4

Financial Report | Statutory Auditors’ Report on the Consolidated Financial Statements |

Consolidated

Financial Statements

| Statutory Auditors’ Report on the Financial Statements | Statutory Financial Statements

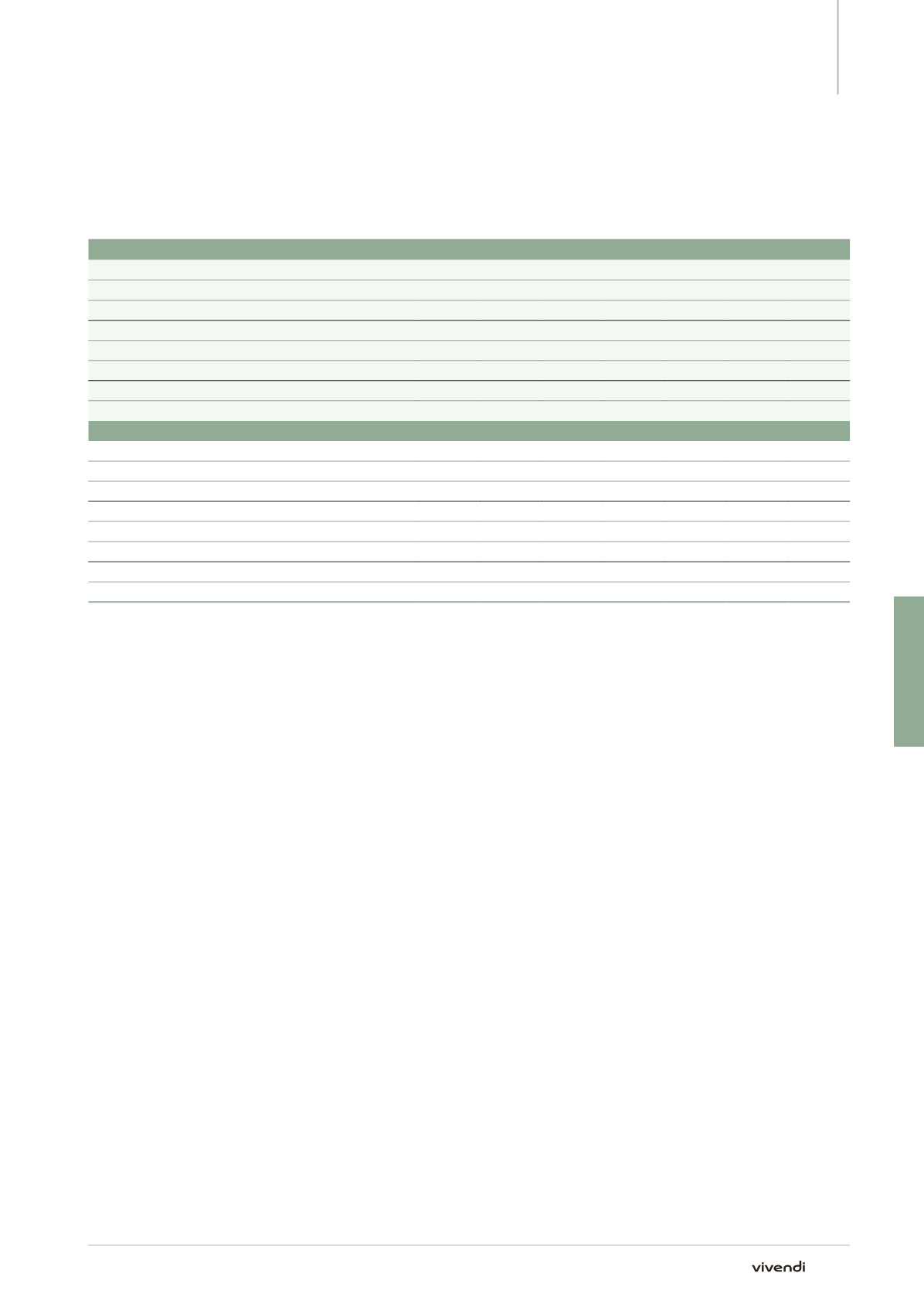

Note 2. Segment data

Consolidated Statements of Financial Position

(in millions of euros)

Canal+

Group

Universal

Music

Group

Vivendi

Village Corporate

GVT

SFR

Total

Vivendi

December 31, 2014

Segment assets

(a)

7,829

8,677

154

5,896

-

-

22,556

Unallocated assets

(b)

13,182

Total Assets

35,738

Segment liabilities

(c)

2,609

3,463

129

2,404

-

-

8,605

Unallocated liabilities

(d)

4,145

Total Liabilities

12,750

Increase in tangible and intangible assets

205

47

7

-

-

-

259

Capital expenditures, net (capex, net)

(e)

190

46

7

-

-

-

243

December 31, 2013

Segment assets

(a)

7,500

8,256

251

154

4,674

18,304

39,139

Unallocated assets

(b)

10,041

Total Assets

49,180

Segment liabilities

(c)

2,542

3,402

78

2,213

548

5,913

14,696

Unallocated liabilities

(d)

15,454

Total Liabilities

30,150

Increase in tangible and intangible assets

213

54

8

1

776

1,665

2,717

Capital expenditures, net (capex, net)

(e)

211

26

8

-

769

1,610

2,624

Additional operating segment data is presented in Note 9 “Goodwill”, and Note 10 “Content assets and commitments”.

(a)

Segment assets include goodwill, content assets, other intangible assets, property, plant and equipment, investments in equity affiliates, financial

assets, inventories and trade accounts receivable, and other.

(b)

Unallocated assets include deferred tax assets, current tax receivables and cash and cash equivalents. As of December 31, 2014, they also

included GVT’s assets of discontinued businesses for €5,393 million. As of December 31, 2013, they also included Maroc Telecom group’s assets of

discontinued businesses for €6,562 million and the remaining 83 million Activision Blizzard shares held by Vivendi, valued at €1,078 million (please

refer to Note 3).

(c)

Segment liabilities include provisions, other non-current liabilities, and trade accounts payable.

(d)

Unallocated liabilities include borrowings and other financial liabilities, deferred tax liabilities and current tax payables. As of December 31, 2014,

they also included GVT’s liabilities associated with assets of discontinued businesses for €1,094 million (excluding financial liabilities to Vivendi SA).

As of December 31, 2013, they also included Maroc Telecom group’s liabilities associated with assets of discontinued businesses for €2,429 million

(please refer to Note 3).

(e)

Relates to cash used for capital expenditures, net of proceeds from sales of property, plant and equipment, and intangible assets.

223

Annual Report 2014