332

Annual Report -

2013

-

Vivendi

4

Financial Report | Statutory Auditors’ Report on the Consolidated Financial Statements | Consolidated

Financial Statements | Statutory Auditors’ Report on the Financial Statements |

Statutory Financial Statements

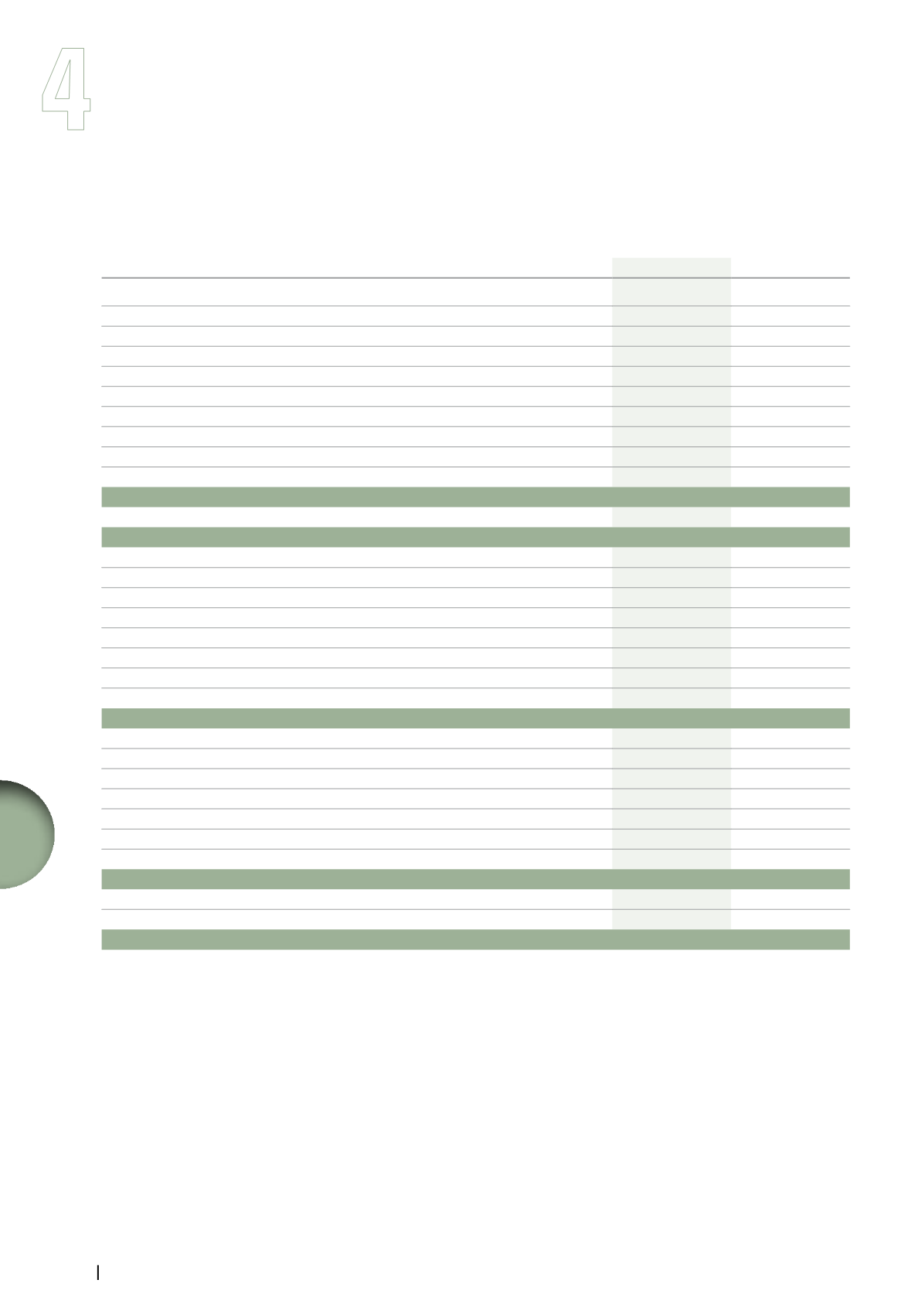

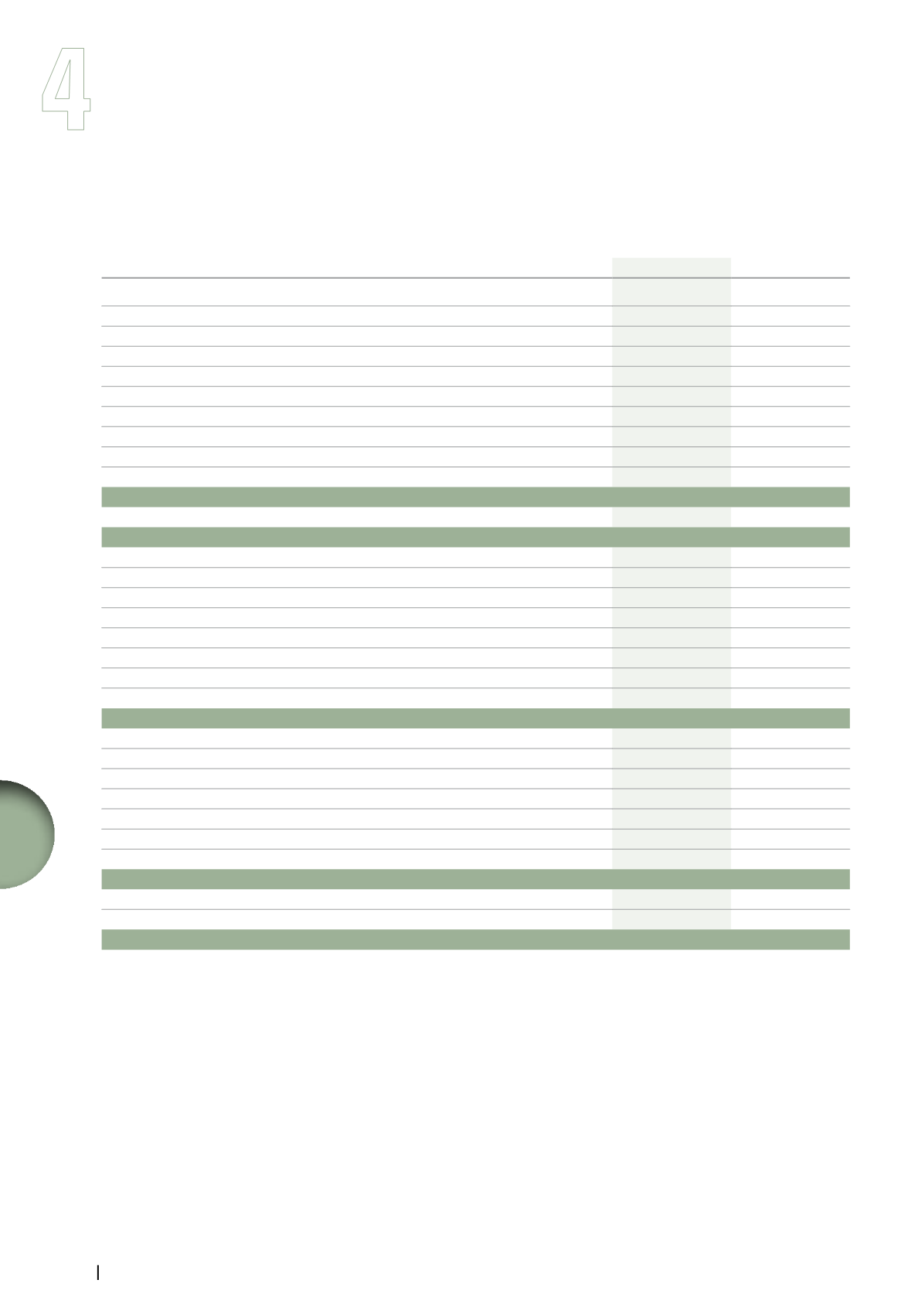

2013 Statutory Financial Statements

III.

Statement of Cash Flows

(in millions of euros)

2013

2012

Earnings/(losses) for the year

(4,857.6)

(6,045.0)

Elimination of non-cash income and expenses

Charges to depreciation and amortization

19.1

13.6

Charges to provisions net of (reversals)

Operating

5.9

(12.5)

Financial

5,750.8

6,241.9

Exceptional

(18.4)

1,492.1

Capital gains

2,640.6

24.5

Dividends received in assets

(2,562.5)

Other income and charges without cash impact

37.2

(61.8)

Operating cash flows before changes in working capital

1,015.1

1,652.8

Changes in working capital

97.3

(255.8)

Net cash provided by operating activities

1,112.4

1,397.0

Capital expenditure

(0.7)

(0.8)

Purchases of investments in affiliates and securities

(188.6)

(2,386.2)

Increase in loans to subsidiaries and affiliates

(32.3)

(61.1)

Receivables related to the sale of non-current assets and other financial receivables

336.6

(0.6)

Proceeds from sales of intangible assets and PP&E

Proceeds from sales of investments in affiliates and securities

6,043.3

80.2

Decrease in loans to subsidiaries and affiliates

449.5

1,005.8

Increase in deferred charges relating to financial instruments

(8.6)

(24.2)

Net cash provided by/(used in) investing activities

6,599.2

(1,386.9)

Net proceeds from issuance of shares

193.3

132.3

Dividends paid

(1,324.9)

(1,245.3)

New long-term borrowings secured

7,570.5

7,053.1

Principal payments on long-term borrowings

(10,799.0)

(6,453.9)

Increase (decrease) in short-term borrowings

(1,326.9)

2,834.8

Change in net current accounts

(1,770.9)

(2,338.4)

Treasury shares

0.6

(17.3)

Net cash provided by/(used in) financing activities

(7,457.3)

(34.7)

Change in cash

254.3

(24.6)

Opening net cash

(a)

56.0

80.6

Closing net cash (a)

310.3

56.0

(a)

Cash and marketable securities net of impairment (excluding treasury shares).