1

Group Profile

| Businesses | Litigation | Risk Factors

Financial Communication Policy and Value Creation

Vivendi, a global integrated industrial group in content and media, has implemented an integrated reporting pilot project to illustrate how promoting

cultural diversity, one of Vivendi’s strategic CSR issues, creates societal and financial value while preventing risks and opening up opportunities

to win markets.

■

■

The Challenge

Vivendi exerts a human, cultural and intellectual influence on the lives of millions

of customers and citizens worldwide due to the activities of the Universal

Music Group, the world leader in music; the Canal+ Group, the leading French

audiovisual media group also active in French-speaking Africa as well as Poland

and Vietnam, and its subsidiary Studiocanal, which is a leading European player

in the production, acquisition, and international distribution and sales of films

and TV series. Vivendi has a societal responsibility to satisfy the curiosity of its

audiences on all continents, to reveal their talent, to help them achieve their full

potential, and to provide the necessary conditions for them to become open to

the world and exercise their critical spirit.

In addition, cultural diversity is at the heart of Vivendi’s businesses: music,

television and film. Providing rich, original content; signing new artists in

all categories; avoiding creative talent drain; meeting the expectations of

subscribers; making the group’s platforms attractive in a digital environment

where existing methods are being revolutionized – these are the goals being

pursued by our businesses as they strive to preserve their leading position in their

respective markets (please refer to diagram below).

■

■

The Approach

As a first step, in 2013, Vivendi decided to take a pragmatic approach to this

initiative and to implement it initially on a limited basis at Universal Music

France, Canal+ in France, and Studiocanal. Led by Vivendi’s Corporate Social

Responsibility (CSR) department, this endeavor brought together the managers in

charge of Finance and Strategy of these three entities of the group and analysts

representing the investment community (Amundi, Groupama AM, and Oddo

Securities). Indicators establishing the link between investments in diversity of

content and returns were chosen then submitted to analysts for review (please

refer to diagram below).

The Chief Financial Officers of Vivendi’s businesses have welcomed and given

their full support to this approach and the analysts whose views were sought

believe it to be innovative, scalable and fully integrated into the strategy of

Vivendi, a key player in the media sector.

In 2014, the scope of the exercise was expanded to include an international

dimension in line with previous undertakings. The Management Board and

General Management supported the project by making it part of the integrated

management of the business (see previous double page).

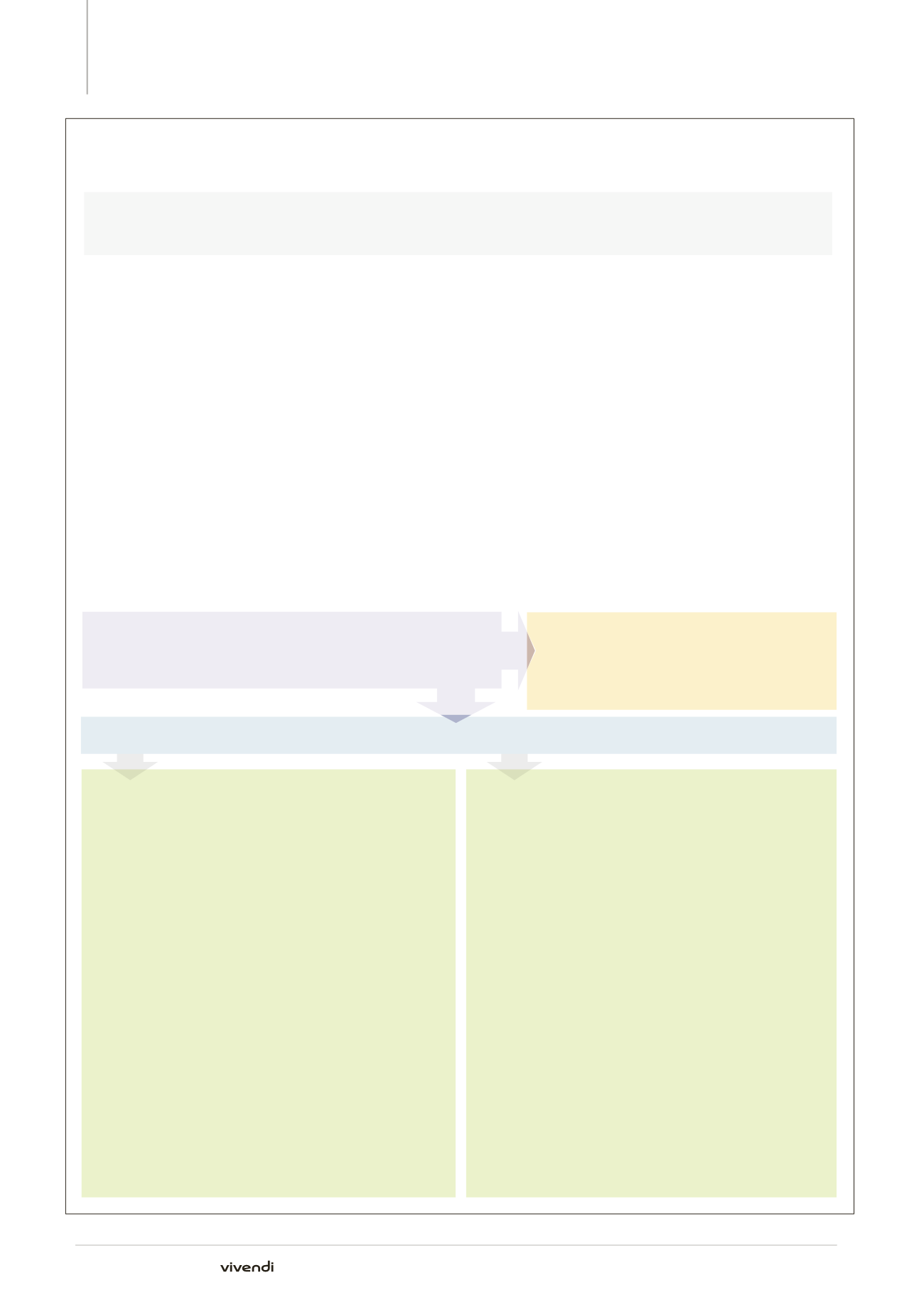

Contribution to Value Creation of Investment in Diversity of Content (2014 figures)

CSR Issue

Financial Value

UNIVERSAL MUSIc GROUP

(excluding publishing)

CANAL + group

CANAL+

p

p

Survey of Canal+ subscribers: “Canal+ is a leading channel for films”: 84%

of subscribers agreed with this statement in 2014 (vs. 85% in 2013).

p

p

Canal+ Group investments in local African content in absolute value and

percentage terms: €3 million invested in African production (films, audiovisual

programs, Afrik’Art, A+ etc.) out of €29 million invested in programs broadcast

in Africa (excluding sporting rights), or 10%.

STUDIOCANAL

p

p

Investments in European works in absolute value and percentage terms:

€173 million or 79% (71% in 2013).

Societal Value

p

p

To promote cultural diversity in the content offering.

p

p

To invest in new talent and sign new artists.

p

p

To promote cultural heritage by exploiting an exceptional catalogue of content.

p

p

To encourage the group's audiences participation in cultural life,

a source of personal enrichment.

p

p

To facilitate increased access to knowledge and entertainment.

p

p

To foster mutual understanding, social ties and learning

to live together.

�

To increase revenues

�

To improve profitability

�

To enhance exposure of the brands

�

To create value

p

p

Amount of marketing investment dedicated to new talent

(1)

as a percentage of total

investment (scope: France): 28% (21% in 2013).

p

p

Average percentage of revenue generated by new talent (scope: top five countries in

terms of revenue: United States, Japan, United Kingdom, Germany and France): 14%.

p

p

Percentage of UMG physical sales generated by the catalogue

(2)

(scope: 59 countries): 27%.

p

p

Percentage of UMG digital sales generated by the catalogue

(2)

(scope: 59 countries): 49%.

p

p

Percentage of sales generated by local artists in their own country (scope: 59 countries):

60% (61% in 2013).

Universal Music Group’s investments drive musical creativity by identifying and

supporting new talent in all countries where the group operates. Mobilizing its

financial resources and its employees’ know-how in this way helps to increase

revenue while updating its listings to satisfy wide-ranging audience tastes on a global

scale. It also supports the attractiveness of local artists who are keen to be signed by

prestigious labels with an international sphere of influence. Finally, the investments

made to digitize the catalogue meet two requirements: an economic one, since the

revenue generated by digital sales is playing an increasingly important role in UMG’s

financial results, and a societal one, since the digitization of musical works that are

no longer accessible in physical form generates value from the asset represented by

UMG’s exceptional catalogue in all genres: pop, classical, jazz, rock and more. It also

presents an opportunity to share musical emotions across the generations.

(1) New talent is defined as artists releasing their first album.

(2) The catalogue lists works marketed for more than two years.

The fact that Canal+ is described as a “leading channel for films” by 84% of

subscribers establishes a direct relationship between the exclusive selection

of films shown by the channel and its level of customer satisfaction. Building

local capacity for content production in Africa is one of the Canal+ Group’s

ambitions and it aims to increase its market share on the continent by relying on

its experience in supporting the creativity of local artists and pooling the group’s

various areas of expertise. Studiocanal’s investments in European works is helping

to develop an offering that complements that of the major American studios on the

international market and is more suitable to its direct distribution areas, namely

France, Germany and the United Kingdom. Studiocanal is securing its pipeline by

helping to keep talented Europeans in Europe and achieves higher profitability than

the average of its competitors.

Source: Studiocanal

Source: Canal+

Integrated Reporting Pilot Project

Intangible Cultural Capital: the Impact of the Group’s Investment in Diversity of Content on Value Creation

Source: UMG

18

Annual Report 2014