4

Financial Report | Statutory Auditors’ Report on the Consolidated Financial Statements |

Consolidated

Financial Statements

| Statutory Auditors’ Report on the Financial Statements | Statutory Financial Statements

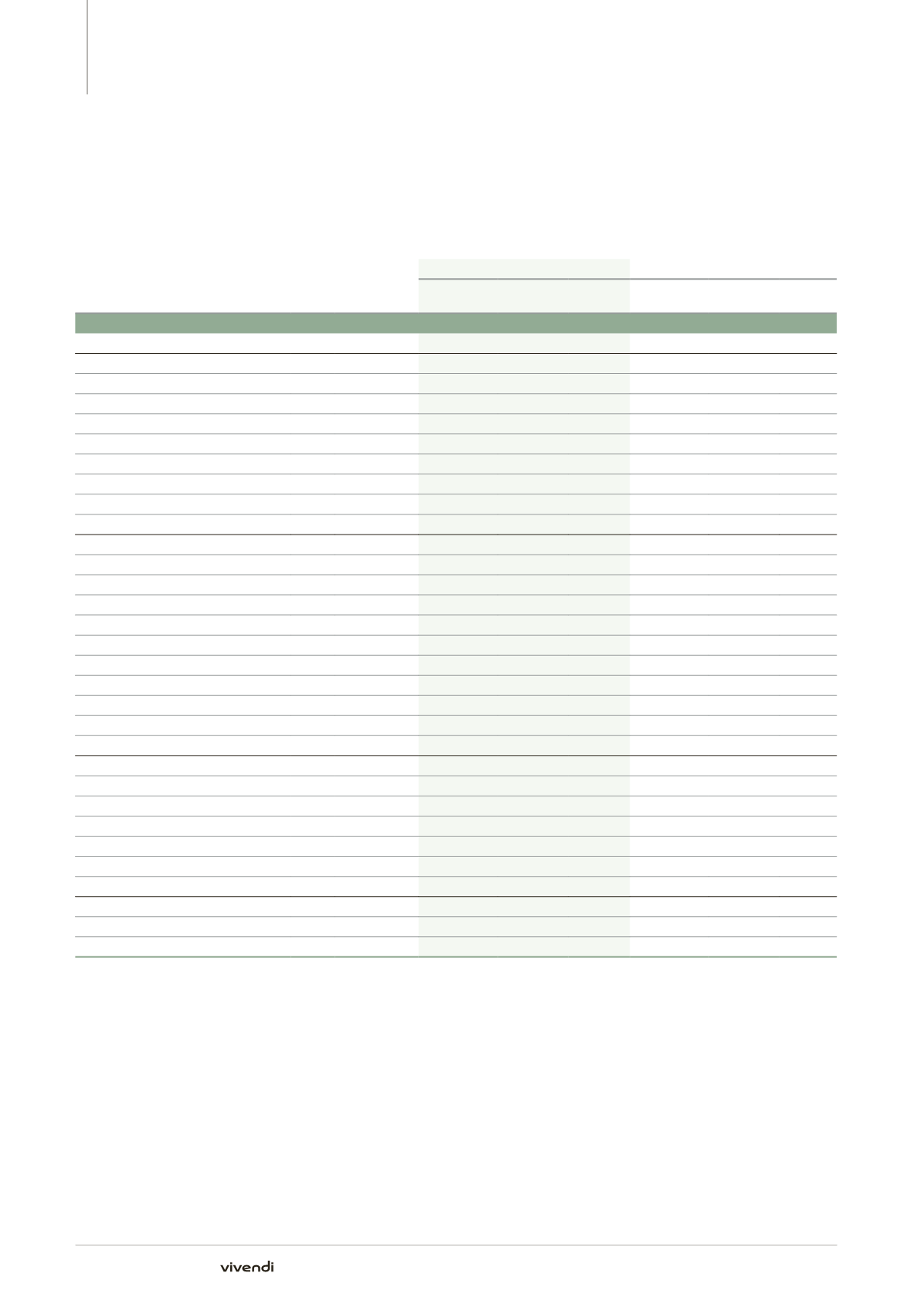

Note 27. Major consolidated entities or entities accounted under equity method

Note 27.

Major consolidated entities or entities accounted under equity method

As of December 31, 2014, approximately 540 entities were consolidated or accounted for using the equity method (compared to approximately

630 entities as of December 31, 2013).

Note

Country

December 31, 2014

December 31, 2013

Accounting

Method

Voting

Interest

Ownership

Interest

Accounting

Method

Voting

Interest

Ownership

Interest

Vivendi S.A.

France

Parent company

Parent company

Groupe Canal+ S.A.

France

C

100%

100%

C

100%

100%

Société d’Édition de Canal Plus

(a)

France

C

49%

49%

C

49%

49%

Multithématiques S.A.S.

France

C

100%

100%

C

100%

100%

Canal+ Overseas S.A.S.

France

C

100%

100%

C

100%

100%

D8

France

C

100%

100%

C

100%

100%

Studiocanal S.A.

France

C

100%

100%

C

100%

100%

ITI Neovision

Poland

C

51%

51%

C

51%

51%

TVN

13

Poland

E

49%

26%

E

49%

26%

VSTV

(b)

Vietnam

C

49%

49%

C

49%

49%

Universal Music Group, Inc.

United States

C

100%

100%

C

100%

100%

Universal Music Group Holdings, Inc.

United States

C

100%

100%

C

100%

100%

UMG Recordings, Inc.

United States

C

100%

100%

C

100%

100%

Vevo

13 United States

E

48%

48%

E

47%

47%

SIG 104

France

C

100%

100%

C

100%

100%

Universal International Music B.V.

Netherlands

C

100%

100%

C

100%

100%

Universal Music Entertainment GmbH

Germany

C

100%

100%

C

100%

100%

Universal Music LLC

Japan

C

100%

100%

C

100%

100%

Universal Music France S.A.S.

France

C

100%

100%

C

100%

100%

Universal Music Holdings Limited

United Kingdom

C

100%

100%

C

100%

100%

EMI Group Worldwide Holding Ltd.

United Kingdom

C

100%

100%

C

100%

100%

Vivendi Village

See Tickets

United Kingdom

C

100%

100%

C

100%

100%

Digitick

France

C

100%

100%

C

100%

100%

Wengo

France

C

100%

90%

C

100%

95%

Watchever Group S.A.

France

C

100%

100%

C

100%

100%

Watchever GmbH

Germany

C

100%

100%

C

100%

100%

Elektrim Telekomunikacja

Poland

C

100%

100%

C

100%

100%

Discontinued businesses

3

Global Village Telecom S.A.

(c)

3

Brazil

C

100%

100%

C

100%

100%

SFR

(d)

3

France

na

-

-

C

100%

100%

Maroc Telecom S.A.

(e)

3

Morocco

na

-

-

C

53%

53%

C: Consolidated; E: Equity.

na: not applicable.

(a)

Vivendi consolidated Société d’Édition de Canal Plus since (i) Vivendi has majority control over the Board of Directors, (ii) no other shareholder or

shareholder group is in a position to exercise substantive participating rights that would allow them to veto or block decisions taken by Vivendi

and (iii) Vivendi assumes the majority of risks and benefits pursuant to an agreement with this company through Canal+ Distribution S.A.S. Canal+

Distribution S.A.S., wholly-owned by Vivendi, guarantees this company’s results in return for exclusive commercial rights to its subscriber base.

(b)

VSTV (Vietnam Satellite Digital Television Company Limited) is held 49% by Canal+ Group and 51% by VCTV, a subsidiary of VTV (the Vietnamese

public television company). This company has been consolidated by Vivendi given that Canal+ Group has both operational and financial control over

it pursuant to a general delegation that was granted by the majority shareholder and pursuant to the company’s bylaws.

(c)

On September 18, 2014, Vivendi entered into a definitive agreement with Telefonica for the sale of GVT.

(d)

On November 27, 2014, Vivendi completed the sale of SFR to Numericable Group.

(e)

On May 14, 2014, Vivendi completed the sale of its 53% interest in Maroc Telecom group.

288

Annual Report 2014