4

Section 5 - Treasury and capital resources

Financial Report

| Statutory Auditors’ Report on the Consolidated Financial Statements | Consolidated

Financial Statements | Statutory Auditors’ Report on the Financial Statements | Statutory Financial Statements

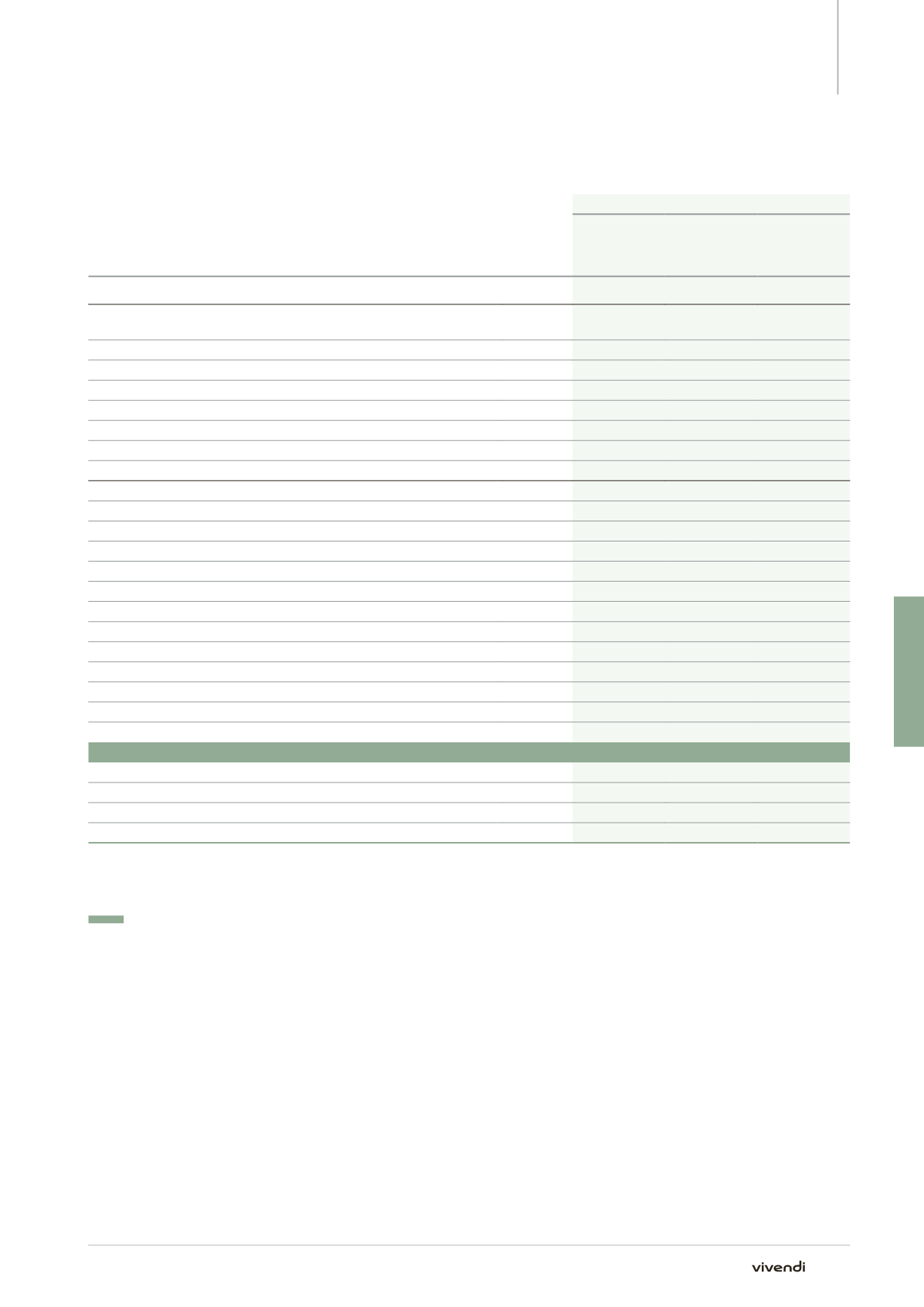

(in millions of euros)

Refer to

section

Year ended December 31, 2014

Impact

on cash

and cash

equivalents

Impact

on borrowings

and other

financial items

Impact

on Financial

Net Debt

Transactions with shareowners

Net proceeds from issuance of common shares in connection with Vivendi SA’s

share-based compensation plans

(197)

-

(197)

of which exercise of stock options by executive management and employees

(197)

-

(197)

(Sales)/purchases of Vivendi SA’s treasury shares

32

-

32

Distribution to Vivendi SA’s shareowners (€1 per share)

1

1,348

-

1,348

Other transactions with shareowners

2

-

2

Dividends paid by consolidated companies to their non-controlling interests

34

-

34

Total transactions with shareowners

1,219

-

1,219

Transactions on borrowings and other financial liabilities

Setting up of long-term borrowings and increase in other long-term financial liabilities

(3)

3

-

Principal payments on long-term borrowings and decrease in other long-term financial liabilities

1,670

(1,670)

-

of which bank credit facilities

1,655

(1,655)

-

Principal payments on short-term borrowings

7,680

(7,680)

-

of which bonds

5,564

(5,564)

-

commercial paper

1,906

(1,906)

-

Other changes in short-term borrowings and other financial liabilities

(140)

140

-

Non-cash transactions

-

(5)

(5)

Interest paid, net

3

96

-

96

Other cash items related to financial activities

3

606

-

606

Total transactions on borrowings and other financial liabilities

9,909

(9,212)

697

Net cash provided by/(used for) financing activities of continuing operations

11,128

(9,212)

1,916

Net cash provided by/(used for) financing activities of discontinued operations

756

(508)

248

Financing activities

11,884

(9,720)

2,164

Foreign currency translation adjustments of continuing operations

(10)

(1)

(11)

Foreign currency translation adjustments of discontinued operations

4

3

7

Reclassification of Financial Net Debt from discontinued operations

203

(293)

(90)

Change in Financial Net Debt

(5,804)

(9,930)

(15,734)

5.4. Changes to financings

p

p

In January 2014, Vivendi redeemed the 7.75% bond issued in

January 2009, for €894 million, upon its contractual maturity.

p

p

On November 27, 2014, following the receipt of cash proceeds from

the sale of SFR, Vivendi cancelled all of its existing bank credit

facilities for €7.1 billion and set up a new €2 billion bank credit

facility, maturing in five years (2019) and with two one-year renewal

options. As of December 31, 2014, this credit facility was undrawn.

p

p

On December 15, 2014, Vivendi redeemed all its euro-denominated

bonds with a make-whole option representing a total principal

amount of €4,250 million and paid a net cash premium of

€572 million.

p

p

On December 29, 2014, Vivendi redeemed all its US dollar-

denominated bonds with a make-whole option representing a

total principal amount of $595 million (€420 million) and paid a net

premium of €70 million.

For a detailed analysis of the borrowings as of December 31, 2014,

please refer to Note 21 to the Consolidated Financial Statements for the

year ended December 31, 2014.

Continued from previous page.

183

Annual Report 2014