Maturing during the following periods

Dec.

31, 2013

Nominal Effective

2015 2016 2017 2018 2019

After

2019

€750 million (March 2010)

4.000% 4.15% Mar. 2017

750

-

-

750

-

-

-

750

€700 million (December 2009)

4.875% 4.95% Dec. 2019

700

-

-

-

-

700

-

700

€500 million (December 2009)

4.250% 4.39% Dec. 2016

500

-

500

-

-

-

-

500

€300 million – SFR (July 2009)

5.000% 5.05% Jul. 2014

-

-

-

-

-

-

-

300

€1,120 million (January 2009)

7.750% 7.69% Jan. 2014

(a)

-

-

-

-

-

-

-

894

Bonds without make-whole option

1,950

-

500 750

-

700

-

3,144

€750 million (July 2013)

2.375% 2.51% Jan. 2019

-

-

-

-

-

-

-

750

€700 million (December 2012)

2.500% 2.65% Jan. 2020

-

-

-

-

-

-

-

700

$650 million (April 2012)

3.450% 3.56% Jan. 2018

-

-

-

-

-

-

-

69

$800 million (April 2012)

4.750% 4.91% Apr. 2022

-

-

-

-

-

-

-

189

€1,250 million (January 2012)

4.125% 4.31% Jul. 2017

-

-

-

-

-

-

-

1,250

€500 million (November 2011)

4.875% 5.00% Nov. 2018

-

-

-

-

-

-

-

500

€1,050 million (July 2011)

4.750% 4.67% Jul. 2021

-

-

-

-

-

-

-

1,050

$700 million (April 2008)

6.625% 6.85% Apr. 2018

-

-

-

-

-

-

-

175

Bonds with make-whole option

(b)

-

-

-

-

-

-

-

4,683

Nominal value of bonds

1,950

-

500 750

-

700

-

7,827

(a)

Redemption at maturity in January 2014 of the 7.75% bond issued in January 2009 for €894 million.

(b)

Vivendi allocated a portion of the SFR sale proceeds to the early redemption of all eight tranches of its euro and U.S. dollar denominated bonds with

a make-whole option, representing an aggregate principal amount of €4,250 million and $595 million (€420 million). This transaction, completed

in December 2014, resulted in a premium payment of €642 million (net of gains on interest rate risk hedging) in addition to the principal amount of

€4,670 million.

The bonds denominated in euros are listed on the Luxembourg

Stock Exchange.

Bonds issued by the group contain customary provisions related to events

of default, negative pledge and, rights of payment (pari-passu ranking). In

addition, bonds issued by Vivendi SA contain an early redemption clause

in case of a change in control trigger if, as a result of any such event, the

long-term rating of Vivendi SA is downgraded below investment grade

status (Baa3/BBB-).

21.2.

Bank credit facilities

On November 27, 2014, following the receipt of cash proceeds from the

sale of SFR, Vivendi cancelled all of its existing bank credit facilities

for €7.1 billion and set up a new €2 billion bank credit facility, maturing

in five years (2019) and with two one-year renewal options. As of

December 31, 2014, this credit facility was undrawn.

The €2 billion bank credit facility contains customary provisions

relating to events of default and covenants relating to negative pledge,

divestiture and merger transactions. In addition, at the end of each half

year, Vivendi SA is required to comply with a Proportionate Financial Net

Debt

(1)

to EBITDA

(2)

financial covenant over a 12-month rolling period

not exceeding 3 for the duration of the loan. Non-compliance with this

covenant could result in the early redemption of the facility if it were

drawn, or its cancellation. As of December 31, 2014, Vivendi SA was in

compliance with its financial covenant.

The renewal of Vivendi SA’s confirmed bank credit facility when it is

drawn is contingent upon the issuer reiterating certain representations

regarding its ability to comply with its financial obligations with respect

to loan contracts.

In addition, on March 4, 2013, a letter of credit for €975 million, maturing

in March 2016, was issued in connection with Vivendi’s appeal against

the Liberty Media judgment (please refer to Note 26). This letter of credit

is guaranteed by a syndicate of 15 international banks with which Vivendi

signed a Reimbursement Agreement that includes an undertaking by

Vivendi to reimburse the banks for any amounts paid out under the letter

(1)

Relates to Financial Net Debt as defined by Vivendi.

(2)

Relates to EBITDA as defined by Vivendi, plus dividends received from unconsolidated companies.

264

Annual Report 2014