3

Trading in Company Securities

Information about the Company |

Corporate Governance

| Reports

3.5. Trading in Company Securities

Vivendi complies with the General Regulations of the AMF and the

recommendations of the AFEP and MEDEF. Consequently, purchase and

sale transactions involving the Company’s securities are prohibited during

the period from the date when a member of the Supervisory Board or

Management Board becomes aware of precise market information

concerning the Company’s day-to-day business or prospects which, if

made public, would likely have a material impact on the Company’s share

price, up to the date when this information is made public. In addition,

such transactions are prohibited for a period of 30 calendar days up to

and including the date of publication of the Company’s quarterly, semi-

annual and annual financial statements. Vivendi prepares and distributes

a summary schedule setting out the periods during which transactions

involving the Company’s shares are prohibited (“blackout periods”). This

schedule also makes clear that the periods indicated do not preclude the

existence of other blackout periods that may apply, due to awareness

of specific market information concerning developments in Vivendi’s

business or prospects which, if made public, would be likely to have a

material impact on the Company’s share price.

At its meeting held on January 24, 2007, Vivendi’s Management Board

prohibited the use of all hedge transactions on stock options, shares

resulting from the exercise of stock options, performance shares, and

the Company’s securities in general, through the hedged purchase or sale

of shares or the use of any other option mechanism. These prohibitions

appear in the rules of the stock option and performance share plans,

and beneficiaries of these plans are reminded of them in the individual

grant letters. This prohibition also appears in the internal rules of the

Supervisory Board and Management Board.

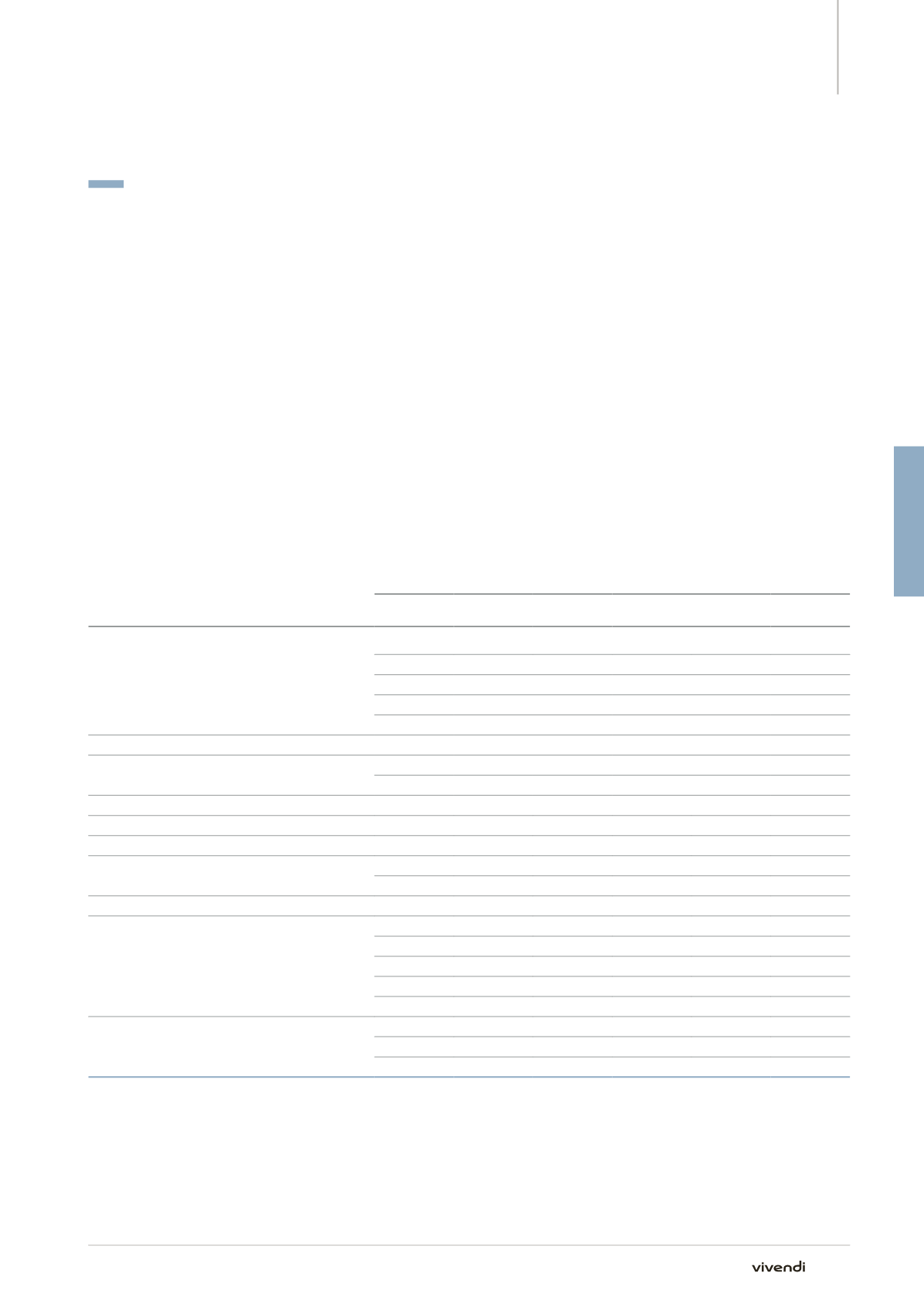

3.5.1.

Trading in Securities by Members of the Supervisory Board and the Management Board

Pursuant to Article 223-26 of the General Regulations of the AMF, the

table below sets out transactions involving the Company’s securities

in 2014 up to the date of registration of this Annual Report that were

reported to the Company and to the AMF:

Name

Purchases

Sales

Date

Quantity

Unit price

in euros

Date

Quantity

Unit price

in euros

Compagnie de Cornouaille

(Bolloré Group)

09/01/14

730,810

19.8410

09/02/14

1,103,287

19.9480

09/03/14

37,447

19.9090

02/17/15

158,609

20.7980

03/02/15 40,548,020

21.00

Vincent Bolloré

05/16/14

2,000

18.6350

Philippe Bénacin

06/13/14

6,300

19.19

06/25/14

7,800

18.27

Aliza Jabès

03/11/15

910

21.790

Virginie Morgon

03/12/15

1,000

21.9551

Katie Stanton

03/10/15

1,000

21.99

Arnaud de Puyfontaine

06/03/14

500

19.335

03/04/15

2,000

21.0386

Hervé Philippe

03/03/15

2,400

21.00

Jean-René Fourtou

05/16/14

163,484

18.5775

05/19/14

163,484

18.65

05/19/14

163,484

18.8695

05/19/14

163,484

18.9275

05/20/14

163,488

18.8349

Jean-François Dubos

05/16/14

78,833

18.5021

05/16/14

78,833

18.6500

05/16/14

78,834

18.6217

143

Annual Report 2014