4

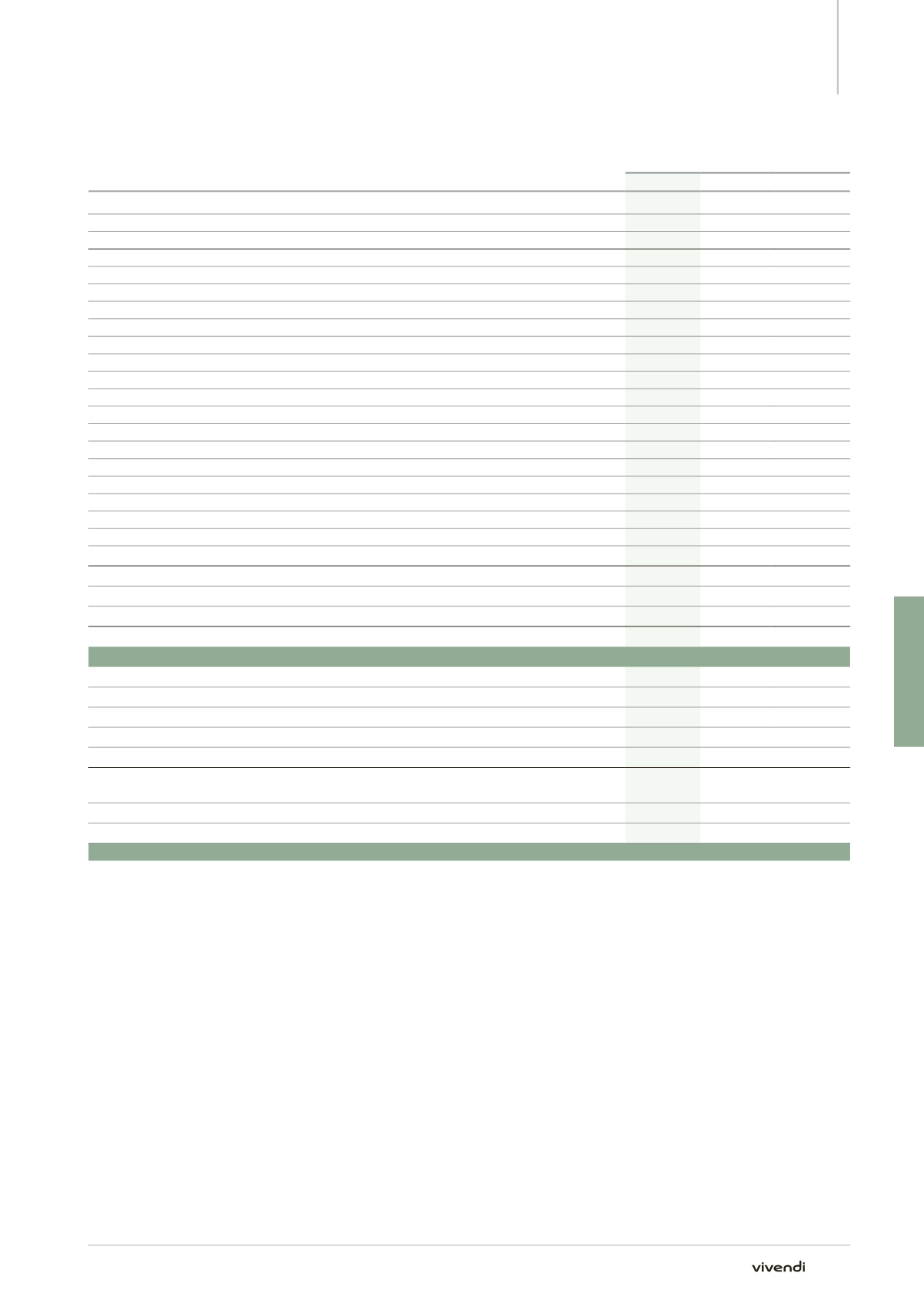

Section 3 - Cash flow from operations analysis

Financial Report

| Statutory Auditors’ Report on the Consolidated Financial Statements | Consolidated

Financial Statements | Statutory Auditors’ Report on the Financial Statements | Statutory Financial Statements

(in millions of euros)

Year ended December 31,

2014

2013

(a)

% Change

Revenues

10,089

10,252

-1.6%

Operating expenses excluding depreciation and amortization

(8,646)

(8,797)

+1.7%

EBITDA

1,443

1,455

-0.8%

Restructuring charges paid

(84)

(105)

+20.2%

Content investments, net

19

(148)

na

of which film and television rights, net at Canal+ Group

acquisition of film and television rights

(604)

(738)

+18.1%

consumption of film and television rights

713

743

-4.1%

109

5

×19.7

of which sports rights, net at Canal+ Group

acquisition of sports rights

(818)

(714)

-14.4%

consumption of sports rights

801

759

+5.5%

(17)

45

na

of which payments to artists and repertoire owners, net at UMG

payments to artists and repertoire owners

(554)

(599)

+7.5%

recoupment of advances and other movements

613

561

+9.2%

59

(38)

na

Neutralization of change in provisions included in operating expenses

(154)

(78)

-97.9%

Other cash operating items

(22)

(78)

+72.3%

Other changes in net working capital

(123)

36

na

Net cash provided by operating activities before income tax paid

(b)

1,079

1,082

-0.2%

Dividends received from equity affiliates

(c)

4

3

+32.3%

Dividends received from unconsolidated companies

(c)

3

54

-96.1%

Cash flow from operations, before capital expenditures, net (CFFO before capex, net)

1,086

1,139

-4.7%

Capital expenditures, net (capex, net)

(d)

(243)

(245)

+0.9%

Cash flow from operations (CFFO)

843

894

-5.8%

Interest paid, net

(e)

(96)

(266)

+64.1%

Other cash items related to financial activities

(e)

(606)

(330)

-84.1%

of which premium paid on early bonds redemption

(642)

(182)

×3.3

gains/(losses) on currency transactions

47

(142)

na

Financial activities cash payments

(702)

(596)

-17.8%

Payment received from the French State Treasury as part of the Vivendi SA’s French Tax Group

and Consolidated Global Profit Tax Systems

366

201

+82.1%

Other taxes paid

(86)

4

na

Income tax (paid)/collected, net

(b)

280

205

+36.6%

Cash flow from operations after interest and income tax paid (CFAIT)

421

503

-16.4%

na: not applicable.

(a)

Data published with respect to fiscal year 2013 has been adjusted following the application of IFRS 5 (please refer to the preliminary comments

above).

(b)

As presented in net cash provided by operating activities of continuing operations in the Financial Net Debt changes table (please refer

to Section 5.3).

(c)

As presented in net cash provided by/(used for) investing activities of continuing operations in the Financial Net Debt changes table (please refer

to Section 5.3).

(d)

Relates to cash used for capital expenditures, net of proceeds from sales of property, plant and equipment, and intangible assets as presented

in the investing activities of continuing operations in the Financial Net Debt changes table (please refer to Section 5.3).

(e)

As presented in net cash provided by/(used for) financial activities of continuing operations in the Financial Net Debt changes table (please refer

to Section 5.3).

171

Annual Report 2014