4

Note 28. Fair Value of Derivative Instruments

Financial Report | Statutory Auditors’ Report on the Consolidated Financial Statements | Consolidated

Financial Statements | Statutory Auditors’ Report on the Financial Statements |

Statutory Financial Statements

Note 28.

Fair Value of Derivative Instruments

As of December 31, 2014, the market values of derivative instrument

portfolios classified as interest rate and currency hedges, pursuant to

Article 224 of the 2014-03 French General Accounting Code, were

€63.0 million and €39.1 million, respectively (theoretical cost of

unwinding). As of December 31, 2013, the fair values of these hedging

portfolios were €81.1 million and €5.7 million, respectively.

As of December 31, 2014, aggregate derivative financial instruments,

which did not qualify for hedge accounting, totaled -€16.7 million

(theoretical cost of unwinding) compared to -€7.6 million as of

December 31, 2013.

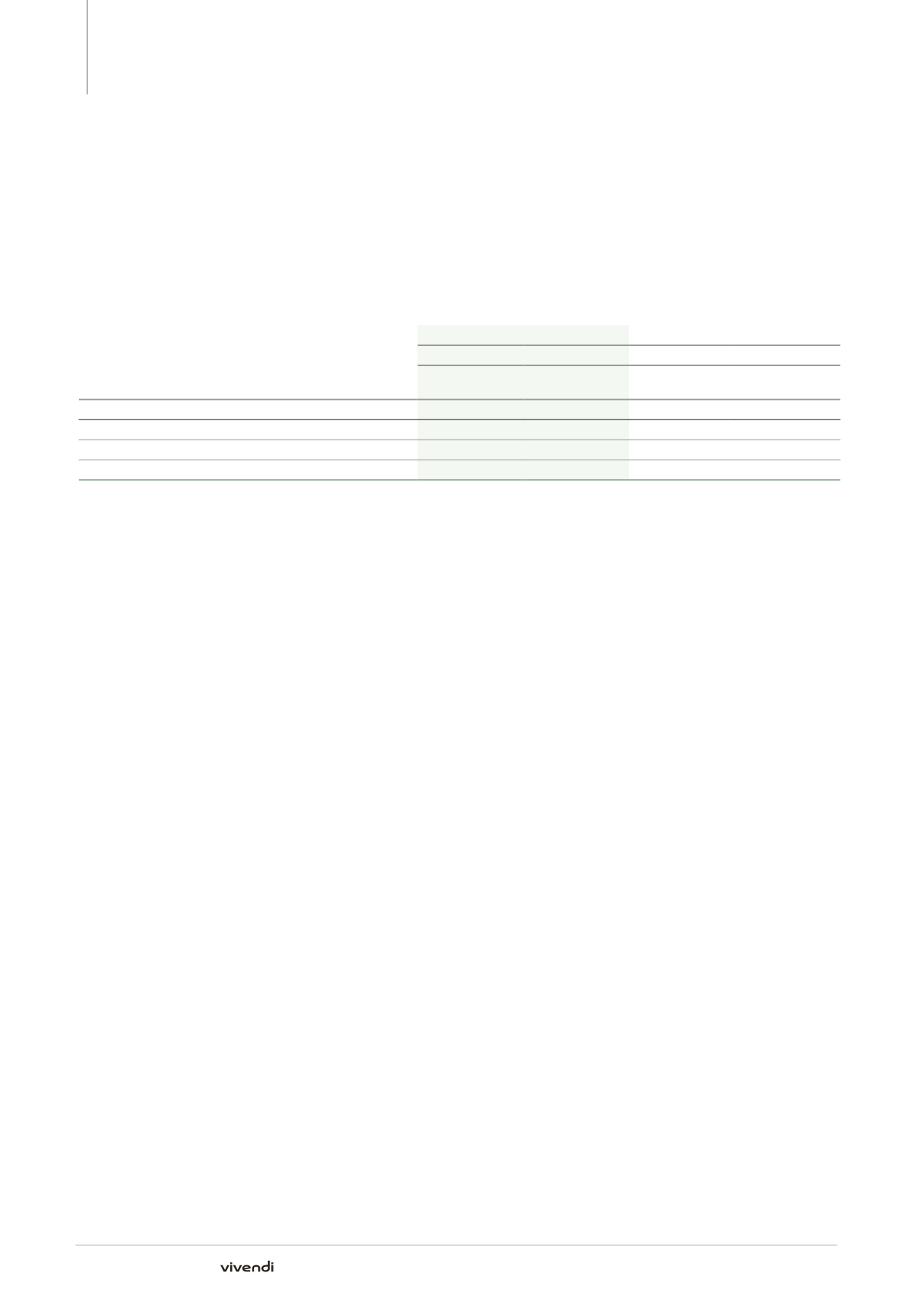

(in millions of euros)

As of December 31, 2014

As of December 31, 2013

Derivative financial instruments

Derivative financial instruments

qualifying for

hedge accounting

not qualifying for

hedge accounting

qualifying for

hedge accounting

not qualifying for

hedge accounting

Interest rate risk management

63.0

0.0

81.1

0.0

fixed-rate payer swaps

(12.0)

-

(7.4)

-

floating-rate payer swaps

75.0

-

88.5

-

Foreign currency risk management

39.1

(16.7)

5.7

(7.6)

Note 29.

Subsequent Events

Between December 31, 2014 and February 11, 2015, the date on

which the 2014 statutory financial statements were approved by the

Management Board, no significant events occurred.

330

Annual Report 2014