192

Annual Report -

2013

-

Vivendi

Financial Report

| Statutory Auditors’ Report on the Consolidated Financial Statements | Consolidated

Financial Statements | Statutory Auditors’ Report on the Financial Statements | Statutory Financial Statements

4

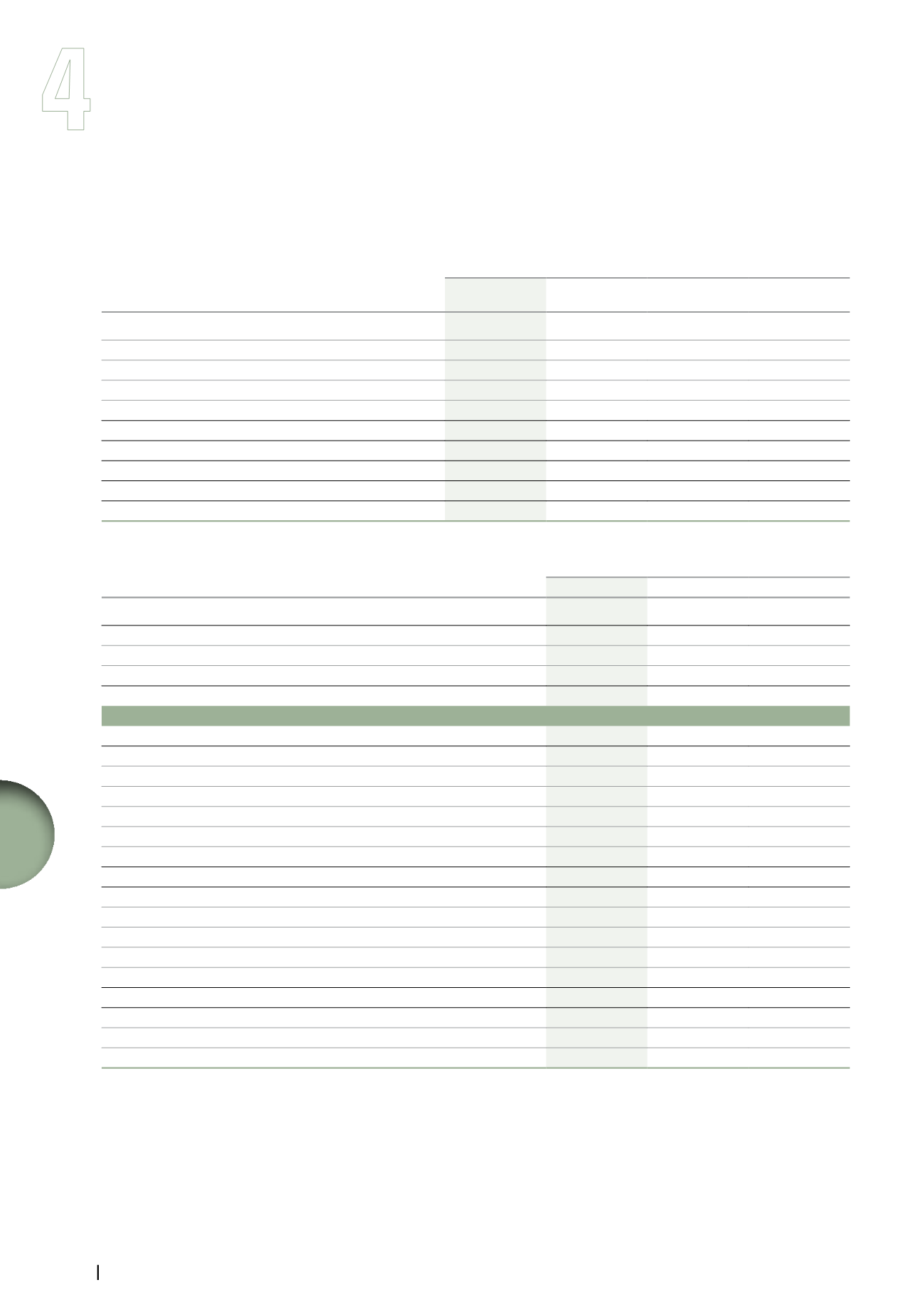

SECTION 4 - Business segment performance analysis

4.2.3.

GVT

(in millions of euros, except for margins)

Year ended December 31,

2013

2012

(a)

% Change

% Change at

constant rate

Telecoms

1,382

1,434

-3.6%

+9.4%

Pay-TV

174

83

x 2.1

x

2.4

Retail and SME

1,556

1,517

+2.6%

+16.4%

Corporate and wholesale

153

199

-23.1%

-12.3%

Total Revenues

1,709

1,716

-0.4%

+13.1%

EBITDA

707

740

-4.5%

+8.7%

EBITDA margin rate (%)

41.4%

43.1%

-1.7 pt

EBITA

405

488

-17.0%

-5.7%

Capital expenditures, net (capex net)

769

947

-18.8%

Cash flow from operations (CFFO)

(91)

(326)

+72.1%

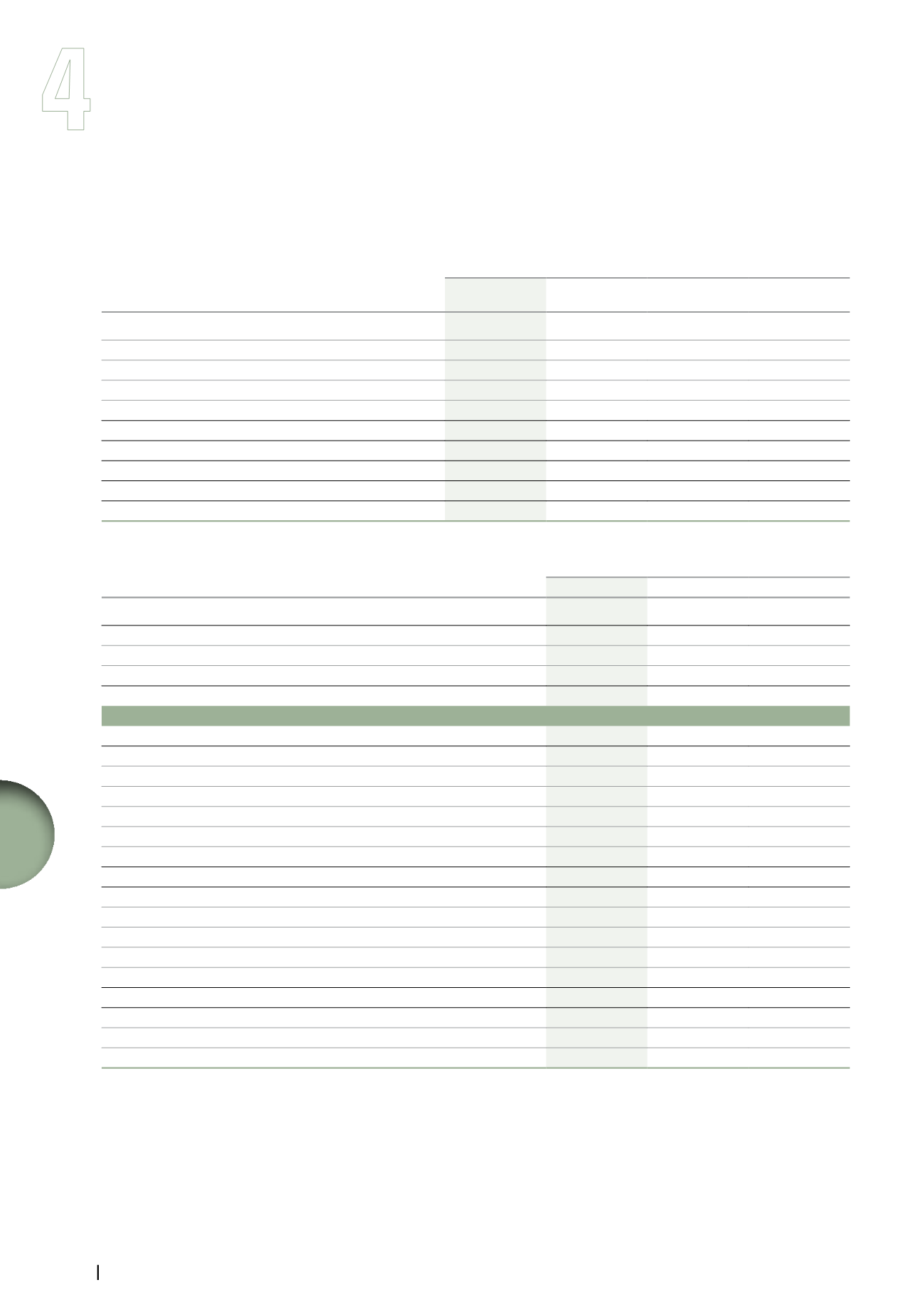

Year ended December 31,

2013

2012

(a)

% Change

Revenues

(IFRS, in millions of BRL)

Retail and SME

4,427

3,804

+16.4%

Corporate and wholesale

435

496

-12.3%

Total

4,862

4,300

+13.1%

Number of covered cities

150

139

+11

Retail and SME

Revenue Generating Units

(in thousands)

Voice

3,934

3,489

+12.8%

Broadband Internet

2,621

2,239

+17.1%

Proportion of offers ≥ 10 Mbps

86%

80%

+6 pts

Total Telecoms

6,555

5,728

+14.4%

Pay-TV

643

406

+58.4%

Total

7,198

6,134

+17.3%

Net New Additions

(in thousands)

Voice

445

660

-32.6%

Broadband Internet

382

515

-25.8%

Total Telecoms

827

1,175

-29.6%

Pay-TV

237

374

-36.6%

Total

1,064

1,549

-31.3%

ARPU

(BRL/month)

Voice

58.6

63.5

-7.7%

Broadband Internet

49.2

51.5

-4.5%

Pay-TV

78.7

77.2

+1.9%

(a)

In 2013, GVT changed the presentation of revenues: due to a new segmentation, some Corporate clients were re-classified as SME

during the third quarter of 2013. 2012 amounts were amended to ensure consistency of information presented.