115

Annual Report -

2013

-

Vivendi

Information About The Company

| Corporate Governance | Reports

3

Major Shareholders

2.3.

Major Shareholders

2.3.1.

Share Ownership and Voting Rights

As of December 31, 2013, the Company’s share capital amounted to

€7,367,854,620.50, divided into 1,339,609,931 shares.

The corresponding number of voting rights, taking into consideration

that treasury shares have no voting rights, totaled 1,339,558,827 as of

December 31, 2013, and 1,339,558,827 as of February 28, 2014.

As of December 31, 2013, employees held 3.54% of the Company’s

share capital.

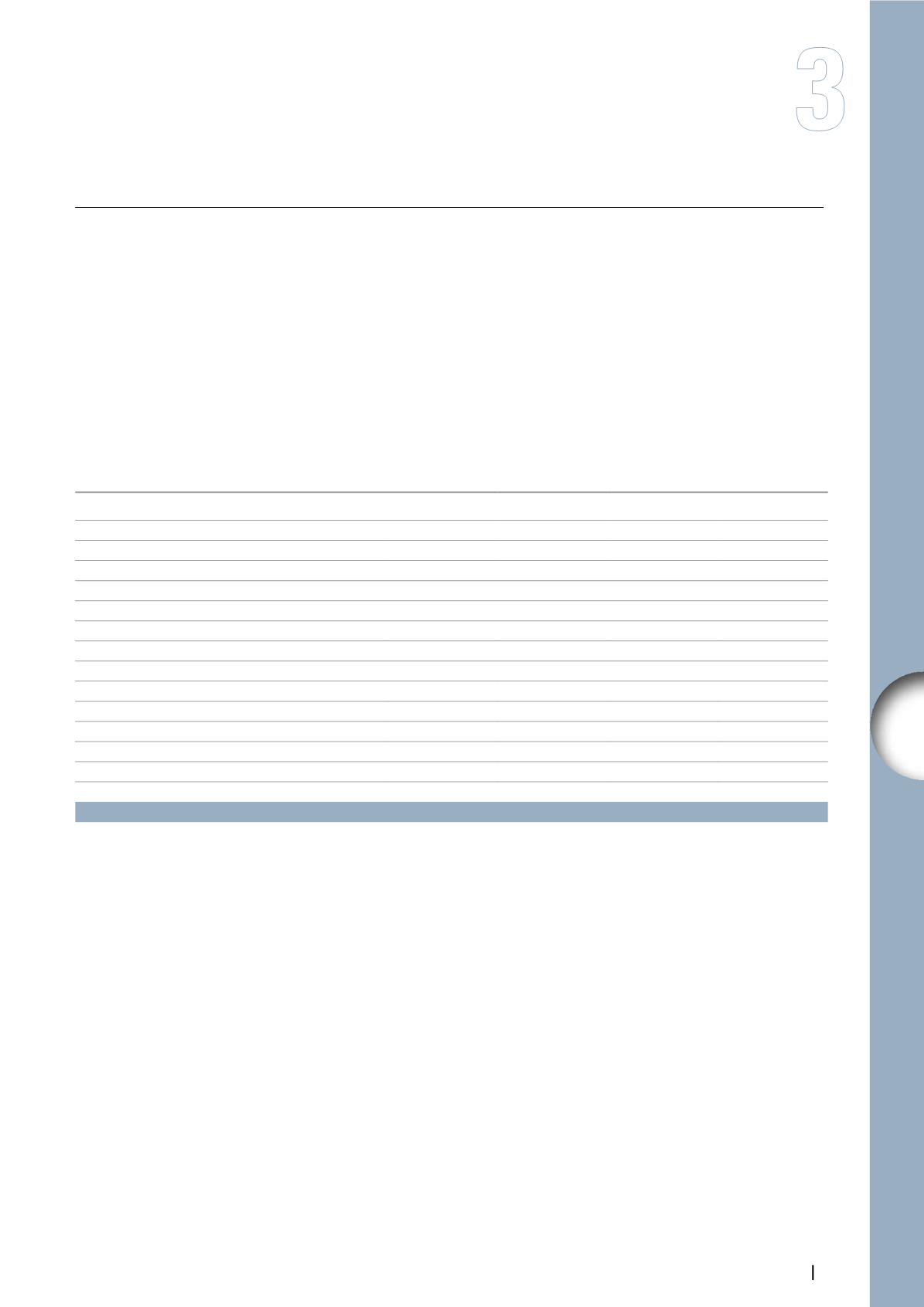

To the Management Board’s knowledge, as of December 31, 2013, the

major shareholders who held shares in registered form or had sent a

share ownership notice to the Company were as follows:

Groups

% of share capital

% of voting rights

Number

of shares

Number

of voting rights

Bolloré Group

5.04

5.04

67,577,281

67,577,281

BlackRock, Inc.

5.00

5.00

66,974,092

66,974,092

Société Générale Group

4.49

4.49

60,152,744

60,152,744

Amundi (Crédit Agricole AM/Société Générale AM)

4.49

4.49

60,096,182

60,096,182

Vivendi Employees

3.54

3.54

47,463,985

47,463,985

CDC/FSI (Caisse des Dépôts et Consignations)

3.48

3.48

46,636,819

46,636,819

The Baupost Group, L.L.C.

2.00

2.00

26,818,707

26,818,707

NBIM (Norges Bank Investment Management)

2.00

2.00

26,754,689

26,754,689

Qatar Holding

1.57

1.57

21,009,122

21,009,122

Natixis Asset Management

1.50

1.50

20,037,517

20,037,517

UBS Investment Bank

1.29

1.29

17,253,929

17,253,929

Rothschild - Asset Management

1.03

1.03

13,822,821

13,822,821

BNP PARIBAS AM

0.96

0.96

12,919,149

12,919,149

Treasury shares

0.00

0.00

51,104

0

Other shareholders

63.61

63.61

852,041,790

852,041,790

Total

100.00

100.00

1,339,609,931

1,339,558,827

2.3.2.

Pledge of Company Shares

As of December 31, 2013, 243,552 shares, representing 0.018% of

the share capital of the Company, held in registered form by individual

shareholders were pledged.

2.3.3.

Control of the Company – Shareholders’ Agreements

As of December 31, 2013, to the Company’s knowledge, no shareholder

other than those listed in the table above held 5% or more of

the Company’s share capital or voting rights, and there were no

shareholders’ agreements, whether publicly disclosed or not, which

related to Vivendi’s securities.

2.3.4.

Notices Made to the Company in relation to the Crossing of Shareholding Thresholds

In 2013, the Company received several notices in relation to the crossing

of statutory thresholds from BlackRock, Inc. and the Bolloré Group. The

company also received notices, as required pursuant to the Company’s

by-laws, in relation to the crossing of shareholding thresholds (being

0.5% or any multiple of this percentage), both upwards or downwards,

including notices from Amundi, the Société Générale Group, The

Baupost Group, LLC., Natixis, NBIM (Norges Bank Investment

Management), Rothschild-Asset Management and BNP Paribas AM,

details of which are contained in the table below.