349

Annual Report -

2013

-

Vivendi

4

Financial Report | Statutory Auditors’ Report on the Consolidated Financial Statements | Consolidated

Financial Statements | Statutory Auditors’ Report on the Financial Statements |

Statutory Financial Statements

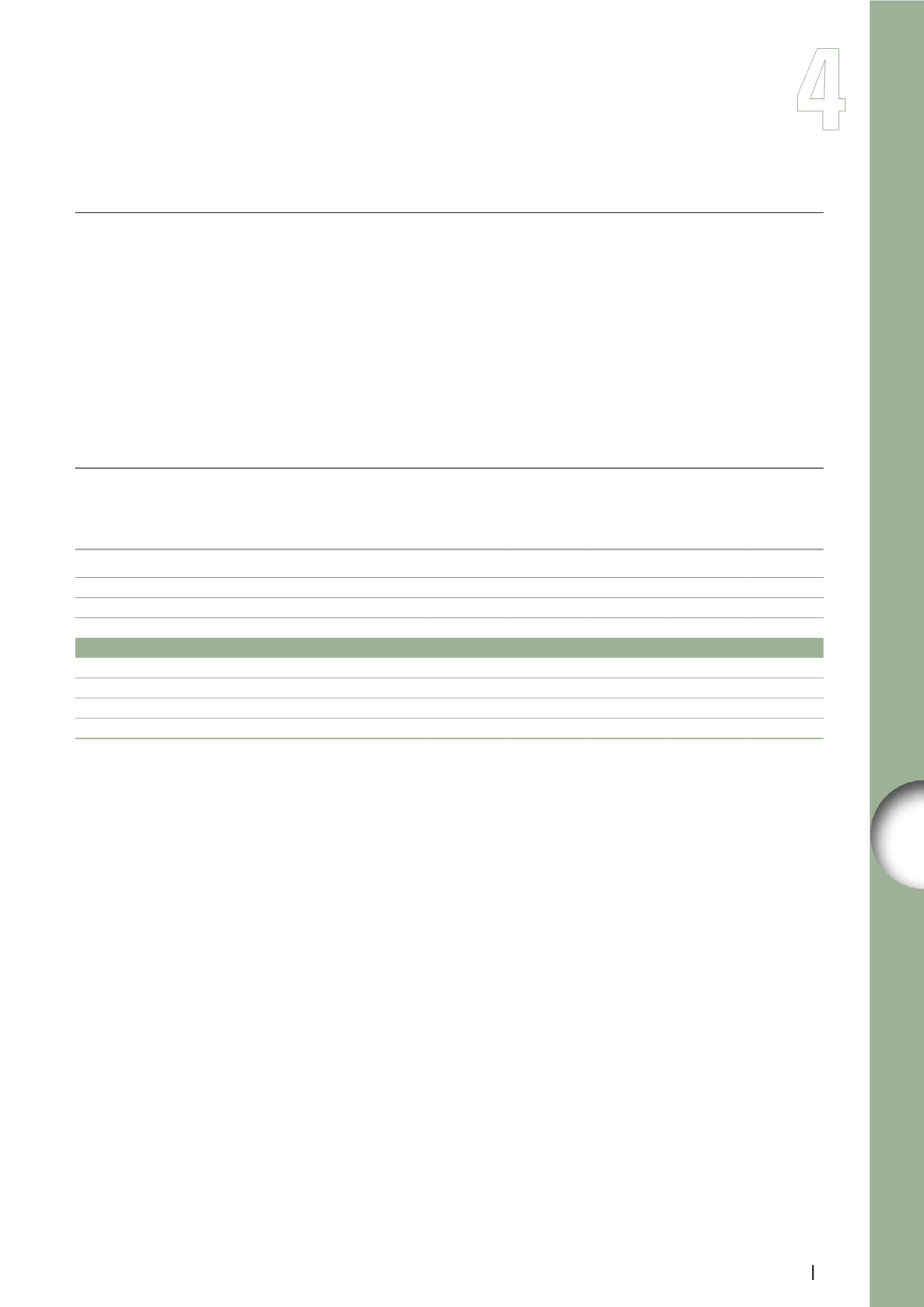

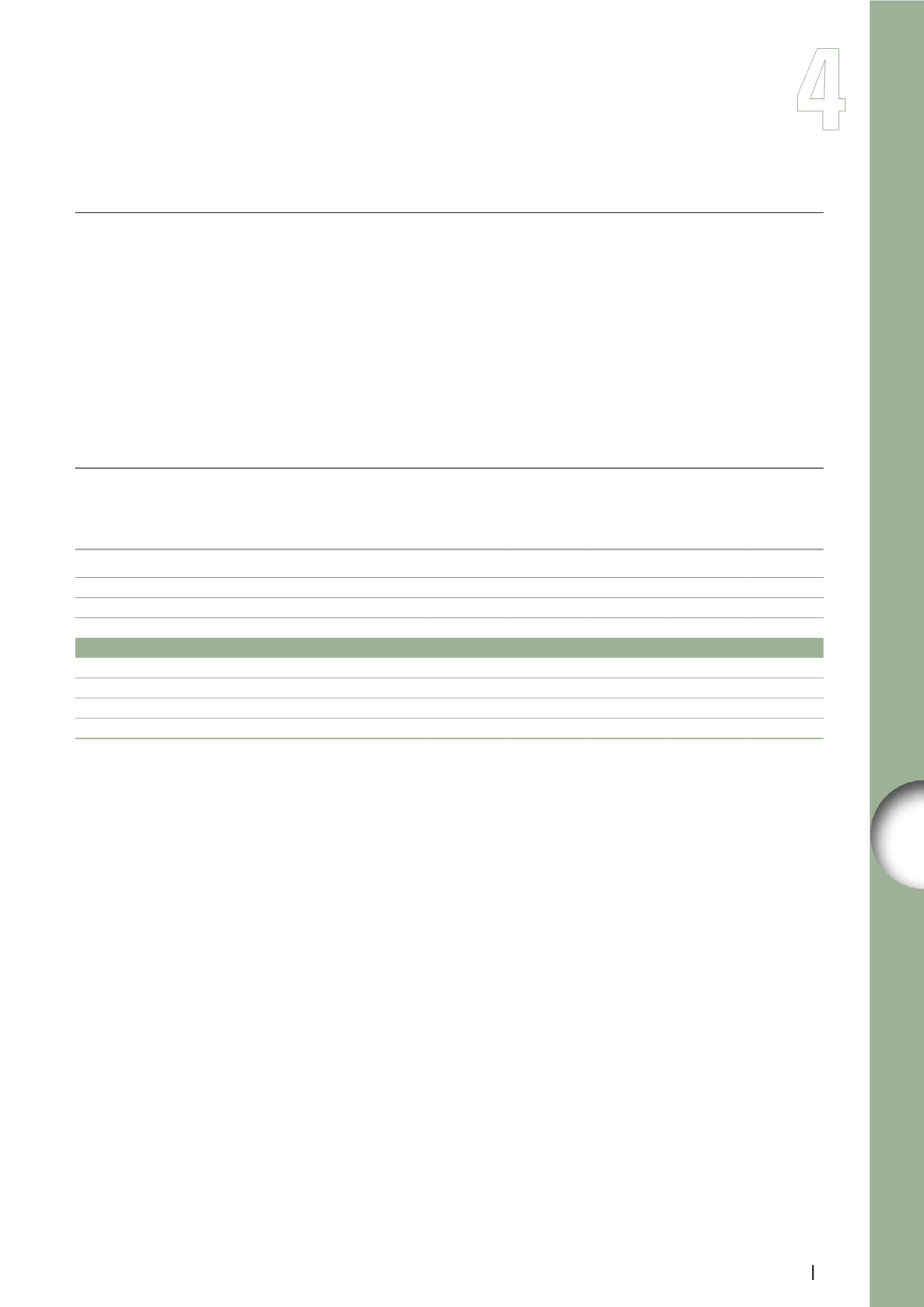

Note 15. Provisions

14.3

50 bonus share plan

On July 16, 2012, Vivendi implemented a plan to allocate 50 bonus

shares to each employee of all the Group’s French subsidiaries.

These shares will be issued at the end of a two-year period, i.e., on

July 17, 2014, without any performance condition subject to the

employee being actively employed at this date.

As of December 31, 2013, 663,050 shares were granted to beneficiaries

actively employed at this date. The fair value of each bonus share

granted was €12.40.

Note 15.

Provisions

Summary table

Nature of provisions

(in millions of euros)

Opening

balance

Charge

Reversal

Utilization

Closing

balance

Provision for real estate contingencies and losses

40.8

-

(3.7)

-

37.1

Foreign exchange losses

2.8

1.3

-

(3.8)

0.3

Employee benefits

14.4

5.9

-

-

20.3

Other provisions

1,656.9

1,006.6

(950.5)

(25.1)

1,687.9

Total - Provisions

1,714.9

1,013.8

(954.2)

(28.9)

1,745.6

Charges and reversals:

operating

13.7

-

(7.7)

financial

1.7

-

(4.1)

exceptional

998.4

(954.2)

(17.1)

As of December 31, 2013, the provision for real estate contingencies

and losses amounted to €37.1 million and covered various risks related

to past commitments given by SIG 35 (Vivendi’s former real estate

division holding company).

As of December 31, 2013, «other provisions» amounted to

€1,687.9 million and included:

a provision in relation to the Liberty Media Corporation for

€944.8 million (see Note 24, Litigation);

a provision in relation to the securities class action in the United

States for €100 million (see Note 24, Litigation);

an aggregate provision for €586.5 million to cover two tax refund

requests which fiscal positions are or could be challenged (please

refer to Note 5, Income Taxes and Note 9, Current Assets):

–– €366.2 million related to the tax savings of the Consolidated

Global Profit Tax System for the fiscal year ended

December 31, 2011,

–– €220.3 million related to using effects of the taxes due, under the

French Tax Group System for the year ended December 31, 2012,

and a provision valued at €43.8 million in relation to rights which

are in the process of being acquired by employees and Corporate

Officers of Vivendi and its subsidiaries in respect of the allotment

of free performance shares with an acquisition period ending

in 2014 or before. These plans are covered through the acquisition

of treasury shares (please refer to Note 8, Treasury Shares and

to Note 14, Stock Option Plans and Performance Share Plans).

As of December 31, 2013, the provision for employee benefits amounted

to €20.3 million, compared to €14.4 million in 2012 (please see Note 1.9,

Accounting Rules and Methods; Employee benefit plans). The amount

of unrecognized actuarial losses amounted to €48.3 million as of

December 31, 2013. Related obligations are valued using the following

assumptions: a 3.00% to 4.00% wage increase rate; a 3.00% discount

rate for the general statutory scheme and “Article 39” schemes; and an

assumed retirement age of between 60 and 65 years.

Supplemental pension obligations, other than retirement termination

payments, are partially funded by external insurance policies, the

updated value of which is deducted from the actuarial obligation.

The expected rate of return on plan assets is 4.00%.