339

Annual Report -

2013

-

Vivendi

4

Financial Report | Statutory Auditors’ Report on the Consolidated Financial Statements | Consolidated

Financial Statements | Statutory Auditors’ Report on the Financial Statements |

Statutory Financial Statements

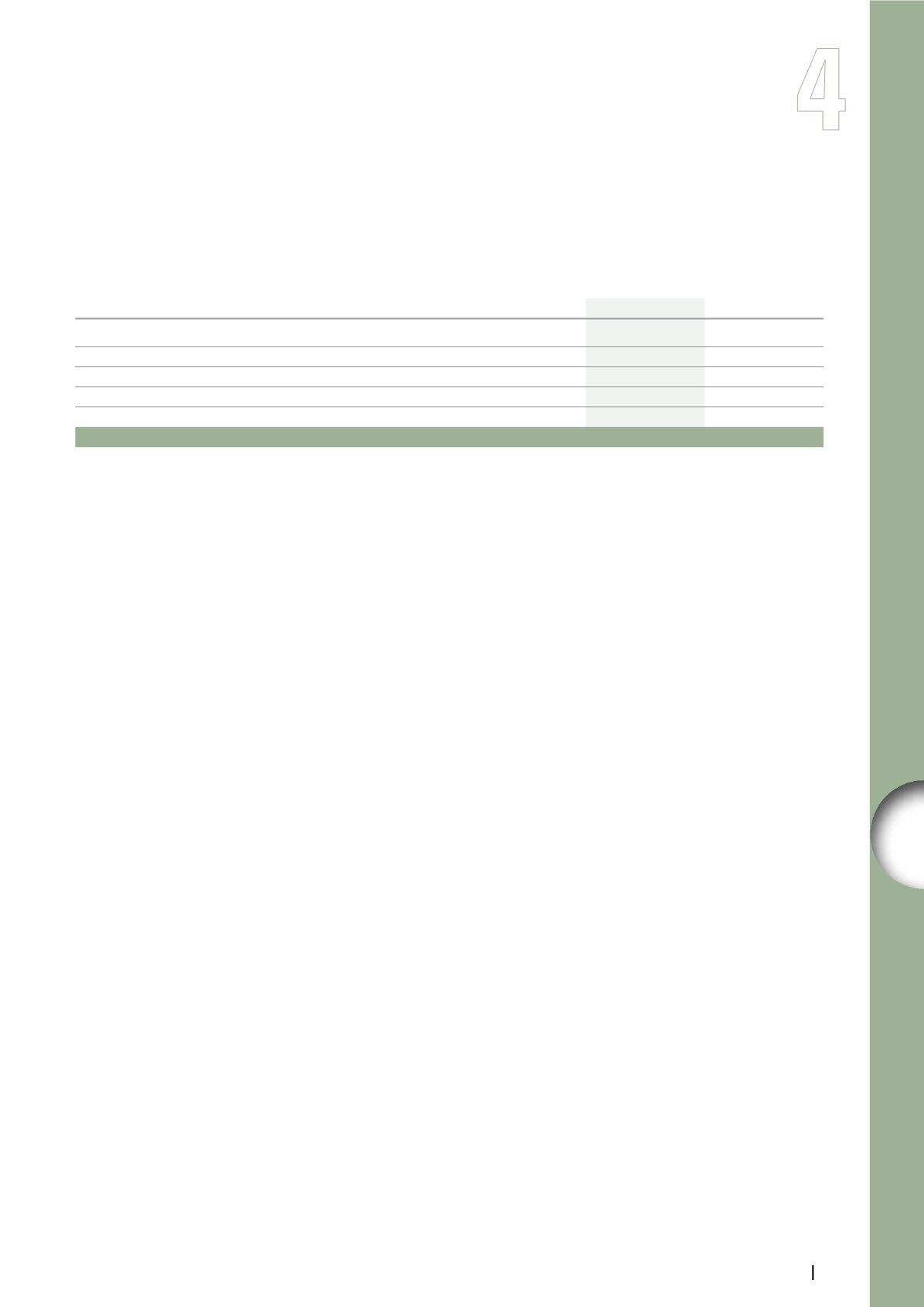

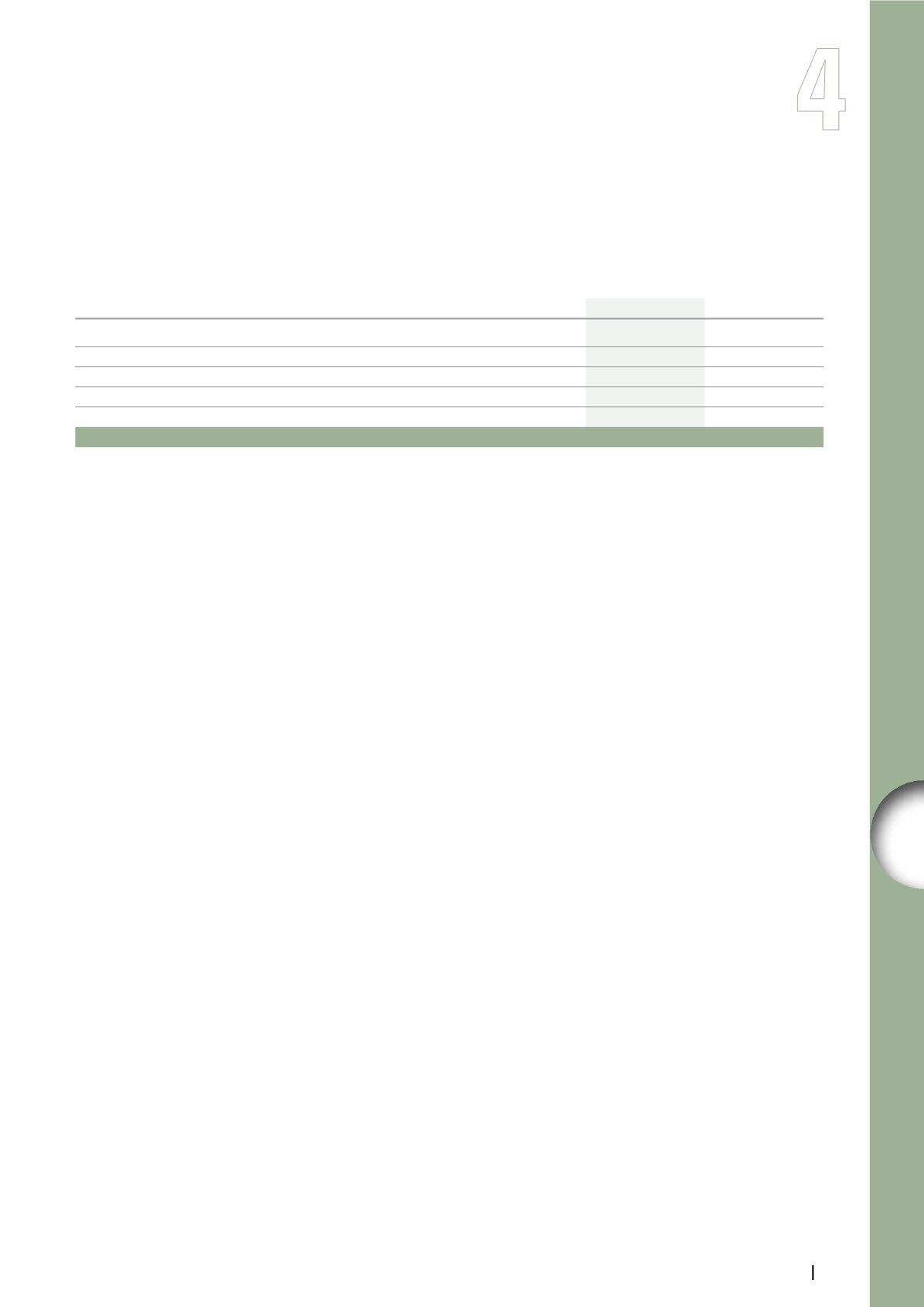

Note 3. Net Financial Income/(Loss)

Note 3.

Net Financial Income/(Loss)

Net economic financial income/(loss) is broken-down as follows:

(in millions of euros)

2013

2012

Net financing costs

(172.2)

(190.7)

Dividends received

3,545.5

975.9

Foreign exchange gains & losses

(19.2)

24.4

Other financial income and expenses

(36.9)

(15.7)

Movements in financial provisions

(5,692.6)

(6,181.6)

Total

(2,375.4)

(5,387.7)

The decrease in the net financing costs from -€190.7 million in 2012 to

-€172.2 million in 2013 is due to:

the decrease in external financing net costs from -€457.7 million

in 2012 to -€454.6 million in 2013, despite an increase in the

average external net debt from €14.1 billion in 2012 to €14.6 billion

in 2013, mainly reflecting the impact of the dividend payment of

€1,324.9 million as well changes in the scope of the Group (please

see, “Significant Events” above); and

conversely, an increase in internal net financing income (see Note 9,

Current Assets) from €267.0 million in 2012 to €282.4 million

in 2013.

Within income from affiliates, dividends recorded totaled

€3,545.5 million in 2013 including a dividend of €2,562.5 million

received from Vivendi Holding I LLC (formerly, Vivendi Holding I Corp.)

in the form of Activision Blizzard shares and a dividend from SFR of

€981.9 million, compared to €975.8 million in 2012 (which included a

dividend received from SFR of €974.4 million).

The changes to financial provisions and impairments resulted in a

net charge of €5,692.6 million including €5,706 million impairment

on long-term investments in affiliates (please see Note 7, Long-term

investments):

as of December 31, 2013, Vivendi examined the value in use of SFR

telecommunication activities in France using the usual valuation

methods (in particular the DCF method) for which Vivendi required

the assistance of an independent appraiser. The most recent

cash flow forecasts, and financial assumptions approved by the

Management of the Group were used and were updated to take

into account the strong impact on revenues of the new tariff policies

decided by SFR in a highly competitive environment, partially

offset by cost savings which were consistent with expectations

under SFR’s transformation plan, while maintaining high capital

expenditures, notably due to SFR’s acceleration of very-high speed

mobile network investments. The value in use of the 51.9% interest

in Maroc Telecom held indirectly by SFR was determined based on

the definitive agreement entered into with Etisalat which values this

interest at MAD 92.6 per share or total sale proceeds to Vivendi

Group of approximately €4.2 billion in cash, including a €310 million

dividend distribution with respect to fiscal year 2012, according

to the financial terms known to date (please see “Significant

Events” above). As a result, Vivendi’s Management decided to

record an impairment loss of €5,318 million on its interest as of

December 31, 2013;

as of December 31, 2013, as was done at the end of 2012,

Groupe Canal+ SA value in use and, in particular, the value in

use of its pay-TV activities in France, was determined through

the usual methods of valuation (in particular, the DCF method).

The most recent cash flow forecasts and financial assumptions

approved by the Management of the Group were used. They take

into account the expected increase in the VAT rate from 7% to 10%

(effective January 1, 2014 in Metropolitan France) and the adverse

changes in the macro-economic and competitive environments of

the markets on which the Group operates. As a result, Vivendi’s

Management determined that Groupe Canal+ value in use as of

December 31, 2013 was below its carrying value and consequently

recorded an impairment loss of €380 million.

As a reminder, as of December 31, 2012, Groupe Canal+ SA

cumulative impairment was €660 million.